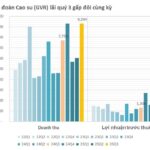

On November 5-11, the Vietnam Rubber Industry Group (VRG, stock code GVR) held its 2025 Extraordinary General Meeting of Shareholders.

Rising Rubber Prices Propel VRG to Early Profit Targets

According to VRG, 2025 marks a pivotal year in the group’s journey toward sustainable development and integration.

Despite challenges from extreme weather and other objective difficulties, VRG achieved its production and business targets in the first 10 months of 2025, with revenue and profit surpassing the same period in 2024.

Discussions at VRG’s 2025 Extraordinary General Meeting of Shareholders

In the first 10 months of 2025, consolidated revenue reached VND 25,888 billion, 83.4% of the annual plan; consolidated after-tax profit was VND 5,367 billion, 107.9% of the annual plan.

The parent company’s revenue was VND 5,440 billion, 95.5% of the annual plan; pre-tax and after-tax profit of the parent company were VND 2,698 billion, 109.9% of the 2025 plan.

Financial indicators for revenue and profit, both consolidated and individual, exceeded 2024 figures, primarily due to higher rubber prices. Pre-tax profit has already surpassed the 2025 plan agreed upon by the Ministry of Finance and approved by the Annual General Meeting of Shareholders.

The group’s equity capital has been preserved and grown, major financial balances are secure, and VRG has prepared sufficient resources to pay a 4% dividend on charter capital, totaling VND 1,600 billion, to shareholders as planned.

With rubber prices at their highest since 2014 (averaging VND 47–47.5 million per ton), these results demonstrate VRG’s effective management, rapid adaptability, and resilience in overcoming challenges.

VRG General Meeting Scene

Pursuing Long-Term Goals

VRG continues to focus on restructuring, digital transformation, green transition, technology application, optimized governance, and building a modern, transparent, efficient, and socially responsible enterprise model.

The group aims for consolidated revenue of at least VND 32,007 billion, 103.1% of the annual plan; consolidated after-tax profit is projected at VND 5,682 billion, 114.2% of the annual plan.

The parent company’s revenue is expected to reach VND 5,819 billion, 102.1% of the annual plan; the parent company’s profit is projected at VND 2,770 billion, 112.8% of the 2025 plan.

To achieve these goals, VRG will implement synchronized solutions: optimizing production, cost savings, enhancing productivity and investment efficiency across subsidiaries; accelerating digital transformation, transparent governance, and restructuring for a lean, efficient organization; developing new products, diversifying revenue streams, especially in industrial zones, wood processing, and energy; expanding export markets, developing key customers, and e-commerce channels; enhancing technology application and implementing “green production – low emissions – circular economy” models for sustainable development.

Mr. Nguyễn Quế Dương, Deputy Director of the State Enterprise Development Agency, Ministry of Finance, speaking at the meeting

Enhancing State-Owned Enterprise Efficiency

At the meeting, Mr. Nguyễn Quế Dương, Deputy Director of the State Enterprise Development Agency, Ministry of Finance, praised VRG’s efforts in maintaining stable production, ensuring growth, and fulfilling state budget obligations despite economic challenges.

Mr. Dương noted that 2026 will be a pivotal year for implementing growth and sustainable development strategies for the economy and state-owned enterprises.

Following government directives, the Ministry of Finance is collaborating with relevant ministries to implement the Plan for Restructuring, Innovating, and Enhancing the Efficiency of State Corporations and Groups, focusing on streamlining operations, improving governance, and optimizing resource use.

In this context, VRG is recognized as the largest agricultural conglomerate with strong financial potential, modern infrastructure, and a high-quality workforce.

The Ministry of Finance is confident that with the right development strategy, VRG will remain a key player in the rubber industry’s value chain and significantly contribute to Vietnam’s sustainable agricultural development.

The meeting elected additional members to the Board of Directors, including Mr. Trương Minh Trung and Ms. Huỳnh Thị Cẩm Hồng; Mr. Nguyễn Văn Cường was appointed as the Group’s Chief Inspector for the 2021-2026 term.

DCM Profits Surge 2.7x Year-on-Year, Achieving 200% of Annual Plan in 9 Months

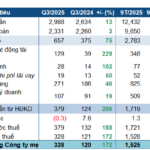

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo or Ca Mau Fertilizer, HOSE: DCM) reported robust earnings in Q3/2025, closely aligning with preliminary estimates. Over the first nine months, the company’s cumulative profit surged by 45%, surpassing its full-year target by an impressive 200%.

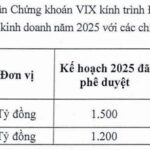

Securities Firm Aims to Quadruple 2025 Profit Plan, Targeting Capital Raise of Over 24 Trillion VND

The company anticipates raising over 11,000 billion VND through its upcoming share offering. This capital will be allocated to fund the development of the VIX Cryptocurrency Exchange and bolster resources for proprietary trading and margin lending activities.