The Ho Chi Minh City Stock Exchange (HoSE) has announced the receipt of the initial listing application from Masan Consumer Corporation (Masan Consumer – stock code MCH). Founded by Nguyen Dang Quang, the company boasts a chartered capital of VND 10,676 billion, equivalent to over 1.067 billion shares registered for listing. Vietcap Securities is the listing advisor.

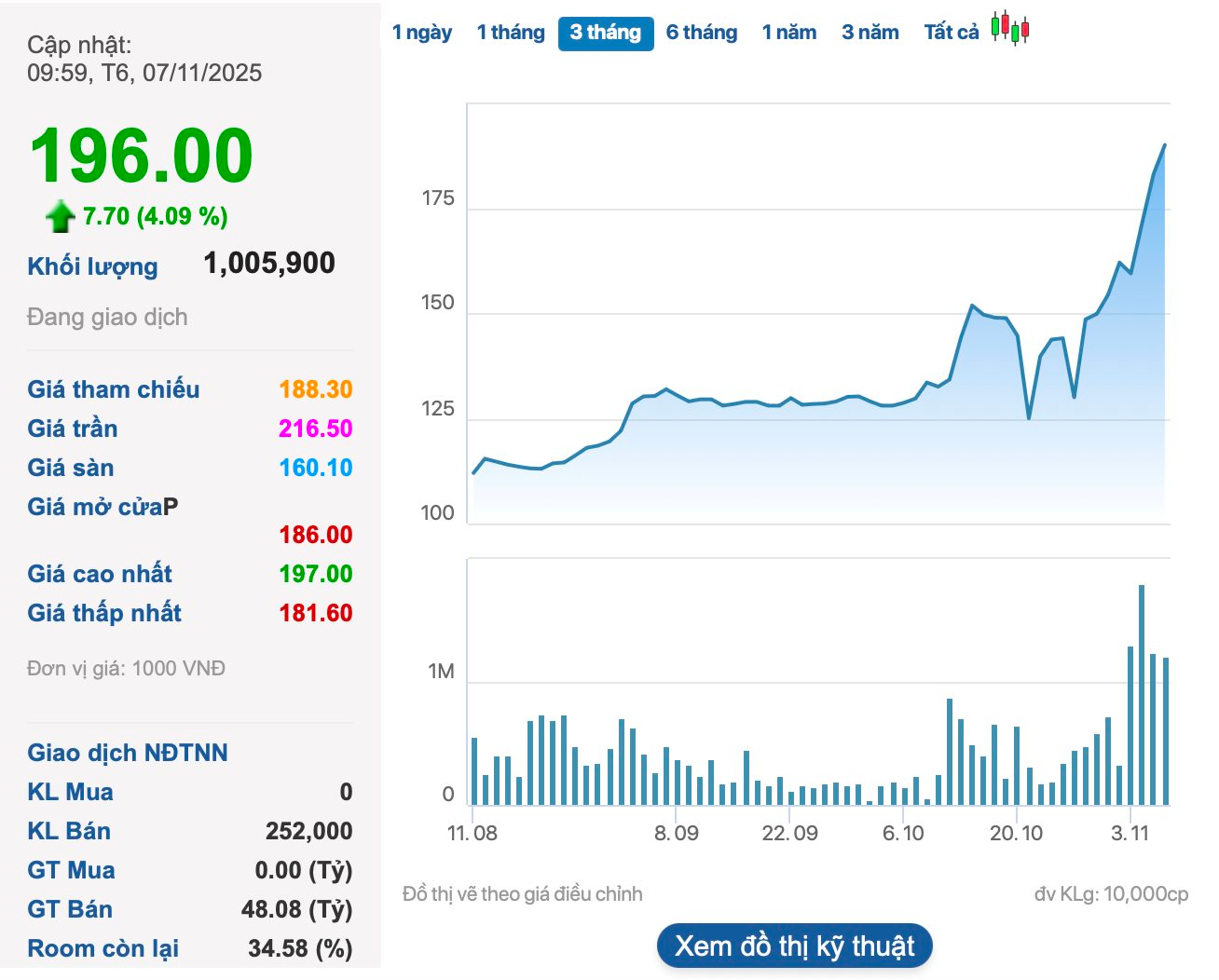

On the stock market, MCH shares have seen a significant uptrend recently as listing plans become clearer. In the past month alone, the stock has surged by over 50%, pushing Masan Consumer’s market capitalization to VND 200,000 billion.

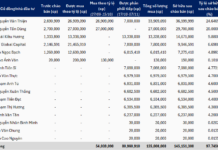

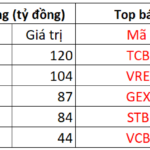

This valuation places billionaire Nguyen Dang Quang’s enterprise among the top companies on UPCoM by market cap, even surpassing well-known listed firms such as Vinamilk, PV Gas, GVR, ACB, STB, and its parent company, Masan Group. With its current market cap, MCH is poised to enter major indices upon its HoSE listing.

During an online investor meeting in late October, Michael Hung Nguyen, Deputy CEO of Masan Group, stated that the company anticipates stronger financial results from Masan Consumer in the upcoming quarters. They are also awaiting favorable market conditions to ensure a smooth IPO process.

In Q3, Masan Consumer reported revenues exceeding VND 7,500 billion, a 6% year-on-year decline but a 20% increase from the previous quarter. This growth was primarily driven by sales recovery following anti-counterfeiting efforts and tax policy changes in Q2. Nine-month revenues for 2025 reached VND 21,000 billion, fulfilling 63.5% of the annual target.

According to management, the strategy of directly engaging with retailers is supported by robust growth in the MT channel (up 13% year-on-year) and a 40% increase in active retail outlets during Q3/2025.

Gross profit fell 8% year-on-year to VND 3,400 billion due to lower sales. Gross margin decreased by 1.1 percentage points to 45.6%, as high-margin segments like seasonings and convenience foods have not fully recovered. However, margins improved by 1.5 percentage points compared to the previous quarter, signaling potential recovery in future periods.

Selling and administrative expenses as a percentage of revenue decreased slightly to 21.7% in Q3/2025, down 0.3 percentage points, primarily due to more efficient sales cost management. Advertising and promotion expenses, as well as sales staff costs, dropped by 6% and 23%, respectively. Conversely, logistics costs rose by 13% year-on-year due to expanded direct retail outreach.

Net profit in Q3 declined sharply by 19% year-on-year to VND 1,900 billion, attributed to weaker gross profit and a 66% drop in net financial income. Interest income from deposits and bond investments fell by 58% year-on-year to VND 159 billion. Nine-month net profit for 2025 reached VND 4,700 billion, achieving 63.8% of the annual goal.

Why Masan Consumer’s Stock Defied the Odds, Surging to a Record High and Nearly $8.5 Billion Market Cap Despite Q3 Earnings Decline?

The dip in Q3 sales isn’t a sign of weakness but a strategic “investment cost” essential for restructuring our distribution system.

Phat Dat Divests Entire Stake in Subsidiary Valued at Over VND 1,408 Billion

The Board of Directors of Phat Dat Real Estate has approved the sale of its entire stake in a subsidiary, generating over 1.408 trillion VND in proceeds.