I. VIETNAM STOCK MARKET REVIEW FOR THE WEEK OF NOVEMBER 3-7, 2025

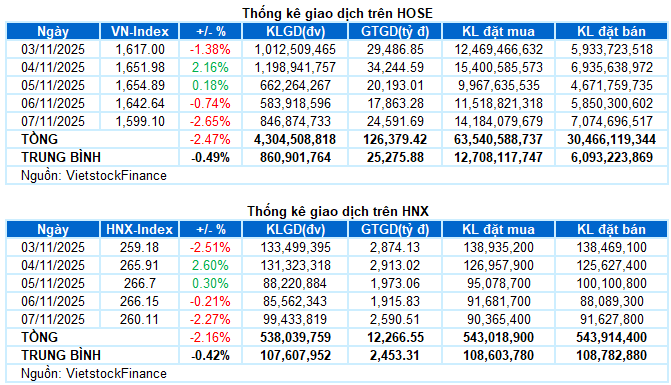

Trading: Major indices plunged during the November 7th session. The VN-Index closed the week at 1,599.1 points, down 2.65% from the previous session; the HNX-Index also tumbled 2.27% to 260.11 points. For the entire week, the VN-Index lost a total of 40.55 points (-2.47%), while the HNX-Index shed 5.74 points (-2.16%).

Vietnam’s stock market ended the first week of November in the red, marking the fourth consecutive week of decline for the VN-Index. Despite bottom-fishing demand around the 1,600-point level supporting a rebound in early sessions, cautious investor sentiment prevented a sustained rally. Amid continued sector rotation and a lack of clear market leadership, selling pressure intensified in the final two sessions, erasing all prior recovery efforts. The VN-Index dropped a total of 40.55 points during the week, breaching the key psychological support level of 1,600 points.

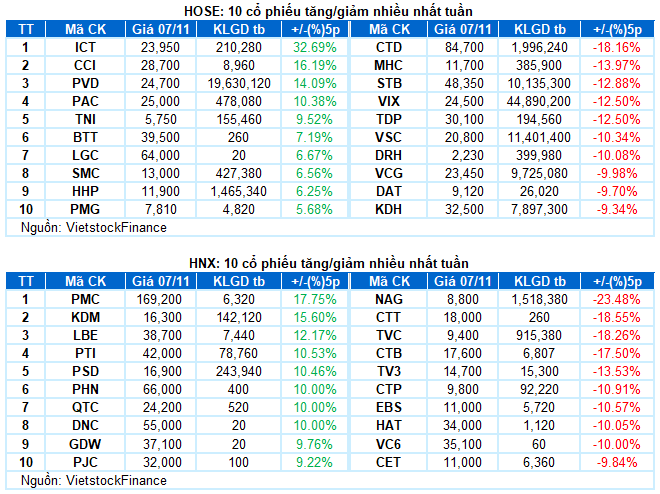

In terms of impact, the top 10 negatively contributing stocks cost the VN-Index a combined 26 points in the final session, with the heaviest pressure coming from VIC and VHM. Conversely, the top 10 positive contributors added less than 1 point to the index, highlighting the dominance of selling pressure.

Among sectors, real estate was the worst performer, plunging nearly 4%. Most stocks in the sector saw deep corrections, notably VHM hitting its lower limit, VIC (-3.9%), VRE (-2.03%), DXG (-4.55%), KDH (-4.69%), KBC (-5.18%), PDR (-3.86%), TCH (-3.23%), KHG (-4.15%), and NVL (-3.7%).

Additionally, the market’s two largest capitalization sectors—finance and industrials—weighed heavily on the index, with stocks like SHB, SSI, STB, VIX, VPB, CTG, VND, LPB, SHS; VCG, VSC, GMD, GEE, BMP, and even CTD falling to their daily limits.

On the positive side, communication services, information technology, and consumer staples sectors retained gains, primarily due to contributions from leading stocks such as VGI (+3.75%), ICT (+6.68%); FPT (+0.8%), and MCH (+3.45%).

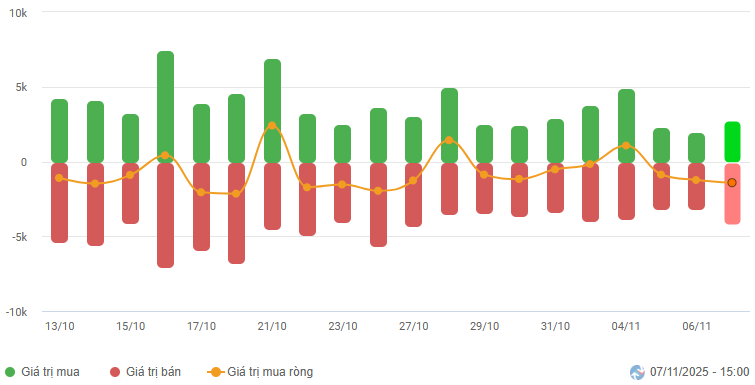

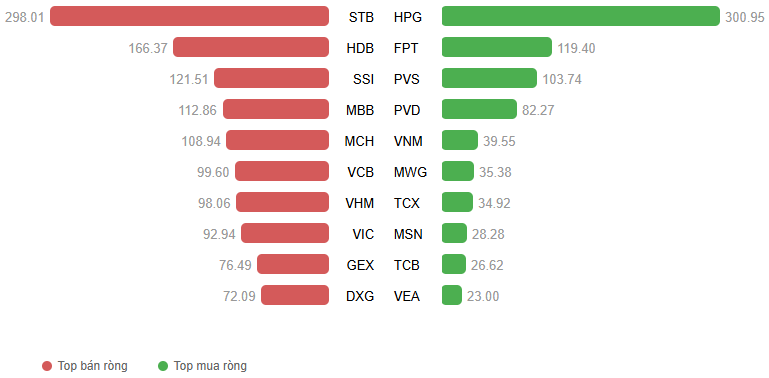

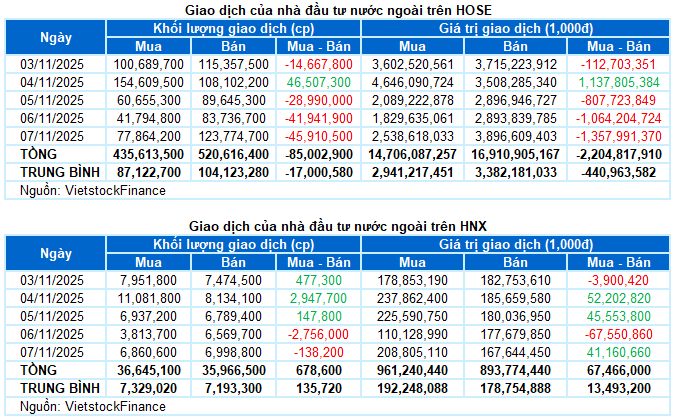

Foreign investors continued to net sell over VND 2.1 trillion across both main exchanges during the week. Specifically, they net sold VND 2.2 trillion on the HOSE but net bought over VND 67 billion on the HNX.

Foreign Investors’ Net Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

Top Gaining Stock of the Week: PVD

PVD +14.09%: PVD had an impressive week after breaking above its 50-day SMA. The stock price closely followed the Upper Band of the Bollinger Bands, accompanied by trading volume well above the 20-session average, indicating strong buying interest.

Furthermore, the MACD indicator continued to widen its gap above the Signal line after generating a buy signal, reinforcing the positive short-term outlook.

Top Losing Stock of the Week: CTD

CTD -18.16%: CTD experienced a sharp correction during the week, with 4 out of 5 sessions closing lower. The stock price fell below the Middle Band of the Bollinger Bands, while the MACD indicator issued a sell signal, suggesting increasing short-term risks.

Currently, the stock is approaching a retest of the 50-day SMA. If this level is breached, the decline could extend toward the October 2025 lows (around 78,000-80,000).

II. WEEKLY MARKET STATISTICS

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:14 November 7, 2025

VN-Index Plunges Below 1,600 Mark After 88 Days

Vietnamese stocks just experienced their most significant decline in Asia, marking a notable downturn in the region’s financial landscape.

Stock Market Liquidity Continues to Hit New Lows

Throughout today’s trading session (November 6th), the VN-Index predominantly fluctuated in negative territory. Despite briefly recovering to the reference level towards the close, the benchmark index struggled to maintain momentum. During the afternoon session, as T+ stocks became available for trading, sellers remained cautious, refraining from aggressive selling. This hesitation reflects the subdued sentiment surrounding short-term trading opportunities, which currently offer limited profit potential.

A Major Force Returns to Scoop Up Vietnamese Stocks Amid Sharp Decline in Late Week Session on November 7th

Proprietary trading desks at securities companies collectively net-purchased VND 35 billion worth of stocks on the Ho Chi Minh City Stock Exchange (HOSE) today.