Recently, the stock market has been on a rollercoaster ride, with dizzying reversals. In a single session, the VN-Index can soar in the morning only to plunge in the afternoon, with fluctuations spanning dozens of points. These sudden swings often leave investors scrambling, causing portfolios to plummet in mere moments.

What drives such intense VN-Index volatility during sessions?

According to Nguyen Minh Hoang, Director of Securities Analysis at VFS, sessions with significant volatility are primarily driven by cautious investor reactions to unclear macroeconomic signals and policies, amplified by speculative sentiment.

In reality, the VN-Index experienced a prolonged rally, becoming one of the world’s hottest markets since early 2025. However, since August, it has entered a consolidation phase. During this sideways movement, sessions with vibrant morning gains followed by sharp afternoon reversals have become commonplace.

The volatility is largely dominated by domestic retail investors, coupled with an influx of “hot money” in margin accounts. With leverage at record highs by Q3, investor sentiment is highly sensitive to every market tremor. Even slightly negative macroeconomic or policy news can trigger aggressive selling.

The intraday volatility highlights lingering short-term uncertainty and a lack of true equilibrium. Essentially, buyers and sellers are locked in a tug-of-war, awaiting a strong catalyst to restore investor confidence.

VFS experts note that while the VN-Index hasn’t confirmed a bottom, positive signs are emerging. September and October declines have made valuations attractive, with a P/E ratio of around 14.4. Many stocks have retraced to levels last seen during the April-May 2025 tariff news. Macroeconomic data and policies still support a low-interest-rate environment, favorable for asset appreciation.

Technically, the index reclaiming the RSI 50 mark signals a reliable uptrend resumption. Liquidity needs to return to around 1 billion shares per session, as robust trading volume fuels new highs. Finally, an increase in short-term profitable stocks will restore investor confidence and signal an oversold market.

Prioritize Risk Management and Capital Preservation

Amid market turbulence and portfolio erosion, VFS experts emphasize risk management and capital preservation. This phase is marked by liquidity scarcity and heightened caution, making it unsuitable for frequent trading or leverage. Investors should focus on two key strategies.

Long-term investors should leverage deep corrections to gradually invest in companies with strong fundamentals, stable management, and attractive valuations, preparing for the next growth cycle.

Short-term traders, if participating, should adopt a “buy low, sell high” strategy within narrow ranges, clearly defining support and resistance levels. Trade with low exposure, strictly adhere to stop-loss and take-profit disciplines, and avoid holding losing positions.

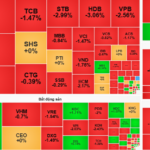

After the steep sell-off, many sectors and stocks have returned to attractive levels, presenting fresh opportunities. From its peak of 1,794 points, the VN-Index has fallen 150 points (8.38%) to 1,642. While the overall index dipped slightly, many banking, securities, real estate, and public investment stocks have dropped 15–30%, offering entry points for cautiously positioned investors.

Long-term, two sectors stand out: retail and public investment. Retail is rebounding strongly, driven by solid earnings, consumer stimulus policies, and year-end shopping peaks. Public investment benefits from expansionary fiscal policy, aiming for 100% capital disbursement this year (54% achieved by October-end), offering businesses expanded workloads. This policy is expected to continue, stabilizing the economy and ensuring long-term projects.

Stock Market Update November 7: Awaiting Signals to Invest in Oil & Gas Stocks

Despite the lackluster market conditions, savvy investors can strategically allocate funds into stocks within the oil and gas sector, as well as public investment domains, particularly those trading near their support levels.