Chairman of MWG, Nguyễn Đức Tài – Illustrative image

|

Mobile World Investment Corporation (HOSE: MWG) has recently established Thien Tam Investment LLC with a charter capital of VND 2,200 billion and An Nhi Investment LLC with a charter capital of VND 500 billion.

This move is part of the company’s strategy to restructure its subsidiaries, focusing on specialized business operations. Specifically, the An Khang pharmaceutical retail segment and the AvaKids mother and baby product retail segment will be managed and operated by two independent legal entities.

MWG’s leadership stated that the restructuring aims to ensure each business segment has its own tailored development strategy, allowing for greater flexibility and depth, aligning with the group’s long-term sustainable growth objectives.

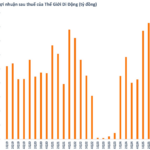

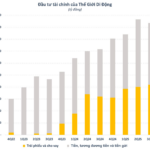

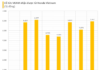

This restructuring follows MWG’s announcement of its Q3/2025 results, which reported net revenue exceeding VND 40 trillion, a 17% year-on-year increase, and a net profit of nearly VND 1.8 trillion, up 121%, marking the highest level since its inception. Consequently, the nine-month net profit reached nearly VND 5 trillion, a 73% increase, surpassing the annual target.

The primary growth drivers were The Gioi Di Dong and Dien May Xanh chains, with a 15% revenue increase over nine months despite a reduction in store numbers compared to the same period last year. Bach Hoa Xanh continued to improve efficiency in Q3, thanks to stable revenue, reduced shrinkage, and enhanced operations.

Other chains, including An Khang, AvaKids, and Erablue, also showed operational improvements. Notably, the An Khang pharmacy chain achieved an average monthly revenue of VND 540 million per store in the first nine months, marking three consecutive months of growth and moving closer to profitability.

AvaKids recorded an average monthly revenue of VND 1.8 billion per store, a 10% increase from the previous quarter and 30% from the same period last year. AvaKids has already turned a profit at the company level and is steadily improving its financial performance month by month.

– 08:53 07/11/2025

“Retail Empire” of Nguyen Duc Tai Makes New Move with An Khang and AvaKids Pharmacy Chains

MWG is committed to restructuring its subsidiaries to specialize and streamline their business operations, fostering greater efficiency and focus across the organization.

Mobile World Group (MWG) Reports Record-Breaking Q3 Profit of Nearly VND 1.8 Trillion, Surpassing Annual Plan in Just 9 Months

Over the first nine months, The Gioi Di Dong (Mobile World) achieved an accumulated after-tax profit of VND 4,989 billion, a remarkable 73% surge compared to the same period in 2024, surpassing its full-year target.