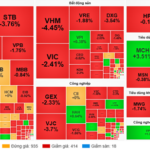

However, during the ATC session, intense selling pressure overwhelmed the market’s earlier efforts, dragging the VN-Index down by 12 points. VIC remained the primary support for the VN-Index, with notable news that Vingroup plans to present to shareholders a proposal to issue 3.85 billion shares (1:1 ratio). This is the largest bonus share issuance in the history of Vietnam’s stock market.

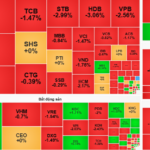

Meanwhile, the banking sector—a market pillar—was the focal point of selling pressure: HDB, STB, VPB, SHB, VCB, and TCB all plunged by 2-3%, pulling the VN-Index downward.

Trading value on the HoSE floor reached only over 17.8 trillion VND—the lowest in the past 5 months.

Influential sectors such as banking, securities, and real estate faced significant distribution pressure. VIX led the securities sector in liquidity with 26.2 million shares traded but still fell by 3%. SSI lost nearly 1.7%. The real estate sector showed mixed performance, with most stocks declining, while industrial zone stocks benefited.

Industrial zone stocks rallied today following news that realized foreign direct investment in Vietnam over 10 months reached approximately USD 21.3 billion, an 8.8% increase compared to the same period last year. BCM led the VN30 group with a 2.2% gain, while KBC, PDR, SZC, and others also rose.

Oil and gas stocks, along with MSCI updates, drew attention. PVD was a rare bright spot in a gloomy market, rising on news of a new drilling rig contract for the Block B – 48/95 project in 2027.

Additionally, MSCI’s decision to add three Vietnamese stocks (CII, MBS, HVN) to its Frontier Market index and remove one (CTR) heated up interest in these stocks. By the close, CII and MBS maintained their gains.

At the session’s end, the VN-Index fell by 12.25 points (0.74%) to 1,642.64. The HNX-Index dropped 0.55 points (0.21%) to 266.15, and the UPCoM-Index declined 0.28 points (0.24%) to 116.22. Trading value on the HoSE floor reached only over 17.8 trillion VND—the lowest in the past 5 months.

A Major Force Returns to Scoop Up Vietnamese Stocks Amid Sharp Decline in Late Week Session on November 7th

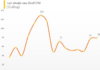

Proprietary trading desks at securities companies collectively net-purchased VND 35 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.

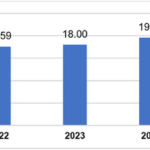

Record-High FDI Disbursement Achieved in the First 10 Months Over the Past 5 Years

According to data from the General Statistics Office and the Ministry of Finance, Vietnam’s realized foreign direct investment (FDI) in the first 10 months of 2025 reached an estimated $21.3 billion, marking an 8.8% increase compared to the same period last year. This represents the highest FDI disbursement for the 10-month period in the past five years, underscoring foreign businesses’ confidence in Vietnam’s investment policies and business environment.

Who is the Largest ‘Eagle’ Investor in Vietnam Today?

Vietnam has attracted over $31.5 billion in foreign direct investment (FDI) in the first 10 months, according to data from the General Statistics Office and the Ministry of Finance. Singapore emerged as the largest investor, contributing $3.76 billion, which accounts for 26.7% of the total newly registered capital.

Market Pulse 07/11: Foreign Investors Offload Financial & Real Estate Stocks, VN-Index Dips Below 1,600 Points

At the close of trading, the VN-Index dropped 43.54 points (-2.65%), settling at 1,599.1 points, while the HNX-Index fell 6.04 points (-2.27%), closing at 260.11 points. Market breadth was overwhelmingly negative, with 540 decliners outpacing 204 advancers. Similarly, the VN30 basket saw red dominate, as 28 stocks declined and only 2 advanced.