Domestic gold prices have consistently exceeded global rates by 18 to over 20 million VND in recent days. Experts suggest that establishing a gold trading platform could help narrow this gap, unlocking the vast gold reserves held by Vietnamese citizens.

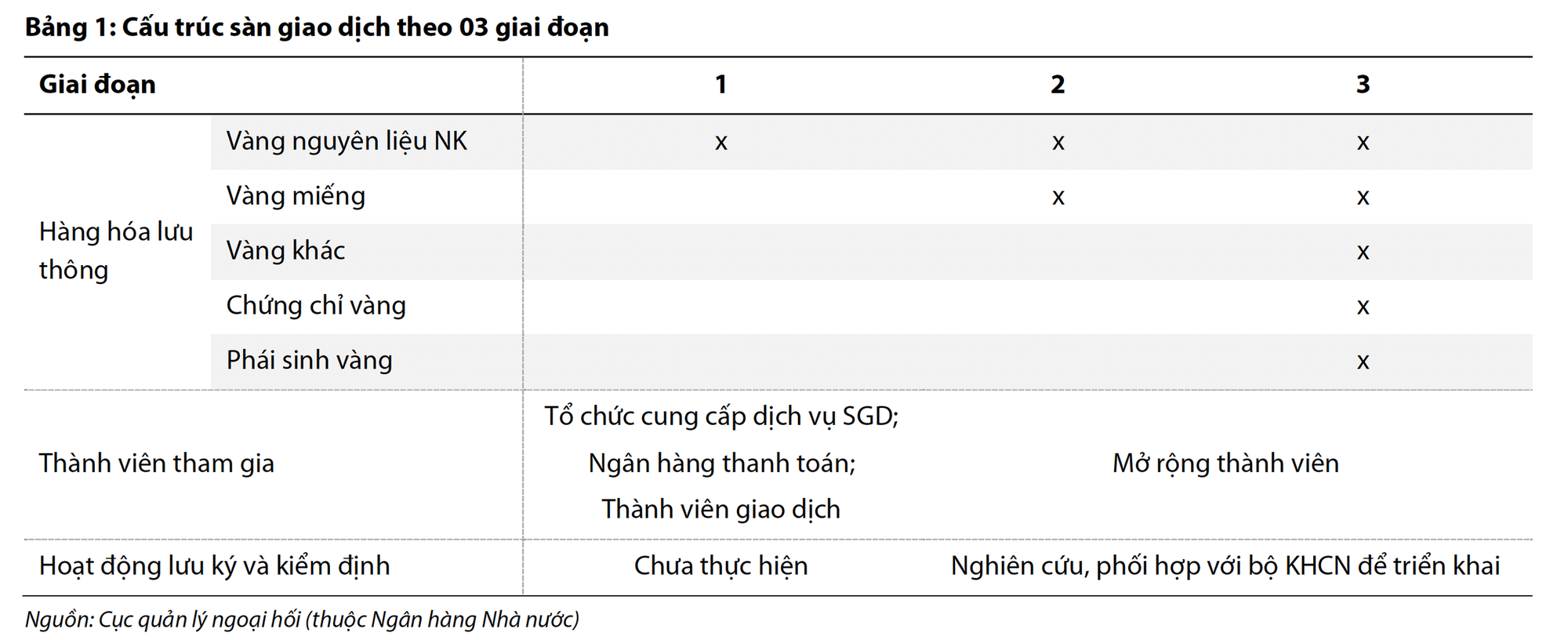

The State Bank of Vietnam is actively working to pilot a gold trading platform. Among the proposed models, the Shanghai Gold Exchange (SGE) is widely recommended by experts as the most suitable for Vietnam’s context.

According to Vietnam Dragon Securities Company (VDSC), the Shanghai Gold Exchange (SGE) serves as an ideal reference for Vietnam’s pilot gold trading platform in the Asian region.

The State Bank of Vietnam is taking steps to pilot the establishment of a gold trading platform.

“As the world’s largest physical gold spot exchange, SGE’s spot and forward contracts are complemented by futures trading on the Shanghai Futures Exchange (SHFE), though the two platforms are not directly linked.

SGE members include domestic commercial banks, designated foreign banks acting as settlement banks, gold producers, consumers, investors, thousands of institutional clients, and millions of individual customers,” noted a VDSC expert.

At the Shanghai Gold Exchange, gold bars are produced in compliance with SGE’s current standards. The gold is refined by SGE-accredited entities, and standard gold is supplied by qualified vendors recognized by the international SGE market.

Each member or customer is issued a physical gold account with a unique identifier, facilitating physical delivery transactions through gold account transfers.

Regarding the pilot gold trading platform, Đặng Văn Thành, Chairman of TTC Group, recently emphasized the feasibility of establishing such a platform but stressed the need for cautious implementation. He advocated for transparent mechanisms aligned with legal frameworks and market realities. Given the substantial gold reserves held by citizens, the platform should be designed to mobilize this resource, transforming it into a financial instrument to support economic development.

“Vietnam can draw lessons from Asian countries like India, China, and Russia to develop an efficient, transparent, and beneficial operational framework for businesses and the economy,” stated Mr. Thành.

Source: VDSC

Dr. Lê Anh Tuấn, CEO of Dragon Capital Vietnam Fund Management (DCVFM), highlighted several international models for gold mobilization and trading that Vietnam could consider. In India, the government issues gold bonds, allowing investors to contribute to gold reserves without purchasing physical gold, thereby efficiently mobilizing large resources. However, this requires robust legal and operational frameworks. China operates both physical and non-physical gold trading platforms.

“Transitioning from physical gold to digital gold is inevitable, but implementation is complex, requiring transparent mechanisms and strong integration with capital markets,” said Dr. Lê Anh Tuấn.

Banks’ Willingness to Lend for Real Estate Deposits Signals Overheated Credit Market

According to Dr. Dinh The Hien, credit growth in the first nine months of 2025 reached approximately 13%, while the growth in real estate market capitalization was significantly higher, nearing 20%. The months of August and September saw particularly robust increases.

Banks Gear Up to Launch $21 Billion Credit Package for Infrastructure and Digital Technology Investments

For long-term financing, our target clients are businesses investing in critical national projects within strategic infrastructure sectors (transportation, power) as designated by the Ministry of Construction and the Ministry of Industry and Trade. In the realm of strategic technology, eligible borrowers are projects producing goods listed in the “National Strategic Technology and Product Directory” under Decision 1131/QĐ-TTg dated June 12, 2025, with verification from the Ministry of Science and Technology.

Unlocking Wealth: National Assembly Delegate Proposes Mobilizing 500 Tons of Gold from Citizens

According to delegate Thạch Phước Bình, two significant yet underutilized resources are the state’s off-budget financial funds and the accumulated gold and assets held by the population.