VCI’s Extraordinary General Meeting Held on November 7, 2025

|

Private Placement to Raise Capital to Over VND 8.5 Trillion

At the recent Extraordinary General Meeting, VCI approved the issuance of up to 127.5 million shares, with an offering price not lower than the book value as of December 31, 2024, set at VND 18,026 per share (based on the 2024 audited financial report). All privately placed shares will be restricted from transfer for one year following the completion of the offering.

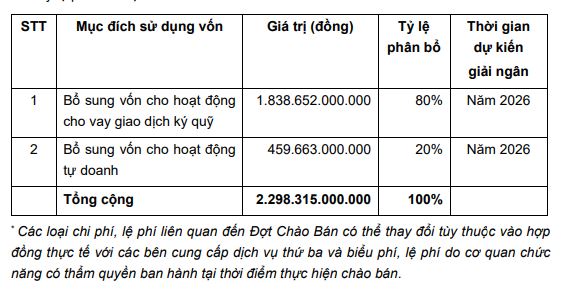

The expected proceeds from this private placement are nearly VND 2.3 trillion. After deducting related fees and expenses, the funds will be allocated as follows: 80% (VND 1.8 trillion) for margin lending activities and 20% (approximately VND 460 billion) for proprietary trading.

|

Capital Allocation by VCI

Source: VCI

|

Following the issuance, VCI’s chartered capital will increase to over VND 8.5 trillion.

This capital increase aims to meet growing margin demands and prepare for upcoming major transactions, aligning with market development trends.

According to VCI, in 2025, Vietnam’s stock market has shown positive signs, with trading liquidity maintaining a strong upward trend. The average daily trading value across all markets (HOSE, HNX, UPCoM) in Q3 2025 reached VND 44,029 billion per session, up 81% from Q2 2025. For the first nine months of 2025, it averaged VND 29,266 billion per session, a 30% increase year-on-year.

Notably, on October 8, 2025, FTSE Russell officially upgraded Vietnam from a frontier market to a secondary emerging market. This milestone is expected to significantly enhance foreign investment inflows into Vietnam’s stock market in the near future.

With the market poised for continued growth, VCI’s Board of Directors recognizes the need to increase chartered capital to strengthen financial resources, enhance competitiveness, and ensure sustainable long-term development.

Regarding 2025 earnings prospects, Mr. Dinh Quang Hoan, Vice Chairman of the Board, stated that the initial pre-tax profit target was VND 1,400 billion. Given favorable market conditions, Vietcap anticipates exceeding this target by 10% to 20%.

In addition to the capital increase, the company approved the establishment of a subsidiary in Singapore with an investment of USD 29 million (approximately VND 725 billion). The subsidiary will focus on overseas proprietary investments and provide securities services in compliance with local regulations. The primary goal is to collaborate with companies within the ASEAN region.

Mr. To Hai expressed confidence in the new leadership

On October 30, VCI announced significant leadership changes, including the departure of Mr. To Hai as CEO and legal representative. His successor, Ms. Ton Minh Phuong, currently serves as the Executive Director of the Investment Banking Division. The change takes effect on November 18, 2025, with a five-year term.

Vietcap Securities Appoints New CEO: Investment Banking Director Succeeds Mr. To Hai

Addressing shareholder concerns about the transition, Mr. To Hai noted he has not been directly involved in management for the past two years. Post-resignation, he plans to remain on the Board of Directors. As per regulations, the Board does not engage in management, and the company will not appoint a director solely acting on the Board’s instructions. The CEO at VCI holds significant authority, as per company bylaws.

“My resignation received overwhelming Board approval. After 18 years as a founder, stepping down is bittersweet but timely. Leaving at the right moment ensures a lasting legacy. As a major shareholder, I must make decisions in the company’s best interest. Staying in the same role could become a problem rather than a solution. I trust the new leadership will outperform me in the coming year,” Mr. Hai shared.

Ms. Ton Minh Phuong, VCI’s new CEO, emphasized her deep understanding of the company’s operations and culture, having been mentored by Mr. To Hai and Chairwoman Nguyen Thanh Phuong. The new management team will specialize in distinct roles, aiming to form a cohesive unit for the company’s growth. VCI remains committed to long-term value creation, focusing on sustainable opportunities rather than short-term fluctuations. The new leadership will prioritize identifying investments in high-potential sectors.

– 16:22 07/11/2025

HD Securities Unveils New Share Offering Plan, Aiming to Boost Capital by 7.5x to Nearly VND 11 Trillion

Following the withdrawal of its initial plan to offer over 365 million shares, HD Securities (HDBS) has unveiled a new proposal, aiming to issue nearly 950 million shares.