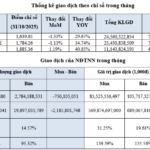

Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 818 million shares, equivalent to a value of more than 23.7 trillion VND; the HNX-Index reached over 79.1 million shares, equivalent to a value of more than 1.7 trillion VND.

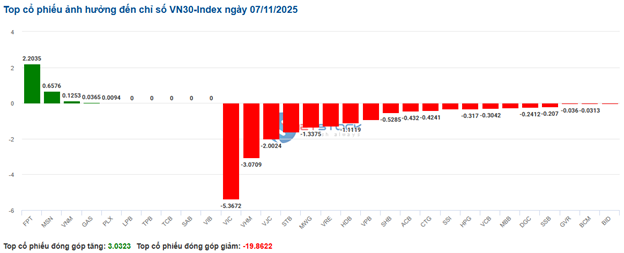

The VN-Index opened the afternoon session on a negative note, with selling pressure continuing to rise, causing the index to plummet uncontrollably and close in pessimistic red. In terms of impact, VIC, VHM, CTG, and VCB were the most negatively influential stocks on the VN-Index, with a decrease of over 17.5 points. Conversely, GAS, FPT, NAB, and SHI managed to stay in the green, but their impact was insignificant.

| Top 10 stocks with the strongest impact on the VN-Index on November 7, 2025 (calculated in points) |

Similarly, the HNX-Index also experienced a rather pessimistic trend, with negative impacts from stocks such as KSF (-3.33%), HUT (-6.59%), SHS (-5.31%), and MBS (-4.04%).

| Top 10 stocks with the strongest impact on the HNX-Index on November 7, 2025 (calculated in points) |

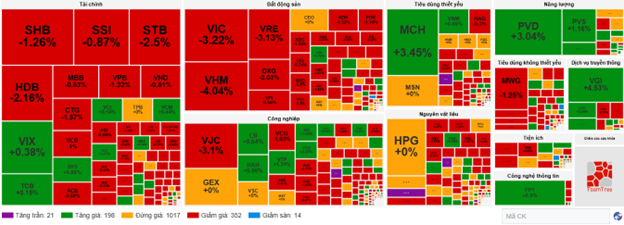

At the close, the VN-Index fell by 2.14%, with red dominating most sectors. The real estate sector saw the most significant decline, at 3.95%, primarily due to VinGroup stocks such as VHM (-6.98%), VIC (-3.9%), VRE (-2.03%), and others like KDH (-4.69%), KBC (-5.18%), NVL (-3.7%), and BCM (-1.02%). This was followed by the non-essential consumer goods and finance sectors, which decreased by 3.18% and 2.55%, respectively. In these sectors, notable stocks under selling pressure included VIX (-6.67%), STB (-6.84%), SSI (-3.94%), SHB (-3.47%), MWG (-4.73%), VPL (-3.12%), and MSH (-2.84%). Additionally, the industrial and energy sectors also ended in the red, with declines of 2.07% and 2.03%, respectively.

On the positive side, the communication services sector was one of the few to remain in the green, with the strongest market increase of 2.47%, primarily driven by VGI (+3.75%) and ICT (+6.68%).

In terms of foreign trading, foreign investors continued to net sell over 1.357 trillion VND on the HOSE, focusing on stocks such as STB (298.01 billion), HDB (166.37 billion), SSI (121.51 billion), and MBB (99.6 billion). On the HNX, foreign investors net bought over 41 billion VND, concentrating on PVS (103.74 billion), IDC (6.14 billion), and MBS (3.29 billion).

| Foreign net buying and selling trends |

Morning Session: VN-Index Retreats to 1,620 Points

Increased selling pressure caused major indices to remain in the red by the end of the morning session. At the midday break, the VN-Index fell by more than 21 points (-1.29%), to 1,621.47 points; similarly, the HNX-Index retreated to 264.5 points, down 0.62%. Market breadth favored sellers, with 432 declining stocks and 235 advancing stocks.

Among the top 10 stocks influencing the VN-Index, VIC and VHM had the most negative impact, reducing the index by 4.34 points and 3.96 points, respectively. In contrast, the top 10 positively influential stocks collectively added only 1.3 points to the index.

| Top 10 stocks with the strongest impact on the VN-Index in the morning session of November 7, 2025 (calculated in points) |

Sector-wise, red dominated most stock groups. The real estate sector temporarily led the decline with a 2.4% drop. In addition to significant pressure from VinGroup stocks, several others also plunged into the red, including KSF (-3.57%), BCM (-1.31%), KDH (-2.2%), KBC (-1.68%), PDR (-2.05%), DXG (-3.54%), and TCH (-2.76%).

The market’s two large-cap sectors, finance and industry, also weighed heavily on the index, with several stocks adjusting downward by over 1%, such as CTG, VPB, HDB, STB, SHB, SSI, BVH, SSB, PVI; ACV, VJC, HVN, GEE, GEX, GMD, VEF, and VGC.

Meanwhile, the communication services and information technology sectors maintained their green status, with increases of 3.54% and 1.14%, respectively, largely due to positive contributions from leading stocks such as VGI (+4.79%), CTR (+2.46%); FPT (+1.3%), and VEC (+0.98%).

Source: VietstockFinance

|

Foreign investors intensified their net selling, with a value of nearly 1.2 trillion VND across all three exchanges. Selling pressure was concentrated on STB and CTG, with each stock experiencing approximately 98 billion VND in net selling. Conversely, FPT led the net buying list with a value of 61.19 billion VND.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of November 7, 2025 |

10:30 AM: Selling Pressure Continues to Rise

Pessimistic sentiment continued to dominate large-cap stocks, causing major indices to decline. As of 10:30 AM, the VN-Index fell by more than 18 points, trading around 1,624 points. The HNX-Index decreased by 0.67 points, trading around 265 points.

Stocks in the VN30 basket faced strong selling pressure, reducing the index by over 19.86 points. Notably, VIC, VHM, VJC, and STB had negative impacts of 5.36 points, 3.07 points, 2 points, and 1.63 points, respectively. Following closely were stocks like MWG, VRE, and HDB, which also recorded significant declines. Only a few stocks, such as FPT, MSN, and VNM, managed to stay in the green, but their impact was minimal.

Source: VietstockFinance

|

Capital is fleeing the real estate sector, causing most stocks in this sector to decline. Notably, strong selling pressure was observed in VIC (-2.79%), VHM (-3.64%), and VRE (-2.81%). Additionally, red was also seen in stocks such as KDH (-1.17%), DXG (-2.78%), TCH (-2.07%), and KHG (-4.02%).

The financial sector is also under overwhelming selling pressure, with notable declines in STB (-2.31%), SHB (-1.26%), HDB (-2.33%), and CTG (-1.57%). In contrast, green was only seen in stocks like VIX, SHS, VCI, and HCM, but their increases were insignificant.

Furthermore, the non-essential consumer goods sector is also performing poorly, with selling pressure concentrated on large-cap stocks such as VPL (-2.44%), MWG (-1.37%), FRT (-1.54%), and HUT (-2.2%).

Compared to the opening, the market continued to show strong divergence, with over 1,000 reference stocks and sellers maintaining a stronger position, as 352 stocks declined and 198 stocks advanced.

Source: VietstockFinance

|

Market Open: Cautious Sentiment Persists

The VN-Index and HNX-Index opened this morning’s session below the reference level, indicating that cautious sentiment remains. Red dominated most sectors, although a few, such as communication services, industry, and healthcare, managed to stay in the green.

The financial sector showed mixed performance, with selling pressure slightly dominating. Specifically, red was observed in SHB (-0.32%), SSI (-0.73%), VCB (-0.83%), and HDB (-0.83%).

Similarly, the real estate sector was also mixed at the open. Selling pressure was concentrated on large-cap stocks such as VHM (-2.22%), VIC (-1.2%), VRE (-1.25%), and DXG (-1.77%).

In contrast, the industrial sector opened positively. Leading stocks such as GEX, CII, VSC, and HAH maintained their green status, while other stocks in the sector faced selling pressure but with insignificant declines.

– 15:20 07/11/2025

Vietcap Outlines Three November Scenarios for VN-Index, Highlighting 1,500 as Critical Support Level

According to Vietcap Securities’ November strategy report, the VN-Index faces three potential scenarios: continued accumulation, a breakout above 1,700 points, or a deep retreat to the 1,500-point range if strong selling pressure and widespread negative sentiment emerge.

October HOSE Highlights: Listing Activities Shine Amid Market Challenges

Vietnam’s stock market faced continued challenges in October, with the VN-Index declining in both value and liquidity. While the Ho Chi Minh Stock Exchange (HOSE) saw the departure of three companies with market capitalizations exceeding $10 billion, a positive note was struck by the listing and official trading commencement of three new stocks.

Market Pulse 07/11: Selling Pressure Intensifies

Pessimism continues to weigh on large-cap stocks, driving major indices downward. As of 10:30 AM, the VN-Index has fallen by over 18 points, trading around 1,624 points, while the HNX-Index is down 0.67 points, hovering near 265 points.