The Vietnam Association of Realtors (VARS) advises individuals to seize the opportunity to buy property while interest rates remain low and housing supply recovers. However, they caution against borrowing more than 50% of the property’s value.

According to VARS’ analysis, real estate, with its heavy reliance on debt leverage, is the most directly and profoundly affected investment channel due to interest rate fluctuations.

Historically, the real estate market experienced a severe downturn from 2011 to 2013 when lending rates soared to 18-20% annually. Many businesses and investors were forced to liquidate assets to cut losses, leading to a prolonged market freeze. Property prices in many areas, including central districts, plummeted by 30-40%.

Part of the issue stemmed from investors relying on short-term loans while real estate projects and assets have long investment cycles. When capital costs surged abruptly, cash flow disruptions made liquidity risks nearly inevitable.

Buyers should limit loans to 50% of the property’s value to ensure financial safety. (Photo: Minh Đức)

In recent years, to stimulate demand, many developers and commercial banks have launched home loan packages with preferential rates as low as 5.5% per annum, or even interest-free periods with principal grace periods of up to 5 years. These policies have enabled a significant number of individuals and investors to access affordable capital for property ownership.

However, these promotional periods are temporary. Once floating rates apply, if overall interest rates rise, debt repayment pressures will intensify. Many borrowers find themselves paying double the interest without having repaid any principal.

“When market liquidity is low, selling assets to cut losses becomes challenging, and bad debt risks could re-emerge in the credit system,” VARS warns.

Real estate developers face dual risks when interest rates rise. On one hand, they incur higher financing costs for project loans. On the other, market demand weakens as buyers struggle to access home loans. Meanwhile, corporate bond issuance remains sluggish.

Mr. Đỗ Quý Duy, CEO of New Era Real Estate Investment and Trading Company, advises that households with monthly incomes of 30-40 million VND should limit loan repayments to 40% of their income. Specifically, those earning 30 million VND should allocate around 12 million VND for loan repayments, while those earning 40 million VND should set aside 16-17 million VND.

For individuals earning around 20 million VND, increasing income before taking out a mortgage is advisable to mitigate risks.

A bank representative notes that current lending rates average 70-80% of the property’s value, with some cases reaching 100%. Higher loan-to-value ratios mean higher interest payments for borrowers.

“The ‘golden ratio’ for mortgages is 30-50%. Those with stable but modest incomes should opt for longer loan terms, ranging from 10 to 25 years,” the representative advises.

Ms. Cao Thị Thanh Hương, Senior Manager of Advisory and Research at Savills HCMC, cautions young buyers against overextending themselves. A stable installment of one-third of income is far more feasible than half or more, which often overwhelms young couples.

Given current conditions, a safe borrowing limit is 50% of the property’s value, minimizing long-term financial and psychological risks. Thoroughly assessing repayment capacity, choosing projects with clear legal status, and reputable developers are essential steps.

Avoid using all available funds to purchase property. (Photo: Minh Đức)

Many buyers have faced issues with stalled projects or developers failing to honor interest support commitments. For many, buying a home is a once-in-a-lifetime investment. Such setbacks can negatively impact buyer psychology and quality of life.

Interest rate stability is also crucial for borrower peace of mind. Every rate fluctuation can cause anxiety, affecting living standards and the sense of security.

Young people and low-income earners can now aspire to homeownership, thanks to positive government housing policies and ongoing urban infrastructure projects.

Mr. Nguyễn Tuấn Kiệt, a long-time real estate investor in Hanoi, emphasizes that larger loans mean higher monthly principal and interest payments. Borrowers should aim for a loan-to-value ratio of 30-50%, avoiding exceeding 50% of the property’s value. Monthly repayments should not surpass 50% of income to prevent financial strain.

Regarding sufficient income for home buying, Mr. Kiệt notes that a 1 billion VND loan over 15 years at a fixed 7.99% interest rate requires monthly payments of approximately 10 million VND. Higher rates mean higher payments. Thus, a minimum income of 20 million VND is recommended for such loans.

Additionally, buyers should avoid using all available funds for property purchases. For instance, with 1.5 billion VND in savings and a 1.2 billion VND loan, retaining 100 million VND as a contingency fund is wise.

“This reserve acts as a safety net during financial emergencies, such as income loss. If no emergencies arise, it can be used to repay the loan early or invested for returns,” Mr. Kiệt suggests.

MB CEO Pham Nhu Anh: Many FDI Enterprises Opt to Borrow in Vietnam Instead of Their Home Countries Due to Lower Interest Rates

The CEO of MB highlighted that this serves as a prime example of how interest rates in Vietnam have reached historically low levels. In the short term, rates may edge up slightly, but the increase will be minimal. Even with a rise of 0.5-1%, borrowing costs remain remarkably affordable compared to previous periods and global standards.

Vietnam’s Real Estate Market Enters a New Growth Cycle

Mr. MacGregor, Managing Director of Savills Vietnam, predicts that the market over the next decade will be shaped by three key drivers: a stable and transparent legal framework, robust FDI inflows, and infrastructure boom unlocking peripheral markets, thereby boosting affordable housing supply and logistics.

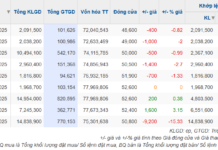

Interest Rates Show Signs of Rising Despite State Bank’s Net Capital Injection

After a prolonged period of remaining at a low level, deposit interest rates are showing signs of a slight increase in the final months of the year. Despite the system’s ample liquidity, interest rates in both the primary and secondary markets are trending upward, reflecting notable shifts in the balance of capital supply and demand within the system.

Dr. Nguyen Tri Hieu: Quy Nhon is at the Dawn of a New Development Cycle

According to financial and banking expert Nguyen Tri Hieu, Quy Nhon currently shares many similarities with Da Nang or Nha Trang a decade ago. With its natural advantages and increasingly developed infrastructure, Quy Nhon is entering a new phase of stable and sustainable growth.