Vietnam stands at the threshold of a new era of growth, with ambitious economic targets – a projected GDP growth rate of over 8% in 2025 and a remarkable 10% or higher in 2026. The country’s economic scale is expected to reach USD 510 billion by 2025, with GDP per capita soaring to USD 5,400 – 5,500 by 2026.

Amidst this dynamic transformation, the role of the business community becomes pivotal. As of the first nine months of 2025, the market has witnessed a dazzling financial landscape, where leading enterprises not only maintained but also achieved remarkable breakthroughs in both revenue and profit.

The financial results of listed companies in the first nine months of 2025 have revealed notable highlights.

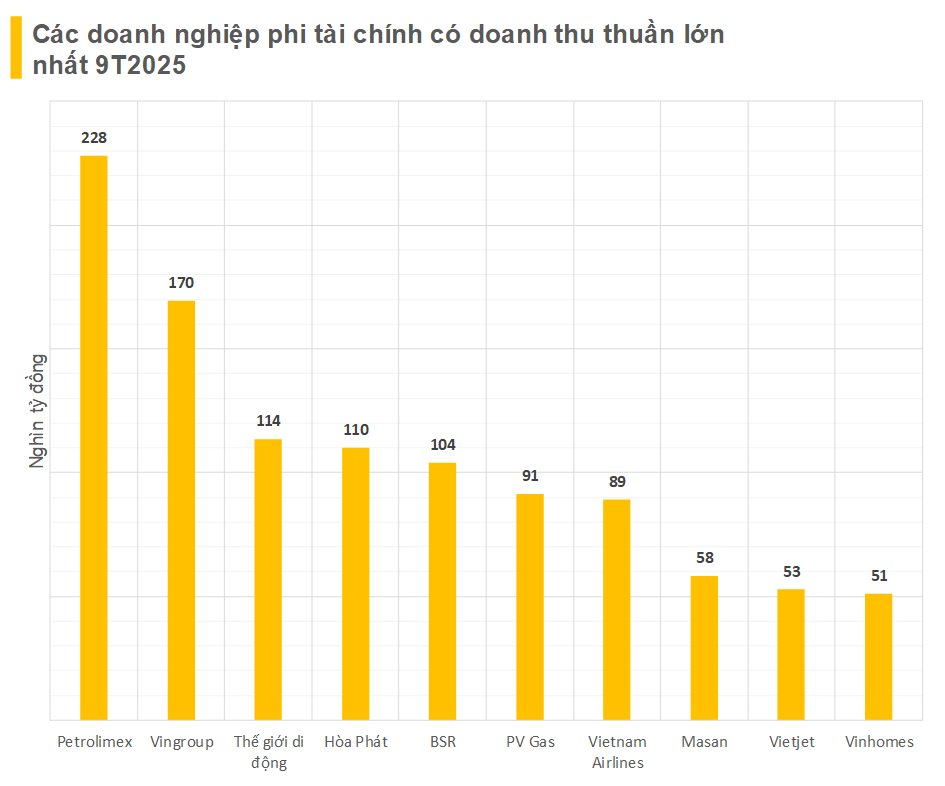

During this period, 10 non-financial enterprises recorded net revenues exceeding VND 50,000 billion. Leading the pack is Petrolimex (PLX) with a net revenue of over VND 228,000 billion, marking a 7% increase compared to the same period last year.

Following closely behind Petrolimex is Vingroup (VIC) with a net revenue of more than VND 169,600 billion, a 34% surge year-on-year. Vingroup’s subsidiary, Vinhomes (VHM), secured the 10th position with a net revenue of nearly VND 51,100 billion.

Other enterprises surpassing the VND 100,000 billion net revenue mark include The Gioi Di Dong (VND 113,600 billion), Hoa Phat (VND 119,900 billion), and BSR (VND 104,000 billion).

The top 10 non-financial enterprises by net revenue in the first nine months of 2025 feature three oil and gas companies (Petrolimex, PV Gas, and BSR), two real estate firms (Vingroup and Vinhomes), two airlines (Vietnam Airlines and Vietjet), one retail company (The Gioi Di Dong), one steel producer (Hoa Phat), and one F&B enterprise (Masan).

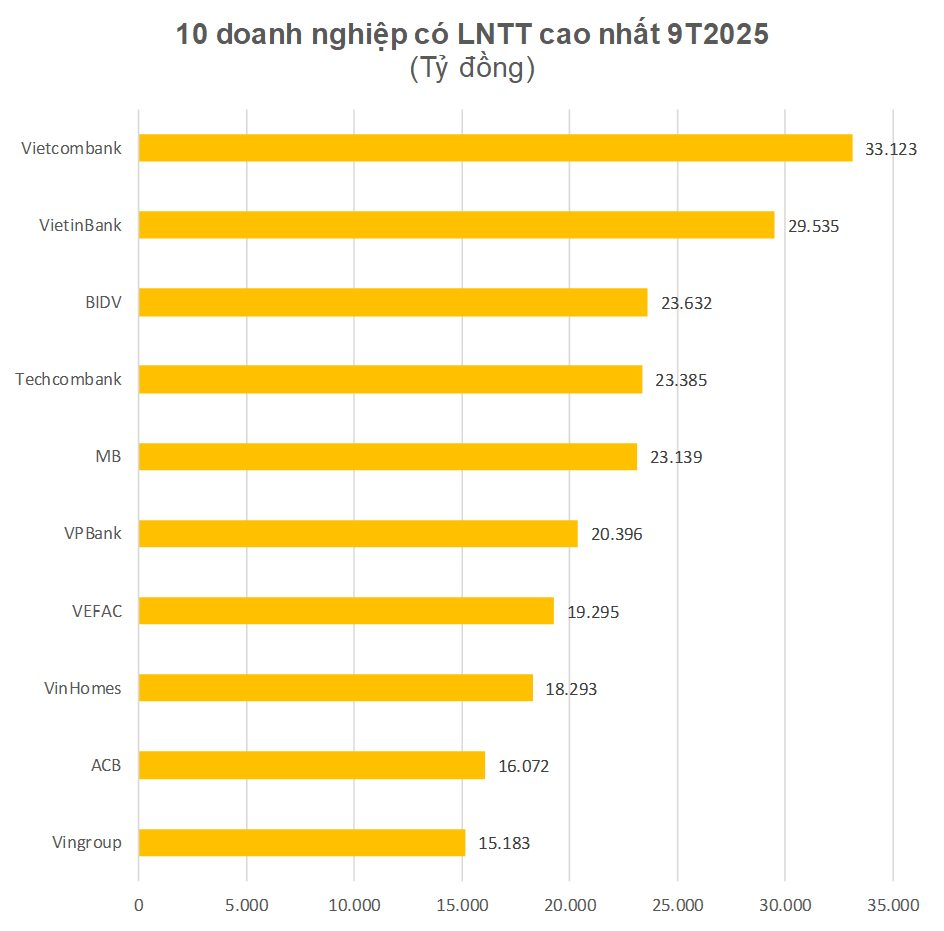

In terms of pre-tax profit, 17 enterprises reported figures exceeding VND 10,000 billion in the first nine months of 2025. Among them, the top 10 enterprises boasted profits surpassing VND 15,000 billion.

The banking sector continues to assert its dominance, with seven banks securing positions in the top 10. The remaining three spots are occupied by Vingroup and its two subsidiaries.

Specifically, Vingroup recorded a pre-tax profit of nearly VND 15,200 billion, ranking 10th; VEFAC (VEF) achieved a pre-tax profit of nearly VND 19,300 billion, securing the 7th position; and Vinhomes claimed the 8th spot with a pre-tax profit of nearly VND 18,300 billion.

Vietcombank maintained its lead in banking profits, reporting a pre-tax profit of VND 33,123 billion, a 5% increase compared to the same period last year.

VietinBank demonstrated robust growth, with a 51% surge in pre-tax profit to VND 29,535 billion. In Q3 alone, VietinBank’s pre-tax profit soared by 62% to VND 6,552 billion.

VPBank also emerged as a standout performer, achieving a 47% growth in pre-tax profit to VND 20,396 billion.

Other familiar names in the banking sector, including BIDV, MBBank, Techcombank, and ACB, also secured positions on the leaderboard.

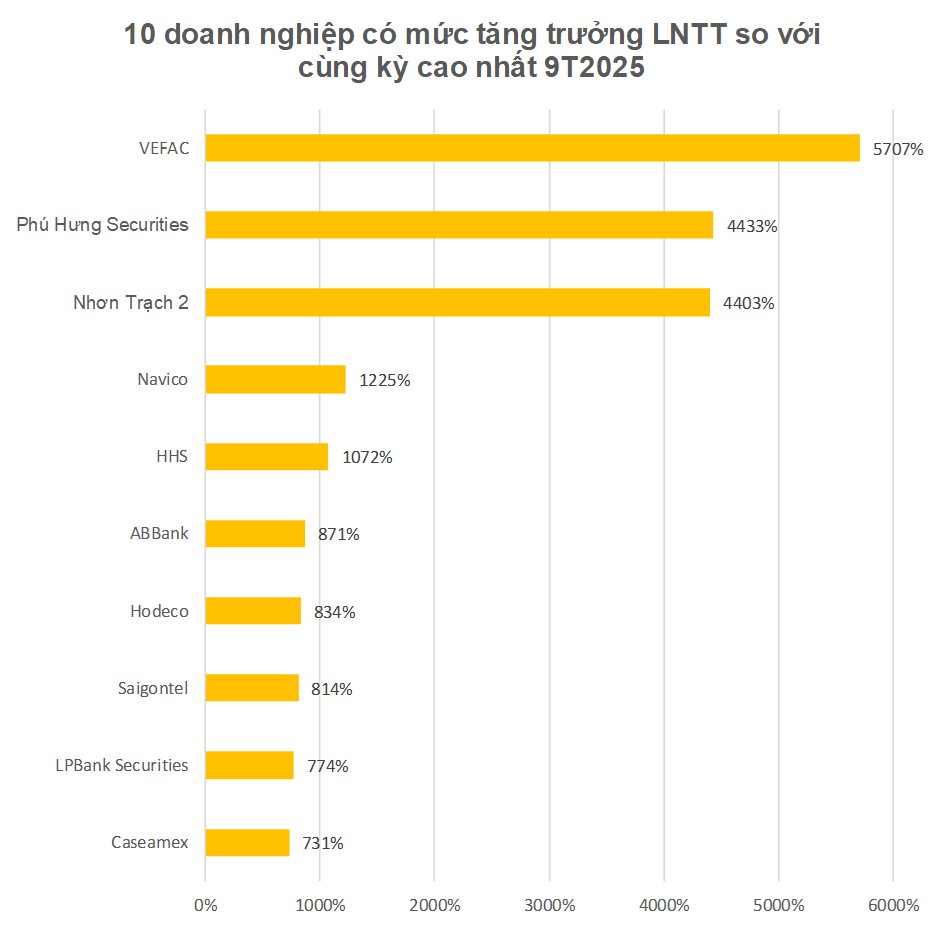

Regarding growth, excluding cases where profits in the first nine months of 2024 were negative, VEFAC led the pack with a staggering 5,707% growth in pre-tax profit.

Five enterprises achieved growth rates exceeding 1,000% in the first nine months of 2025. Apart from VEFAC, these include Chứng khoán Phú Hưng (4,433%), Nhơn Trạch 2 (4,403%), Navico (1,225%), and HHS (1,072%).

The top 10 enterprises by pre-tax profit growth feature three real estate companies, two securities firms, two seafood enterprises (Navico and Caseamex), one power company (NT2), one bank (ABBank), and one automobile and real estate business (HHS).

Among enterprises with pre-tax profits exceeding VND 1,000 billion in the first nine months of 2024, Gelex Electric (GEE) emerged as the top performer, boasting a 162% surge in pre-tax profit to over VND 3,500 billion. Additionally, GEE witnessed a 24% increase in net revenue and a 17% rise in total assets compared to the previous year-end.

GEE’s parent company, Gelex, also reported robust growth in the first nine months, with a 52% increase in pre-tax profit to over VND 3,400 billion and an 18% rise in net revenue to nearly VND 27,900 billion.

The Vietnam Rubber Industry Group (GVR) secured the second position in pre-tax profit growth, with a 94% increase. GVR’s net revenue surged by 21% to over VND 20,400 billion.

Viettel Global, the sole enterprise with a profit exceeding VND 10,000 billion, joined the top 10. In the first nine months of 2025, Viettel Global achieved a revenue of nearly VND 31,900 billion, a 24% increase, and a post-tax profit of over VND 10,500 billion, a 74% surge.

In Q3 2025 alone, Viettel Global’s pre-tax profit reached VND 5,268 billion, a remarkable 306% increase compared to the same period last year, setting a new quarterly profit record.

Beyond revenue and profit growth, Viettel Global’s asset scale also improved significantly. As of September 30, 2025, its consolidated total assets reached nearly VND 73,900 billion, an increase of VND 10,400 billion (16%) compared to the beginning of the year.

The Gioi Di Dong reported a net revenue of nearly VND 113,700 billion in the first nine months of 2025, a 14% increase, and a pre-tax profit of over VND 6,100 billion, a 62% surge compared to the same period in 2024.

According to MWG’s explanation, the profit increase is attributed to the continued 15% revenue growth of The Gioi Di Dong and Dien May Xanh chains, despite a decrease in the number of stores compared to the same period last year. These two chains play a pivotal role in MWG’s profit structure. Additionally, Bach Hoa Xanh’s profit improved in Q3 compared to Q2, while other chains, including An Khang, Avakids, and Erablue, contributed to MWG’s overall profit growth.

Despite a 3% decline in revenue, Masan Group (MSN) achieved a 55% increase in pre-tax profit to over VND 5,200 billion. This growth was driven by improved profitability at Wincommerce, Masan MeatLife, and Phuc Long, along with increased profit contributions from TCB and the deconsolidation of H.C. Starck (HCS). Although MCH is in the early stages of refining its distribution model, it experienced a slight increase in net financial expenses.

Other enterprises demonstrating notable growth in the first nine months of 2025 include PV Power (84%), REE (56%), Đạm Cà Mau (52%), and VPS (52%).

Several leading enterprises are truly “breaking through” in terms of revenue, profit, and growth rates.

First and foremost is Vingroup, the largest private enterprise in the country. Vingroup’s financial report for the first nine months of 2025 showcases robust growth, with a net revenue of over VND 169,600 billion, a 34% increase, and a pre-tax profit of nearly VND 15,200 billion, also up by 34%. Vingroup’s post-tax profit doubled compared to the same period last year, reaching VND 7,565 billion. Vingroup consistently ranks among the top enterprises in both revenue and profit for the first nine months of 2025.

Vingroup’s subsidiaries, such as Vinhomes and VEFAC, also recorded revenues or profits among the market leaders.

Simultaneously, Vingroup’s assets surpassed the VND 1,000 trillion mark, with the group’s massive capital mobilization being channeled into real estate, the VinFast complex, and new industrial pillars.

Among banks, Vietcombank maintained its top position in pre-tax profit for the first nine months of 2025. VietinBank emerged as a strong contender, achieving a 51% growth in pre-tax profit to over VND 29,500 billion, securing the second position.

Hoa Phat, the “Steel King,” reported a 5% increase in revenue and a 29% surge in pre-tax profit compared to the same period last year. In the first nine months of 2025, Hoa Phat produced 7.9 million tons of crude steel, a 23% increase, and sold 7.4 million tons of HRC, construction steel, high-quality steel, and billets, a 22% rise.

Bình Sơn Refinery (BSR) demonstrated impressive profit growth, with a 200% increase in pre-tax profit to over VND 2,500 billion in the first nine months. In Q3 alone, BSR’s pre-tax profit exceeded VND 1,000 billion, compared to a loss of VND 1,300 billion in the same period last year. The company attributed this to the improved margin between crude oil and product prices, with crude oil prices (Dated Brent) decreasing from USD 70.99 per barrel in July 2025 to USD 68.02 per barrel in September 2025, compared to a steeper decline from USD 85.31 per barrel in July 2024 to USD 74.33 per barrel in September 2024.

Additionally, BSR’s Q3 2025 sales volume (1.95 million tons) exceeded the previous year’s figure (1.72 million tons), contributing to the profit turnaround.

Vietnam Airlines reported growth in both revenue and profit, with an 11.5% increase in revenue and a 15% rise in pre-tax profit compared to the same period last year. In the first nine months of 2025, Vietnam Airlines proactively launched new international routes to meet the growing demand for international travel to and from Vietnam, thereby driving positive business results.

Navico Launches Supply Channel for JBS Brazil, Delivers First Fish Shipment as Q3 Exports Surpass $1.5 Trillion

The first container shipment of tilapia to JBS marks Nam Viet Corporation’s (Navico, HOSE: ANV) entry into the Brazilian market, following the company’s impressive Q3 performance, which saw a 71% surge in export revenue and nearly tenfold increase in net profit year-over-year.

Unlocking Success: VinaCapital Expert Reveals 3 Core Factors for Vietnamese Startups to Triumph in IPOs

Vietnam’s stock market is entering a new phase of acceleration, fueled by FTSE Russell’s recent upgrade to “Secondary Emerging Market” status and liquidity levels that continue to lead the region. Amidst this wave of robust reform, the narrative of “going public – IPO” has emerged as a hot keyword among investors and Vietnam’s startup community.

Amata Proposes 3,800-Hectare Industrial Park Investment in Ho Chi Minh City

Amata Corporation (Thailand) is proposing to invest in a large-scale industrial, urban, and service complex spanning over 3,800 hectares in Ho Chi Minh City, with a minimum investment of $180 million.

SCIC’s 10-Month Profit Surges to Nearly VND 11,400 Billion: On Track to Become the Government’s Premier Investment Fund

SCIC is proactively advocating for the Ministry of Finance and the Government to issue a separate Decree, establishing a favorable legal framework for state capital investment and management in the upcoming period. This initiative also seeks to enable a transition to a Government Investment Fund (Sovereign Wealth Fund) operational model.