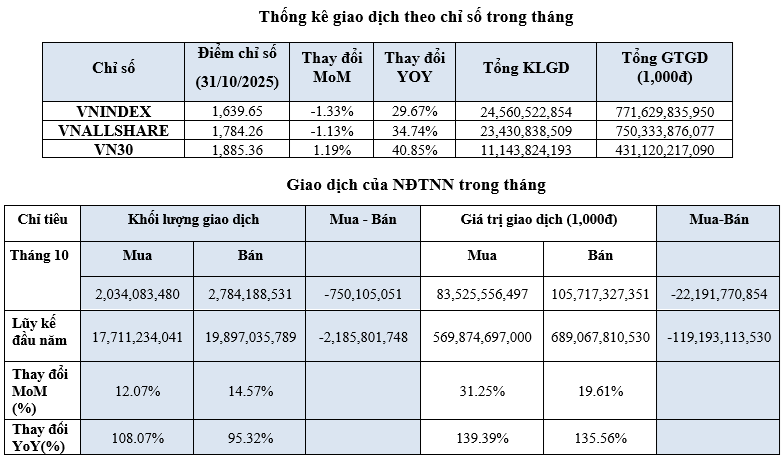

As of the trading session close on October 31, the VN-Index stood at 1,639.65 points, the VNAllshare-Index at 1,784.26 points, and the VN30-Index at 1,885.36 points. Over the month, while the VN30-Index rose by 1.2%, the other two indices experienced slight declines of 1.3% and 1.1%, respectively.

On the Ho Chi Minh Stock Exchange (HOSE), six sector indices posted gains compared to the end of September. Notably, the information technology (VNIT), consumer discretionary (VNCOND), and industrial (VNIND) sectors increased by 10.9%, 7.2%, and 3.5%, respectively. Conversely, the financial (VNFIN), construction materials (VNMAT), and energy (VNENE) sectors saw declines of 5.6%, 3.6%, and 1.3%, respectively.

In terms of liquidity, October recorded an average trading volume of nearly 1.07 billion shares per day, with an average trading value of over 33.549 trillion VND per day. This represents an 8.5% decrease in volume and a 1.4% decrease in value compared to September.

For covered warrants (CW), the average trading volume was over 53.4 million CW per day, with an average trading value of more than 139 billion VND per day, reflecting a 13.2% decline in volume and a 6.8% decline in value.

On the ETF channel, the average trading volume reached over 2 million ETFs per day, with an average trading value of more than 64.2 billion VND per day, marking a 17.8% decrease in volume and an 8.9% decrease in value.

Foreign investors’ total trading value in October exceeded 189.242 trillion VND, accounting for 12.3% of the market’s total trading value. Foreign investors net sold over 22.191 trillion VND during the month.

Source: HOSE

|

By October 31, HOSE listed and traded 669 securities, including 394 stocks, 4 closed-end fund certificates, 18 ETF certificates, and 253 CWs, with a total listed volume of over 195.2 billion securities. The market capitalization of stocks on HOSE exceeded 7.25 quadrillion VND, a 0.7% increase from the previous month, equivalent to 63.02% of the 2024 GDP and nearly 94.2% of the total market capitalization.

HOSE is home to 50 companies with a market capitalization exceeding 1 billion USD. Among these, three companies surpass 10 billion USD: Vingroup (VIC), Vietcombank (VCB), and Vinhomes (VHM), a decrease of three companies compared to the end of September.

However, listing activities were vibrant, with three new stocks joining from CRV Corporation (CRV), Technocom Securities JSC (TCX), and Nam Tan Uyen Industrial Park JSC (NTC).

– 11:00 07/11/2025

Market Pulse 07/11: Selling Pressure Intensifies

Pessimism continues to weigh on large-cap stocks, driving major indices downward. As of 10:30 AM, the VN-Index has fallen by over 18 points, trading around 1,624 points, while the HNX-Index is down 0.67 points, hovering near 265 points.

Vietcap Forecasts Three Scenarios for VN-Index in November, Highlighting Stocks with Positive Growth Potential

As we step into November 2025, Vietcap anticipates a market landscape shaped by a delicate interplay of supportive factors and short-term risks.