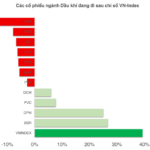

Amidst the stock market’s fluctuations around the 1,650-point mark, investor attention has shifted towards the energy sector, particularly oil and gas stocks.

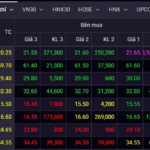

By the close of the November 5th session, several oil and gas stocks experienced a significant surge, with PVS and PVD leading the charge, both climbing 5.9% in value. Trading volumes also skyrocketed, as PVD saw over 32 million shares change hands, while PVS recorded nearly 17 million units traded, significantly surpassing recent averages.

Other notable performers included OIL, GAS, PVB, and BSR, which rallied between 3% and 5%. PTX stood out with a near-limit-up gain of 9.62%, reaching 28,500 VND per share, although only 100 shares were traded at this price.

Broadly speaking, the oil and gas sector has been on an upward trajectory since the latter half of October 2025. In just two weeks, stocks like PVD and PVS have soared by 20%-28%, while PLX and OIL have followed suit with gains of around 8%-10%.

Oil and gas stocks accelerate in the November 5th session

This rally follows the government’s issuance of Resolution No. 66.6/2025/NQ-CP on October 28, 2025, which addresses challenges and bottlenecks in the approval process for certain oil and gas activities.

The resolution delegates authority to the Vietnam Oil and Gas Group (PVN) to perform the duties and powers of the Ministry of Industry and Trade as outlined in the 2022 Petroleum Law and Decree No. 45/2023/NĐ-CP, ensuring no impact on national defense and security. This includes approving general development plans for oil and gas fields, adjusting early exploitation plans, and modifying field development plans with investment adjustments of less than 10%.

Granting PVN greater autonomy in approving oil and gas activities is seen as a crucial step, enhancing flexibility, reducing administrative burdens, and expediting project implementation.

Growth prospects to diverge in 2026

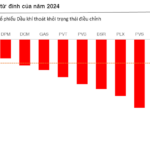

In its latest update, BSC Securities forecasts that oil and gas companies will maintain growth in the final quarter of 2025.

However, BSC notes that the sector’s growth is primarily driven by cost reversals, asset sales, and foreign exchange gains, while core business profits have not met expectations.

Looking ahead to 2026, BSC anticipates a divergence in performance among companies. Those with strong backlogs and favorable charter rates, such as PVS and PVD, are expected to sustain growth. In contrast, GAS may face challenges due to high profit benchmarks set in 2025 from cost reversals, as LNG supplies struggle to offset declining natural gas volumes. BSR could encounter headwinds from lower crude oil prices and narrowing crack spreads in 2026, although it will benefit from continued recovery in consumption volumes.

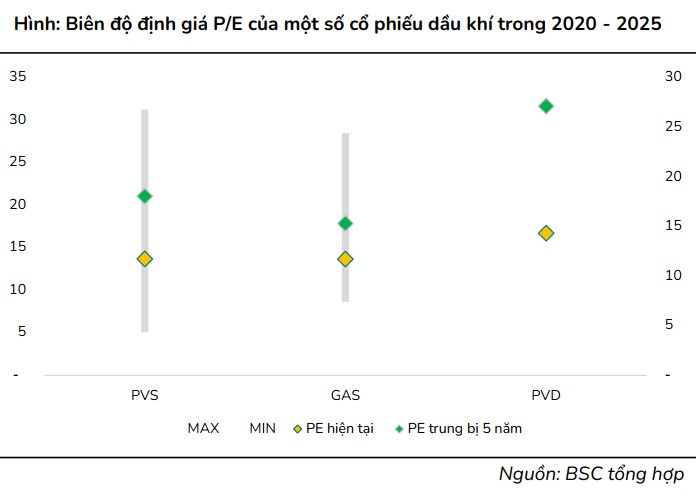

From a medium-term perspective, BSC analysts view oil and gas stocks as attractive investment opportunities, as most are trading at deep discounts to historical valuations. For instance, PVS’s market capitalization is lower than its net cash position (after debt deduction), and PVD is trading at a 43% discount to its 5-year median P/E ratio.

Where Are Oil & Gas Stocks Amid a Soaring Market?

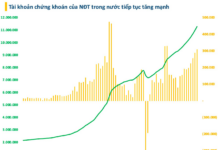

Following the Vietnamese stock market’s ascent to new heights and its official upgrade to secondary emerging market status, investor focus is shifting towards stocks with unique narratives, particularly within the energy sector. However, several energy stocks are currently lagging significantly behind the broader market’s momentum.