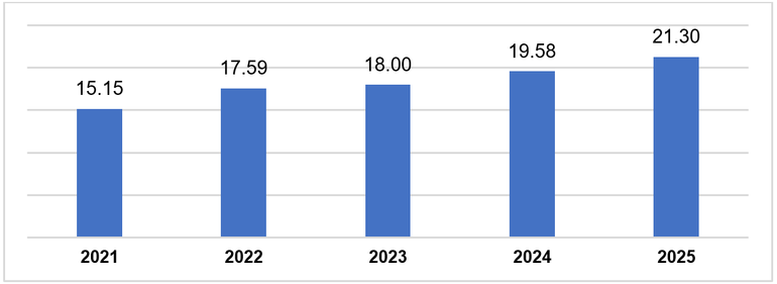

Foreign Direct Investment (FDI) in Vietnam from January to October 2021-2025 (in billions USD). Source: General Statistics Office, Ministry of Finance.

As of October 31, 2025, the total registered foreign investment in Vietnam (including new registrations, adjusted capital, and contributions/share purchases by foreign investors) reached USD 31.52 billion, a 15.6% increase compared to the same period last year.

Newly registered capital accounted for the largest share, with 3,321 licensed projects totaling USD 14.07 billion. While the number of projects increased by 21.1% year-over-year, the registered capital value decreased by 7.6%.

The manufacturing and processing sector attracted the largest share of new FDI, with USD 7.97 billion (56.7% of total new registrations). Real estate followed with USD 2.75 billion (19.5%), and other sectors secured USD 3.35 billion (23.8%).

The manufacturing and processing sector leads in new FDI approvals.

Among the 87 countries and territories investing in Vietnam during the first ten months, Singapore emerged as the top investor with USD 3.76 billion (26.7% of total new registrations). China followed with USD 3.21 billion (22.8%), Hong Kong SAR (China) with USD 1.38 billion (9.8%), Japan with USD 1.17 billion (8.3%), Sweden with USD 1.0 billion (7.1%), Taiwan (China) with USD 901.2 million (6.4%), and South Korea with USD 627.0 million (4.5%).

Adjusted capital registrations saw 1,206 existing projects increase their investment by USD 12.11 billion, a 45.0% rise compared to the same period last year.

According to the General Statistics Office, combining new and adjusted capital, the manufacturing and processing sector attracted USD 16.37 billion (62.5% of total), real estate USD 5.32 billion (20.3%), and other sectors USD 4.49 billion (17.2%).

Who is the Largest ‘Eagle’ Investor in Vietnam Today?

Vietnam has attracted over $31.5 billion in foreign direct investment (FDI) in the first 10 months, according to data from the General Statistics Office and the Ministry of Finance. Singapore emerged as the largest investor, contributing $3.76 billion, which accounts for 26.7% of the total newly registered capital.

Unveiling the Top Regions Surpassing $1 Billion in New FDI Capital Attraction in the First 10 Months of 2025

The latest report from the General Statistics Office (Ministry of Finance) reveals that as of October 31, 2025, Vietnam’s total registered foreign direct investment (FDI) reached $31.52 billion. This figure includes newly registered capital, adjusted capital, and the value of capital contributions and share purchases by foreign investors, marking a 15.6% increase compared to the same period last year.

How Can Vietnam’s Industrial Real Estate Sustain Its Global Momentum?

In the face of shifting trade policies, capital flows, and geopolitical dynamics, Vietnam is actively adapting and updating its strategies. The nation is transitioning from a cost-based advantage to fostering long-term trust and partnerships with global corporations.