At the seminar titled “Cybersecurity: Insights on Fraud and Scams” held on the morning of November 7th, experts highlighted common scenarios where users fall victim to scams and shared preventive measures.

Mr. Doug Matheson, Head of Risk Management and Compliance at HSBC Vietnam, emphasized that safety and security are at the core of the bank’s operations. He pointed out that current fraud threats are highly personalized, constantly evolving, and involve diverse scenarios, making them unpredictable risks for both banks and consumers. The bank considers raising community awareness a vital part of its commitment to protecting customers, especially as scammers often target individuals with limited tech exposure.

Mr. Ngô Minh Hiếu discusses prevalent scam methods. Screenshot.

|

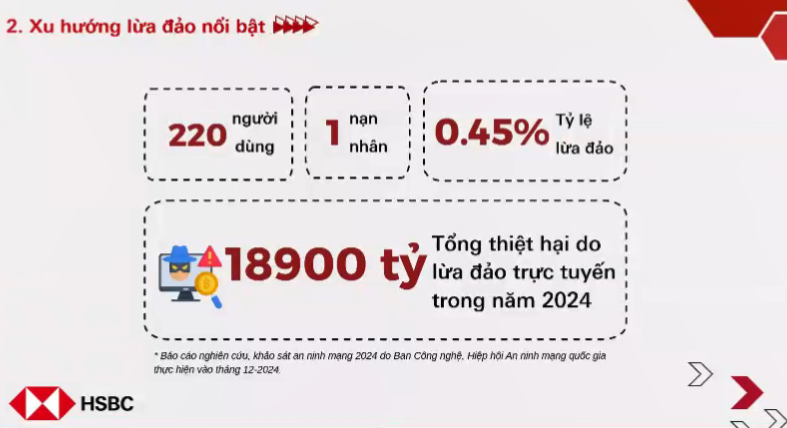

Mr. Ngô Minh Hiếu, Cybersecurity Expert, cited alarming figures from the National Cybersecurity Association. Online fraud losses in Vietnam for 2024 are estimated at 19 trillion VND, with approximately 1 in 220 mobile users falling victim. These are only reported numbers, suggesting the actual impact could be significantly higher. This underscores the urgency of staying informed in the digital age.

Mr. Hiếu outlined the most common scam tactics employed by fraudsters. These include impersonating banks or public services using fake BTS (cell towers) to send fraudulent messages.

Another dangerous method involves impersonating bank employees or authorities, coercing victims into downloading malicious apps (e.g., fake VSSID or tax apps).

Social media scams are also rampant, exploiting platforms to create emotional, investment, or impersonation schemes.

Lastly, fraudsters capitalize on current events—such as new government policies or natural disasters—to launch fake charity campaigns aimed at stealing assets.

Illustrating hacker tactics, Mr. Hiếu described a fake public service app scenario where victims are sent a .apk file. Upon installation, the app requests dangerous “accessibility permissions,” granting hackers full control. In another case, a fake “Credit Limit Increase” message from a bogus BTS station prompts victims to enter card details, allowing hackers to shop using their data while the fake site displays “Verifying…”. Additionally, phishing emails targeting businesses contain malicious attachments designed to steal computer data.

From these insights, Mr. Hiếu stressed: “In the digital transformation era, we’re not in a marathon. We should slow down.” This principle translates to “pausing for 3 seconds, verifying, and confirming” any suspicious information. Users should rely on official channels, such as calling bank hotlines printed on cards, and enable all security layers. Critically, never share OTPs or passwords, avoid downloading apps from unknown sources, and distrust “easy money” offers.

The expert also warned about social media habits, highlighting AI and Deepfake risks that enable sophisticated “online kidnapping” schemes for extortion. Users are advised to limit public personal information sharing and hide friend lists, as scammers may impersonate acquaintances. Parents are cautioned against posting children’s awards online, as school details could expose financial information for targeted scams.

When asked how to outsmart scammers, Mr. Hiếu noted that the biggest issue is users inadvertently exposing data by downloading pirated games, streaming illegal content, or installing apps for promotions. The solution lies not in technology but in self-awareness.

Immediate steps if fraud is suspected: First, halt transactions and call the bank’s 24/7 hotline to lock cards and accounts. Early action increases asset protection. If malware is suspected, disconnect from the internet by turning off Wi-Fi and removing the SIM card. Report the incident to authorities, preserve evidence, and factory reset the device to remove malware.

– 3:13 PM, November 7, 2025

Securing Digital Financial Security for Millions of Vietnamese: MB’s Commitment

“Financial security is the cornerstone of successful digital transformation,” MB emphasizes, highlighting the critical importance of robust cybersecurity in an era where cyber threats are increasingly sophisticated.

Prime Golden Land in the Case of Actress Truong Ngoc Anh’s Arrest: How Strategic is its Location?

Acclaimed actress and producer Truong Ngoc Anh has been detained by the Ho Chi Minh City Police Department’s Investigation Agency for alleged “Breach of Trust and Appropriation of Assets.” The investigation centers on her involvement with a real estate company she founded.