The stock market opened with a slight uptick on October 6th, followed by a day of sideways trading. Notably, trading volume significantly decreased, indicating investors’ cautious sentiment persists. At the close, the VN-Index settled at 1,642.64, down 12.25 points (-0.74%). Foreign investors continued their net selling streak, offloading a total of VND 1,236 billion across the market.

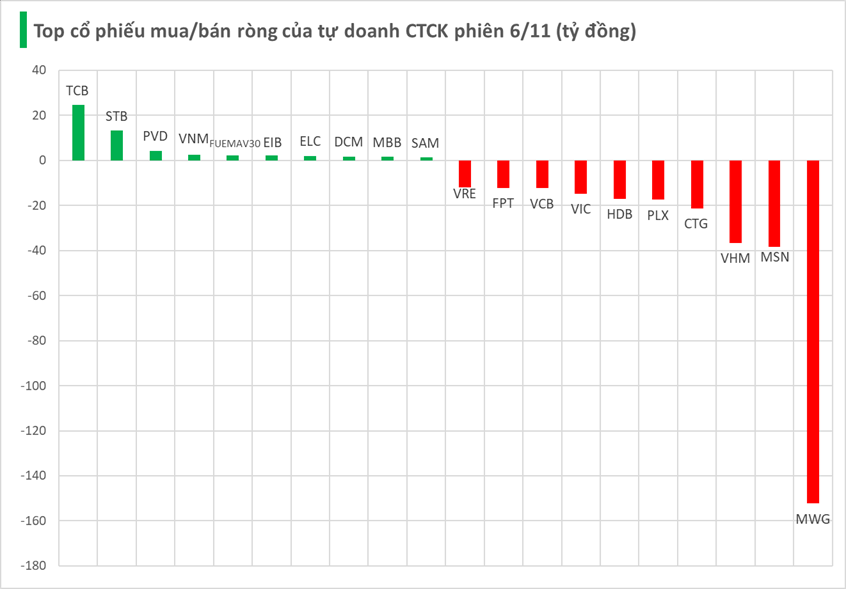

Securities firms net sold VND 355 billion on HOSE.

Specifically, securities firms were most active in net selling MWG, with a value of -VND 152 billion, followed by MSN (-VND 38 billion), VHM (-VND 37 billion), CTG (-VND 21 billion), and PLX (-VND 17 billion). Other stocks experiencing notable net selling included HDB (-VND 17 billion), VIC (-VND 15 billion), VCB (-VND 12 billion), FPT (-VND 12 billion), and VRE (-VND 12 billion).

On the flip side, TCB saw the strongest net buying at VND 25 billion. This was followed by STB (VND 13 billion), PVD (VND 4 billion), VNM (VND 3 billion), FUEMAV30 (VND 2 billion), EIB (VND 2 billion), ELC (VND 2 billion), DCM (VND 2 billion), MBB (VND 2 billion), and SAM (VND 1 billion).

Stock Market Liquidity Continues to Hit New Lows

Throughout today’s trading session (November 6th), the VN-Index predominantly fluctuated in negative territory. Despite briefly recovering to the reference level towards the close, the benchmark index struggled to maintain momentum. During the afternoon session, as T+ stocks became available for trading, sellers remained cautious, refraining from aggressive selling. This hesitation reflects the subdued sentiment surrounding short-term trading opportunities, which currently offer limited profit potential.

Market Pulse 07/11: Foreign Investors Offload Financial & Real Estate Stocks, VN-Index Dips Below 1,600 Points

At the close of trading, the VN-Index dropped 43.54 points (-2.65%), settling at 1,599.1 points, while the HNX-Index fell 6.04 points (-2.27%), closing at 260.11 points. Market breadth was overwhelmingly negative, with 540 decliners outpacing 204 advancers. Similarly, the VN30 basket saw red dominate, as 28 stocks declined and only 2 advanced.