Source: VietstockFinance

|

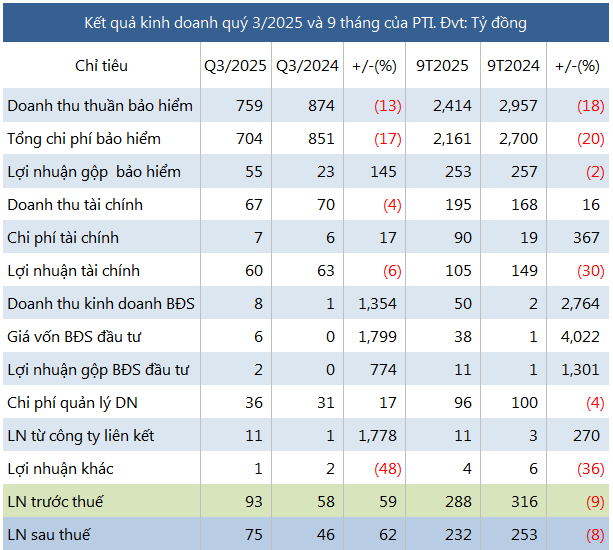

In Q3 2025, PTI reported a net profit of VND 75 billion, marking a 62% increase year-over-year. Despite a 13% decline in insurance revenue, a significant reduction in expenses—particularly a 38% drop in other costs—propelled gross insurance profit to VND 55 billion, a 2.5x surge compared to the same period last year.

Additionally, the company’s investment real estate gross profit soared 8.7 times to VND 2 billion, while profits from joint ventures and associates skyrocketed 19 times to nearly VND 11 billion, offsetting declines in financial activities and rising management costs.

For the first nine months of 2025, insurance profits dipped by 2%, and financial operations saw a 30% decline year-over-year. Against the 2025 target of VND 320 billion in pre-tax profit (a 21% reduction from 2024), PTI has achieved approximately 90% of its goal as of Q3.

As of Q3 2025, PTI’s total assets stood at nearly VND 8.4 trillion, largely unchanged from the beginning of the year. Financial investments accounted for 57% of total assets, totaling over VND 4.7 trillion, primarily comprising bank deposits (nearly VND 3.3 trillion, down 20%) and bonds (over VND 1.096 trillion, a 2.2x increase).

On the liabilities side, PTI’s total debt reached nearly VND 5.8 trillion, a 5% decrease. Short-term insurance reserves dominated, representing 70% of liabilities at over VND 4 trillion, down 9%.

– 11:28 AM, November 6, 2025

What Drove Masan’s Record-Breaking Quarterly Profit of Over 1.8 Trillion VND?

After five years of steadfastly building an integrated consumer-retail platform, Masan Group (HOSE: MSN) has officially marked a pivotal milestone in profitability.