The bond issuance is guaranteed by the Credit Guarantee and Investment Facility (CGIF), a trust fund under the Asian Development Bank (ADB).

These bonds are non-convertible and unsecured, establishing direct debt obligations for the issuer, not subordinated debt. The bonds feature a structured principal repayment schedule, ensuring a balanced cash flow and minimizing refinancing risks for the enterprise.

The entire bond issuance will be offered in a single tranche, scheduled for Q4 2025.

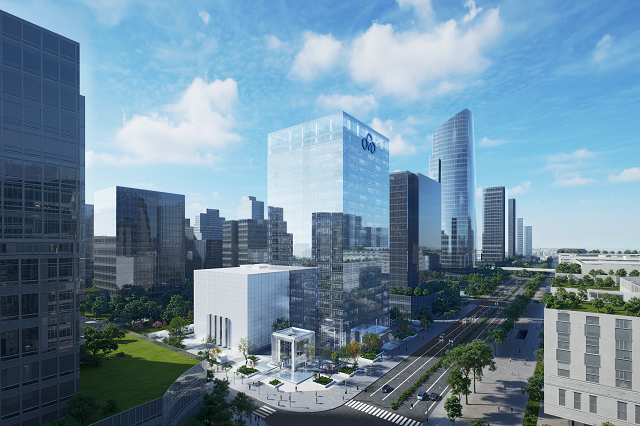

The proceeds will finance the development of the CMC Creative Space Hanoi (CCS Hanoi) within the Starlake urban area in Hanoi. BNP Paribas acts as the issuance advisor, and VietinBank Securities is the issuing agent.

CGIF is primarily funded by ASEAN+3 governments (10 ASEAN members, China, Japan, and South Korea) and ADB, aiming to expand local currency bond markets in the region. Its credibility and capital base enable CGIF to guarantee long-term issuances, underpinning its role in this CMC bond issuance.

Rendering of the CMC Creative Space Hanoi (CCS Hanoi) project

|

CCS Hanoi will provide international-standard computing and data infrastructure for CMC‘s AI and cloud services. Mr. Nguyễn Trung Chính, Chairman of CMC, stated: “CGIF’s support provides CMC with long-term VND funding for CCS Hanoi, a data center and workspace hub for large-scale AI computing. This enables CMC to offer DC/Cloud/AI-as-a-Service, driving AI transformation for businesses and contributing to Vietnam’s digital economy. CGIF’s guarantee reflects confidence in CMC‘s AI-X and Go Global strategies, as well as its financial capabilities.”

CCS Hanoi (formerly CMC Starlake) received Hanoi People’s Committee approval for the investor transfer to CMC Group in June 2023. Located in lot B2CC3, Starlake Tay Ho Tay urban area, the 1.13ha project has an estimated investment of 2.181 trillion VND. Construction began on 01/06/2025, with completion expected by 31/12/2026.

CMC will allocate bond proceeds to high-standard data center components (power, cooling, security, backup) and workspace for engineers, targeting DC/Cloud/AI-as-a-Service for enterprise clients.

In H1 2025 (01/04-30/09/2025), CMC reported revenue of 4.630 trillion VND, up 16% YoY; pre-tax profit of 273 billion VND, up 37%; and post-tax profit of nearly 230 billion VND, up 33%.

– 10:28 06/11/2025

HBC Reports Hundred-Billion Profit but Fails to Repay VND 12.4 Billion in Bond Principal

Hòa Bình Construction Group Joint Stock Company (UPCoM: HBC) has announced its inability to repay the principal amount of VND 12.4 billion for the bond issuance HBCH2225002, citing challenges in securing the necessary funds.

Real Estate Firms Face $6 Billion Bond Repayment Deadline in 2026

The total value of bonds issued by real estate companies set to mature in 2026 is projected to reach 141 trillion VND, marking an 81% surge compared to 2025.