According to Forbes, Barron Trump (19), the youngest member of the Trump family in business, is making waves in the cryptocurrency market. He is credited with helping his father, former U.S. President Donald Trump, navigate the world of fintech.

Vanity Fair reports that Barron explained the concept of a “digital wallet” to Trump and co-founded World Liberty Financial (WLFI) with his father and brothers. The crypto company launched just weeks before the 2024 U.S. presidential election.

Barron Trump, Donald Trump’s youngest son, has amassed an estimated personal fortune of $150 million. Source: Yahoo News Canada.

After Trump’s victory over Kamala Harris, WLFI’s value soared. Forbes notes that the company added over $1.5 billion to the Trump family’s wealth, with Barron’s share at approximately $150 million.

Trump joked during the company’s launch, “It has four wallets or something, and I said, ‘What’s a wallet?'” expressing both surprise and pride in his son’s fintech knowledge.

At 19, Barron’s estimated net worth of $150 million surpasses his mother Melania Trump’s ($20 million). Donald Trump leads with $7.3 billion, per The Irish Star.

Barron, once known for his privacy, is now emerging as a dynamic crypto entrepreneur. His vision and trend-spotting abilities are highly regarded in the industry.

Most of Barron’s wealth stems from cryptocurrency investments. Vanity Fair reports his digital assets grew from $80 million to $150 million in months. Journalist Séraphine Roger reveals he holds 2.3 billion tokens, potentially worth $525 million if unlocked and sold.

Barron Trump is emerging as the Trump family’s true “crypto prince.” Photo: MARCA.

In September 2024, DT Marks Defi LLC, the Trump family’s holding company in WLFI, received 22.5 billion $WLFI tokens. In exchange for using Trump’s name, the company gets 75% of World Liberty’s revenue after the first $15 million profit.

Post-election, crypto billionaire Justin Sun invested $75 million in World Liberty, boosting token prices and pushing sales to $675 million by August 2025. Barron’s post-tax profit from this deal is approximately $38 million.

Additionally, Barron benefited from the family’s $2.6 billion USD-pegged stablecoin launch, earning $34 million, and a $750 million partnership with Alt5 Sigma, yielding $41 million post-tax.

With $150 million in liquid assets and billions in locked tokens, Barron Trump is a bona fide “crypto prince.” Analysts predict he could become America’s youngest billionaire, surpassing tech and finance giants.

Despite his low public profile, Barron is proving he’s more than “Donald Trump’s son,” embodying a new generation of entrepreneurs driving the global digital finance revolution.

Unlocking Potential: A Breakthrough Strategy for Ho Chi Minh City’s International Financial Center to Rival Singapore and Hong Kong

Aspiring to become an international financial center (IFC), Ho Chi Minh City still lags significantly behind regional leaders like Hong Kong and Singapore. The latest data highlights a substantial gap, necessitating a transformative strategy, particularly in the realm of digital finance.

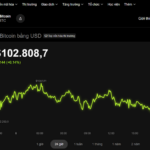

Whales Dump Nearly $2 Billion in Bitcoin Just Before BTC Plunges Below $100,000

Bitcoin ETFs have just experienced their largest outflow in nearly three months, marking the fifth consecutive session of net withdrawals.