High Taxes Proposed for Frequent Real Estate Traders

During the 10th session of the 15th National Assembly on November 5th, discussing the amended Personal Income Tax Law, Professor Hoang Van Cuong (Hanoi Delegation) proposed imposing higher taxes on frequent real estate traders to curb speculation. This contrasts with the current flat 2% tax rate applied to all transactions.

Professor Cuong highlighted the unfairness of the current tax system, which treats individuals with a single residence the same as frequent traders. He illustrated this with an example: someone selling their only home to move elsewhere pays a 2% personal income tax upon sale and an additional 0.5% registration fee when purchasing a new home. In contrast, investors who buy land and hold it for price increases pay the same 2% tax. “This group is the primary driver of skyrocketing real estate prices,” he stated.

According to the delegate, many countries exempt individuals selling their only home or those buying a new residence from taxes. Conversely, those who buy and sell land within a short period, such as less than a year, face significantly higher progressive taxes. In South Korea, for instance, these taxes can reach several dozen percent. The goal is to prevent speculation and land hoarding for profit.

Therefore, he suggested exempting individuals selling their only home from taxes and imposing higher taxes on frequent traders. With the current digitization of land data, it is possible to identify speculators and genuine residents.

Incomplete Data Could Harm Genuine Buyers

In an interview with *Nguoi Lao Dong* newspaper, Vo Nhat Lieu, CEO of Propiin Academy, agreed with the need to curb speculation but warned that hasty implementation could mistakenly target genuine homebuyers.

She noted that many people sell their homes not for speculation but to cover expenses like medical bills, education, or to relocate. If taxes are based solely on the number of transactions or land titles, these individuals could be wrongly classified as speculators.

Currently, Vietnam’s land ownership data is incomplete and overlapping, making it difficult to accurately identify genuine residents and abandoned land. “Without accurate data, genuine buyers will be the first to suffer,” Lieu predicted.

She cited that housing prices in Hanoi and Ho Chi Minh City have risen by over 50% in the past five years, while the average worker’s income is only about 8.3 million VND per month. A 70 m² apartment priced at over 3 billion VND would take an average earner nearly 35 years to afford. “These people are not speculators; they just want a stable home,” she said.

Taxation should be based on holding period, not property count

Taxation Based on Holding Period

Lieu further explained that under current regulations, individuals with a single home are exempt from personal income tax if they have owned it for over six months and sell the entire property. However, if the property lacks a pink book, the seller must still pay a 2% tax, even if it is their only asset. Conversely, actual speculators can easily evade taxes by having others hold titles or delaying registration.

She argued that instead of taxing based on property count, taxation should be based on holding period. Specifically, the tax rate should increase the sooner a property is sold after purchase and decrease the longer it is held. For example, selling within the first year could incur the highest tax rate to deter short-term speculation, with rates gradually decreasing annually. After five years, the current 2% tax rate could apply.

This approach, she noted, is feasible since transaction data is available in notarized contracts. Long-term residents would remain unaffected, while short-term speculators selling within months would face tax costs proportional to their speculative behavior.

“Combating speculation is necessary, but policies must be fair,” Lieu emphasized. “Taxes should serve as a tool for market transparency and protect genuine buyers, not instill fear in those seeking a stable home.”

Taxing Frequent Real Estate Traders: A Path to Fairness?

When property taxes are strategically implemented, they can serve as a powerful economic lever, effectively deterring speculative investors from artificially inflating the market.

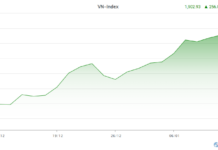

Why Are Property Prices Still Rising Despite Increased Supply?

The housing supply has improved following the resolution of legal hurdles for numerous projects, yet property prices continue to rise. Dr. Lê Xuân Nghĩa asserts that the root of the issue lies not in speculation, but in the acute shortage of actual housing supply, particularly in the price segment affordable to the general population.

Business Tax Management from 2026: Ending Presumptive Tax, Fully Transitioning to Declaration Method

As of January 1, 2026, the lump-sum tax method will be discontinued, and the Ministry of Finance will introduce a new management model. Under this model, businesses will be categorized into three groups based on their revenue scale, with corresponding tax regulations and declaration requirements applied accordingly.