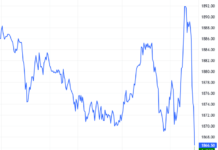

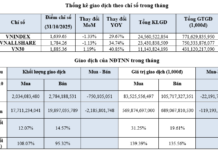

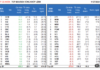

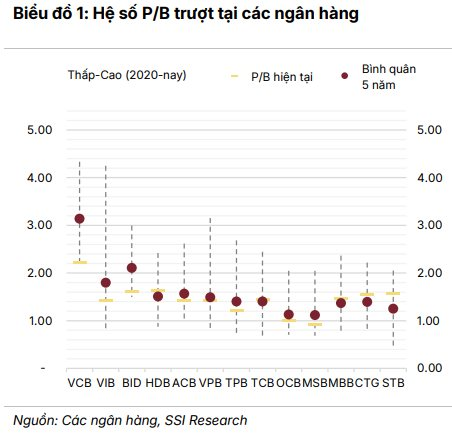

According to a recent report by SSI Research, bank stocks have entered an attractive price range following a market correction. Specifically, after peaking at 1.84x in August 2025, the average P/B ratio of bank stocks in the study declined by 16.4% to 1.53x as of November 3, 2025, falling below the 5-year average of 1.65x.

During this correction, the trailing P/B ratios of STB, CTG, MBB, and HDB remained above their historical averages, while other banks saw significant declines. Additionally, the projected 2026 P/B ratio is estimated at 1.28x, reflecting an attractive valuation amid expectations of an 18% growth in pre-tax profit and a return on equity (ROE) of 18%.

SSI Research noted that the 9-month 2025 results of banks met expectations, reinforcing a positive outlook for Q4 2025 and 2026. The industry’s profit is forecasted to grow by approximately 15% in 2025 and further improve to 18% in 2026, driven by sustainable credit growth, enhanced asset quality, and a more stable net interest margin (NIM).

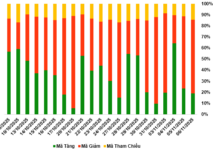

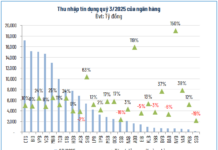

Commercial banks continued to outperform state-owned banks in credit growth, with rates of 4.5% and 4% quarter-on-quarter, respectively. Notable performers included VPB (+8.3%), TCB (+6.1%), ACB (+5.6%), and MBB (+5.5%).

Asset quality remained stable overall, with non-performing loans (NPLs) rising slightly by 1.5% quarter-on-quarter. Banks like ACB, VPB, CTG, and BID showed improvements, while STB, OCB, MBB, and HDB reported NPL increases. The system-wide NPL coverage ratio increased to 93.7%, and credit costs decreased to 1.13%. MBB’s NPL rise was attributed to renewable energy loans awaiting PPA contract restructuring with EVN, expected to be reclassified in Q4 2025.

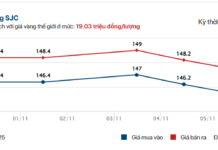

NIMs declined marginally by 4 basis points to 3.14%, driven by higher loan-to-deposit ratios (LDR) and reduced bond investments. HDB saw a sharp drop due to lower commitment fees, while STB improved following interest income recognition from Phong Phú Industrial Park. Excluding one-offs, core NIM remained flat at 3.02%.

Deposit rates increased by 20–80 basis points in October 2025, primarily through short-term promotional programs. SSI anticipates stable NIMs in Q4 and a potential recovery in 2026 as asset yields improve.

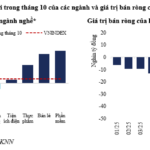

Non-interest income surged in Q3 2025, driven by foreign exchange (+23% year-on-year) and securities. Record highs in the stock market boosted brokerage, margin lending, investment banking, and proprietary trading profits for bank-affiliated securities firms. Consequently, trading and investment securities income rose 33-fold year-on-year, significantly contributing to industry profit growth.

In summary, SSI Research views the banking sector as consolidating its foundation with a promising 2026 outlook, supported by stable profit growth, improved asset quality, attractive valuations, and strong contributions from non-interest segments.

Why Vinhomes Green Paradise is a Top Contender for the “7 Wonders of the Future City”?

On October 31st, the “7 Wonders of the Urban World” campaign, initiated by New7Wonders, officially launched, inviting the global community to nominate iconic symbols that embody innovation, creativity, and sustainable development.

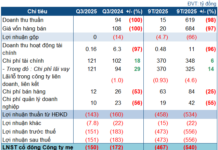

Bank Stocks: Profit Quality and Inherent Risks Insufficient for Valuation Expansion

The Q3/2025 financial results of numerous banks reveal a promising outlook, driven by credit expansion and improved non-interest income, signaling that the toughest phase of the profit cycle may be behind us. However, the stock market has responded with caution, scrutinizing profit quality, net interest margin positioning, potential delays in bad debt formation, and lingering legal risks. As risk premiums rise amid macroeconomic uncertainties and capital flows, valuation multiples are compressing, tempering the short-term positive impact of profit growth.