Following a robust rally near the psychological support level of 1,600 points, the stock market continued its recovery on November 5th, marked by high divergence and significantly reduced liquidity. At the close, the VN-Index edged up by 2.91 points (+0.18%) to 1,656.89 points.

Foreign trading activity remained a downside, with net selling reaching 875 billion VND across the market.

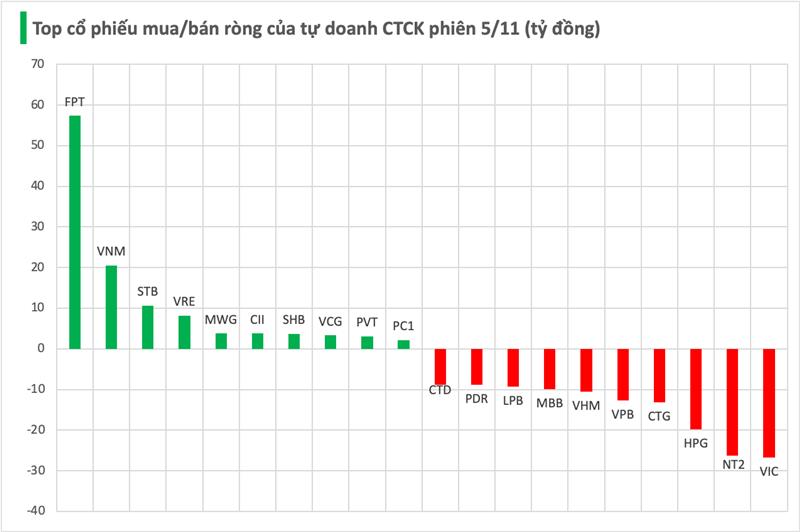

Securities firms’ proprietary trading desks net sold 77 billion VND on HOSE.

Specifically, securities firms were most active in net selling VIC, with a value of -27 billion VND, followed by NT2 (-26 billion), HPG (-20 billion), CTG (-13 billion), and VPB (-13 billion VND). Other stocks also saw notable net selling, including VHM (-10 billion), MBB (-10 billion), LPB (-9 billion), PDR (-9 billion), and CTD (-9 billion VND).

Conversely, FPT led the net buying activity with 57 billion VND. This was followed by VNM (21 billion), STB (11 billion), VRE (8 billion), MWG (4 billion), CII (4 billion), SHB (4 billion), VCG (3 billion), PVT (3 billion), and PC1 (2 billion VND).

Stock Market Update November 6: VN-Index Expected to Fluctuate with Mixed Trends

VCBS Securities forecasts significant volatility in the VN-Index during the November 6th session, driven by cautious investor sentiment.

10 Months of Dull Performance in the Power Sector Stocks

Despite the VN-Index surging over 30% in 10 months and numerous blue-chip stocks hitting new highs, the power sector stocks have largely remained on the sidelines of the market’s exuberance. This isn’t surprising for a defensive sector that prioritizes stability over volatility. Yet, beneath this quiet surface lie compelling narratives worth the market’s attention.

Technical Analysis for the Afternoon Session of November 6th: Shifting Towards the August 2025 Lows

The VN-Index halted its upward momentum, unexpectedly correcting sharply toward its August 2025 lows (around 1,605–1,630 points). Meanwhile, the HNX-Index exhibited negative volatility, forming a Bearish Engulfing candlestick pattern.