This innovative solution empowers customers to “buy now, pay later” for transactions made with their debit cards, utilizing funds from their payment accounts. The installment conversion is instantly approved based on transaction data and the customer’s financial credibility. This marks a significant advancement in consumer credit, as VIB integrates online unsecured loan technology into the familiar payment card, enabling customers to spend, borrow, and pay in installments all within a single platform.

Redefining Installments – Installment Plans Without a Credit Card

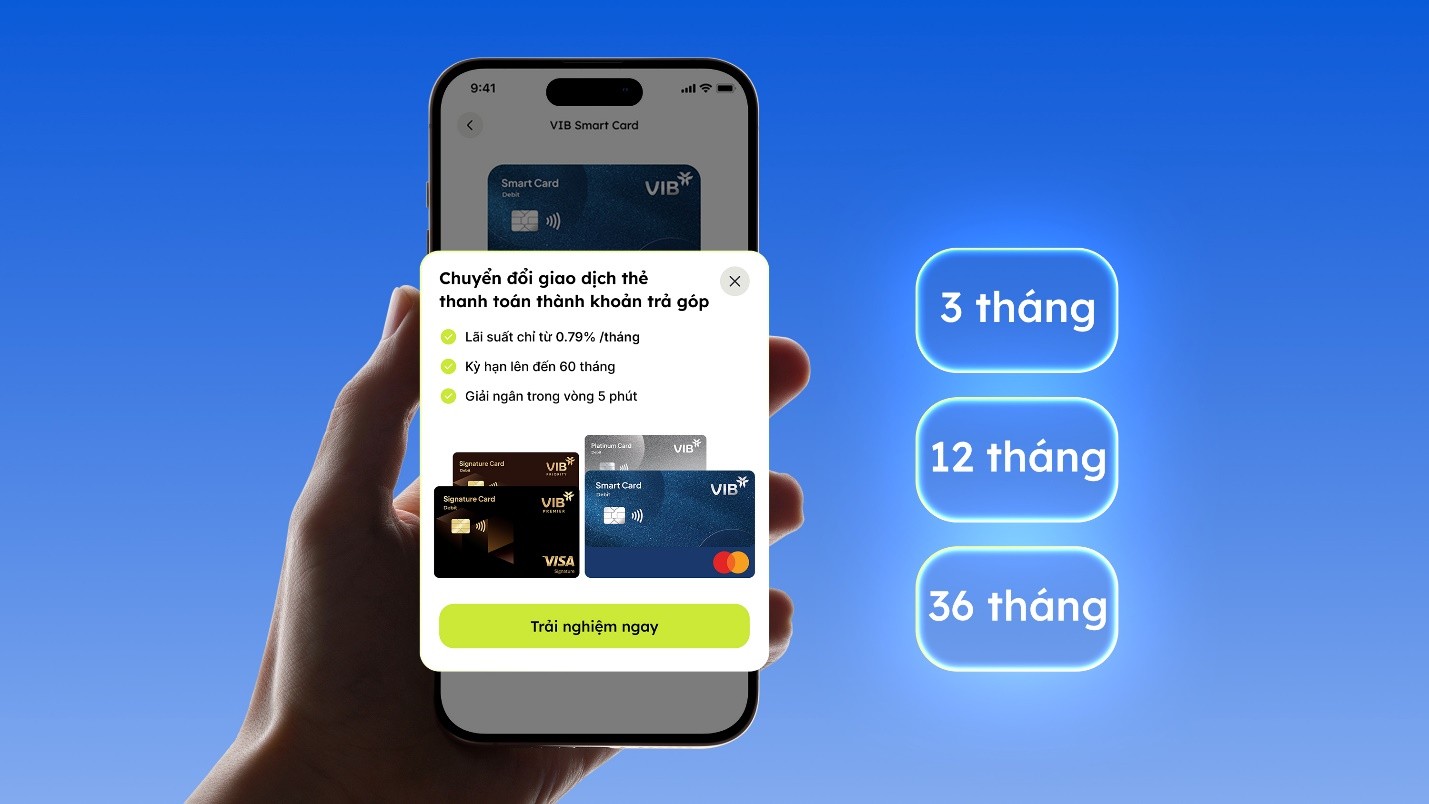

Traditionally, installment payments were a common option for credit card users but were never accessible to debit cardholders. Now, instead of applying for a loan or credit card, international VIB debit cardholders can convert their spending transactions into installment plans with just a few steps on the Max app.

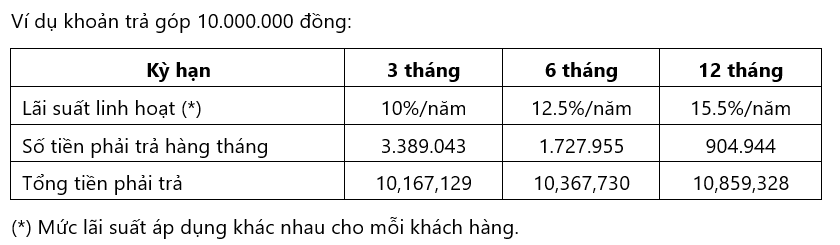

With this new solution, cardholders can split any purchase of 3 million VND or more into flexible installments ranging from 3 to 60 months, with interest rates starting at 0.79%/month (equivalent to 9.5%/year). Alternatively, they can opt for 0% interest installment plans with no conversion fees at over 100 of VIB’s major partners in electronics, technology, education, travel, fashion, and more.

This solution empowers users to manage their finances proactively, offering a clear and fixed repayment plan that helps build creditworthiness through recorded installment history in the bank’s internal system.

A VIB representative stated: “We identified a significant segment of customers who are not yet ready for traditional credit cards or consumer loans. This solution introduces them to financial discipline—borrowing and repaying on time—in a safe, controlled framework, while also building their credit profile for the future.”

Two Flexible Options – Catering to All Spending Needs

The installment solution for international debit cards offers two flexible options:

For large purchases, debit cardholders (without credit cards) can enjoy 0% interest installments at over 100 VIB partners by requesting an installment plan in-store or selecting the “installment payment method” when shopping online. Within seven days, VIB will notify the cardholder to confirm the loan. There are no setup or periodic maintenance fees, with flexible terms ranging from 3 to 36 months.

For transactions of 3 million VND or more using personal funds via the VIB international debit card, cardholders can register for installments directly on the Max app with just a few clicks. Enjoy preferential rates starting at 0.79%/month (equivalent to 9.5%/year), with flexible terms from 3 to 60 months.

Once the installment plan is approved, the bank will disburse the equivalent amount of the purchase into the cardholder’s payment account. Cardholders then make monthly payments according to their chosen term. Notably, installment transactions still qualify for reward points or cashback programs based on the card tier.

The Next Step in VIB’s Strategy to Expand Its Spending-Consumer Lending Ecosystem

Previously, VIB made waves by launching international payment cards with up to 5% cashback, no minimum spending required, creating an attractive ecosystem that delivers real value for everyday spending—from shopping and dining to travel and online services.

In the market, cashback and installment plans have traditionally been exclusive to credit cards. By extending these benefits to debit cards, VIB pioneers a transformation of the debit card from a simple transaction tool into a comprehensive personal financial management instrument—where spending, cashback, and installments converge into a single, seamless experience for all customers.

With the installment solution for debit cards, VIB is expanding consumer credit to customers who prefer using personal funds for all expenses. Now, they can access credit safely and conveniently whenever needed, with the flexibility to convert funds post-purchase. The entire experience is fully digitized on the Max by VIB platform. This privileged experience, once exclusive to financially and technologically advanced nations like the US, Europe, and Singapore, is now available to Vietnamese users exclusively at VIB. Open a card via the Max app and explore flexible installment options here.

“Home Credit and The Gioi Di Dong: A Comprehensive Partnership”

As part of a comprehensive partnership strategy, Home Credit and The Gioi Di Dong’s collaboration on the “buy now, pay later” model, Home PayLater, aims to provide practical benefits to consumers and boost digital payment habits in Vietnam. With a revenue target of VND 15,000 billion, this partnership is expected to be a significant step forward in the digital payment landscape in the country.

“Huge Cash Injection by Banks: Over $8.6 Billion Pumped into the Economy in Mid-September, Says Governor; A 15% Credit Growth Target is Well Within Reach.”

As of the end of Q3, the banking sector has extended an additional VND 1.2 quadrillion in loans, achieving approximately 60% of its targeted credit growth. This leaves a remaining loanable fund of around VND 800 trillion for the final quarter.