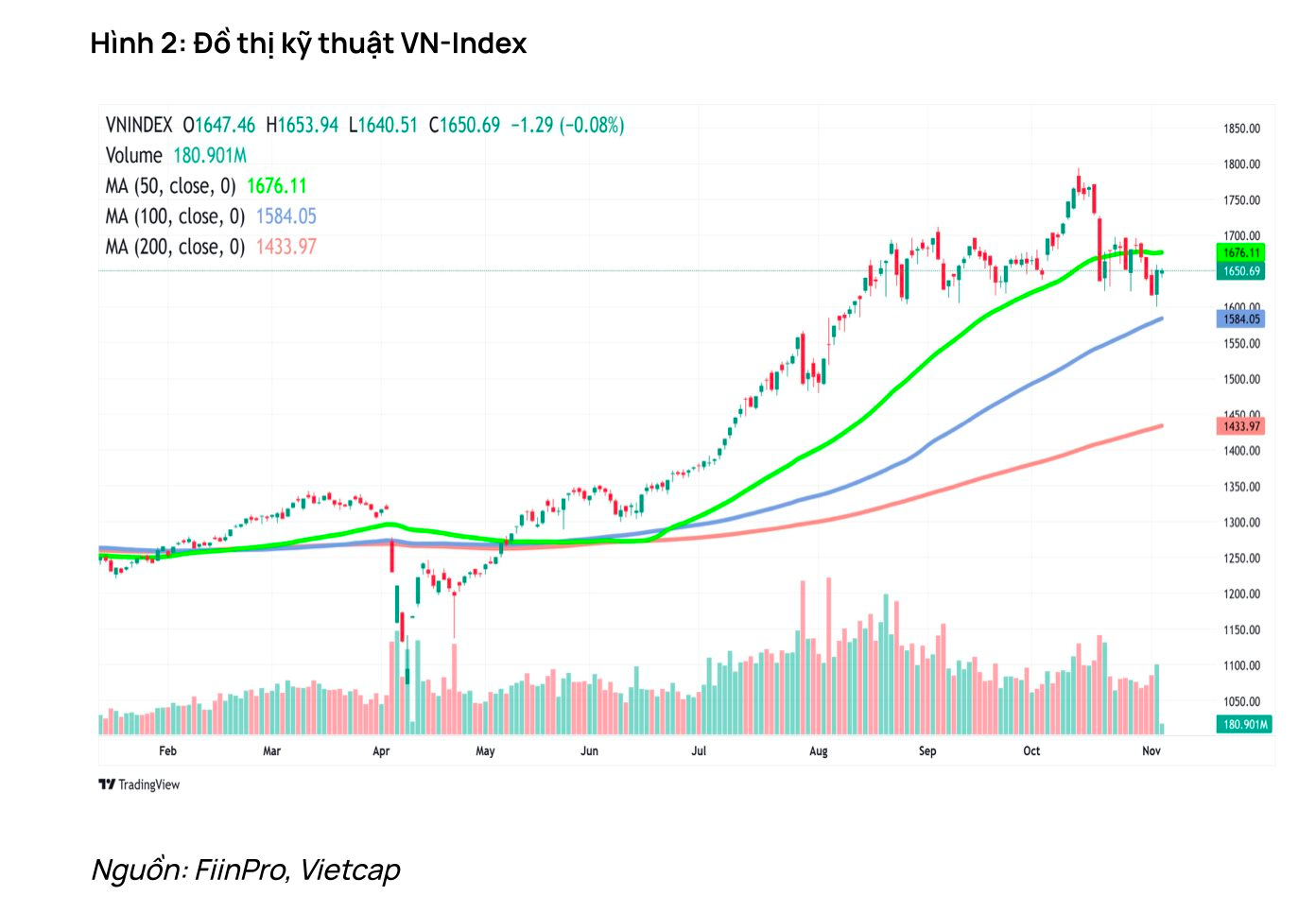

Following a sharp decline in mid-October from its peak of 1,795 points, the VN-Index has been trading sideways, consolidating within the 1,620–1,690 range (±10 points) in late October and early November. This movement indicates the market is stabilizing after significant volatility, as supply and demand forces gradually reach equilibrium.

In a recent report, Vietcap Securities suggests that as we enter November 2025, the market will face a mix of supportive factors and short-term risks.

On the supportive side, listed companies continue to report positive year-over-year profit growth. According to FiinPro data as of October 31, 968 out of 1,644 companies (representing 91.9% of total market capitalization) have released their Q3 2025 earnings, with aggregate after-tax profits up 41.1% year-over-year.

Specifically, the 81 stocks in Vietcap’s tracking portfolio saw a 15.2% increase in parent company net profit, achieving approximately 71% of full-year projections. This underscores the resilience of corporate fundamentals, providing a solid buffer for market stability.

Conversely, with Q3 earnings season concluded, the market lacks fresh catalysts in November. Investor sentiment and global economic developments may therefore exert greater influence on stock price movements.

Notably, on November 4, leaders from major investment banks like Goldman Sachs and Morgan Stanley warned of a potential 10–15% correction in the US stock market due to elevated valuations. This immediately dampened global investor sentiment, including in Vietnam.

Vietcap outlines three scenarios for Vietnam’s market in November.

Base Case (60% probability): The VN-Index remains within the 1,620–1,690 range in November, with a ±10-point buffer at both boundaries. Liquidity is likely to stay subdued as short-term speculation diminishes during this consolidation phase. Stock performance may diverge significantly based on individual news flow, sentiment, and capital allocation.

Bullish Case (15% probability): Following consolidation, the VN-Index could break above 1,690–1,700 with improved liquidity. In this scenario, capital may return to leading sectors like banking and energy, potentially pushing the index toward 1,790–1,800.

Bearish Case (25% probability): Heavy domestic selling pressure, combined with foreign outflows and margin calls, could breach the 1,610–1,620 support. If this occurs, the index may correct further, with the next major support at around 1,500.

Investment Recommendations: For short-term strategies, Vietcap highlights BID and DCM based on technical analysis. Additionally, VGC and ANV are added to the watchlist for their promising mid- to long-term growth prospects.

10 Months of Dull Performance in the Power Sector Stocks

Despite the VN-Index surging over 30% in 10 months and numerous blue-chip stocks hitting new highs, the power sector stocks have largely remained on the sidelines of the market’s exuberance. This isn’t surprising for a defensive sector that prioritizes stability over volatility. Yet, beneath this quiet surface lie compelling narratives worth the market’s attention.

Technical Analysis for the Afternoon Session of November 6th: Shifting Towards the August 2025 Lows

The VN-Index halted its upward momentum, unexpectedly correcting sharply toward its August 2025 lows (around 1,605–1,630 points). Meanwhile, the HNX-Index exhibited negative volatility, forming a Bearish Engulfing candlestick pattern.