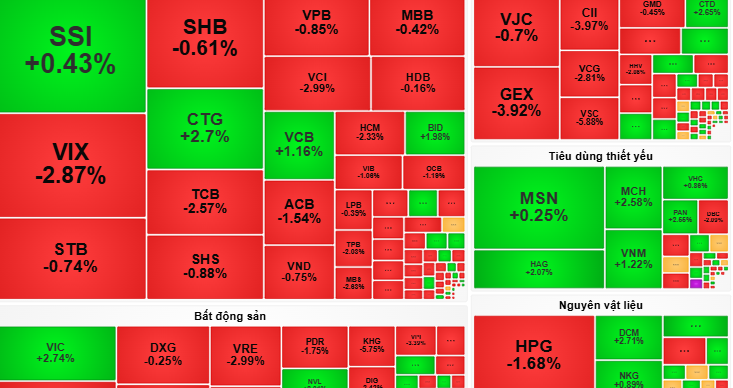

By the close of the session on November 5th, the VN-Index settled at 1,654 points, climbing nearly 3 points (or 0.18%).

The morning session on November 5th opened with investors still reeling from the previous day’s significant volatility. Despite this, the VN-Index swiftly stabilized, fluctuating within a +/-10-point range.

Although red dominated the market, efforts from large-cap stocks helped the benchmark index maintain the 1,650-point level. Notably, VIC (Vingroup) rose 1.2%, CTG (VietinBank) gained 0.8%, BID (BIDV) added 0.6%, and GAS (PetroVietnam Gas) held steady at high levels, serving as crucial pillars of support.

In the afternoon session, the VN-Index hovered around the reference point with significantly narrowed volatility, indicating a gradual balance between supply and demand. The banking sector remained a highlight, with CTG and BID sustaining their upward momentum, alongside Oil & Gas stocks (PLX, BSR, GAS) and VIC.

Remarkably, mid-cap stocks surged, with DCM (Dam Ca Mau) up 3.5%, DPM (Dam Phu My) rising 4.1%, CSV (Binh Dien Fertilizer) gaining 3.2%, and PVD (PV Drilling) briefly hitting its ceiling before cooling to a 5.8% increase. These movements helped prevent the VN-Index from plunging further.

However, foreign investors continued to exert pressure, net-selling VND 806 billion, primarily in TCB (Techcombank), VRE (Vincom Retail), and GEX (Gelex Group). This somewhat restrained the market’s recovery, though selling pressure wasn’t as intense as in previous sessions.

At the close, the VN-Index ended at 1,654 points, up nearly 3 points (or 0.18%).

According to VCBS Securities, proactive buying sentiment remains cautious. The VN-Index is signaling a search for equilibrium around the 1,640-1,660 range, characterized by low liquidity and pronounced sectoral divergence.

VCBS advises investors to leverage the rebound to restructure portfolios, prioritizing the removal of underperforming stocks facing heavy selling pressure. Simultaneously, opportunities should be sought in stocks confirming successful bottom formations or maintaining upward trends with new price bases and increased proactive buying liquidity.

However, other securities firms caution investors to consider short-term exploratory investments, strictly avoiding chasing stocks at high prices to mitigate risks.

Exclusive $3.5 Billion Connection Unveiled Between Vietnam’s Two Most Prestigious International Airports, Just 40km Apart

The government has recently implemented adjustments regarding the connectivity between these two airports.

Proposed Increase in Asset Declaration Threshold from 50 Million to 150 Million

The proposed amendments to the Anti-Corruption Law aim to enhance transparency by raising the asset declaration threshold from 50 million to 150 million VND. Additionally, the draft law suggests increasing the supplementary declaration requirement for asset and income fluctuations within a year from 300 million to 1 billion VND.

KBC, AIC, and Vietinbank Forge $2 Billion Data Center Development Partnership

On October 28, 2025, in London, Kinh Bac City Development Shareholding Corporation (HSX: KBC) signed a Memorandum of Understanding (MoU) with Accelerated Infrastructure Capital (AIC), a leading investment and development platform for data centers and digital infrastructure based in London (UK) and Hong Kong (China), alongside the Joint Stock Commercial Bank for Foreign Trade of Vietnam (VietinBank).