The VN-Index’s sharp decline in the final trading session of the week left investors stunned. A wave of heavy selling, particularly in blue-chip stocks, pushed the index below the 1,600-point threshold.

Notably, despite the market’s deep plunge, liquidity remained low, with lackluster trading activity as order-matching value barely exceeded VND 23 trillion.

At the close, the VN-Index dropped over 43 points (-2.65%) to 1,599 points. Red dominated the market with more than 523 declining stocks. This erased all gains made over the past three months, bringing the VN-Index to its lowest level since early August. The index has lost over 160 points from its peak.

Explaining this steep decline, Mr. Nguyen The Minh – Director of Securities Analysis at Yuanta Vietnam cited multiple contributing factors.

Firstly, profit-taking pressure significantly increased after a strong upward phase. Additionally, the deep downturn in the U.S. stock market impacted domestic investor sentiment, amid weakening market liquidity. Recent sessions have consistently shown low liquidity, reflecting investor caution in the face of numerous uncertainties.

“Investor sentiment currently leans toward profit preservation rather than opening new positions. In this context, even a minor negative signal can trigger a strong selling wave, especially when blue-chip stocks plummet, creating a ripple effect across the market. Margin call pressure late in the session further intensified the decline,” Mr. Minh commented.

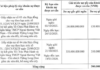

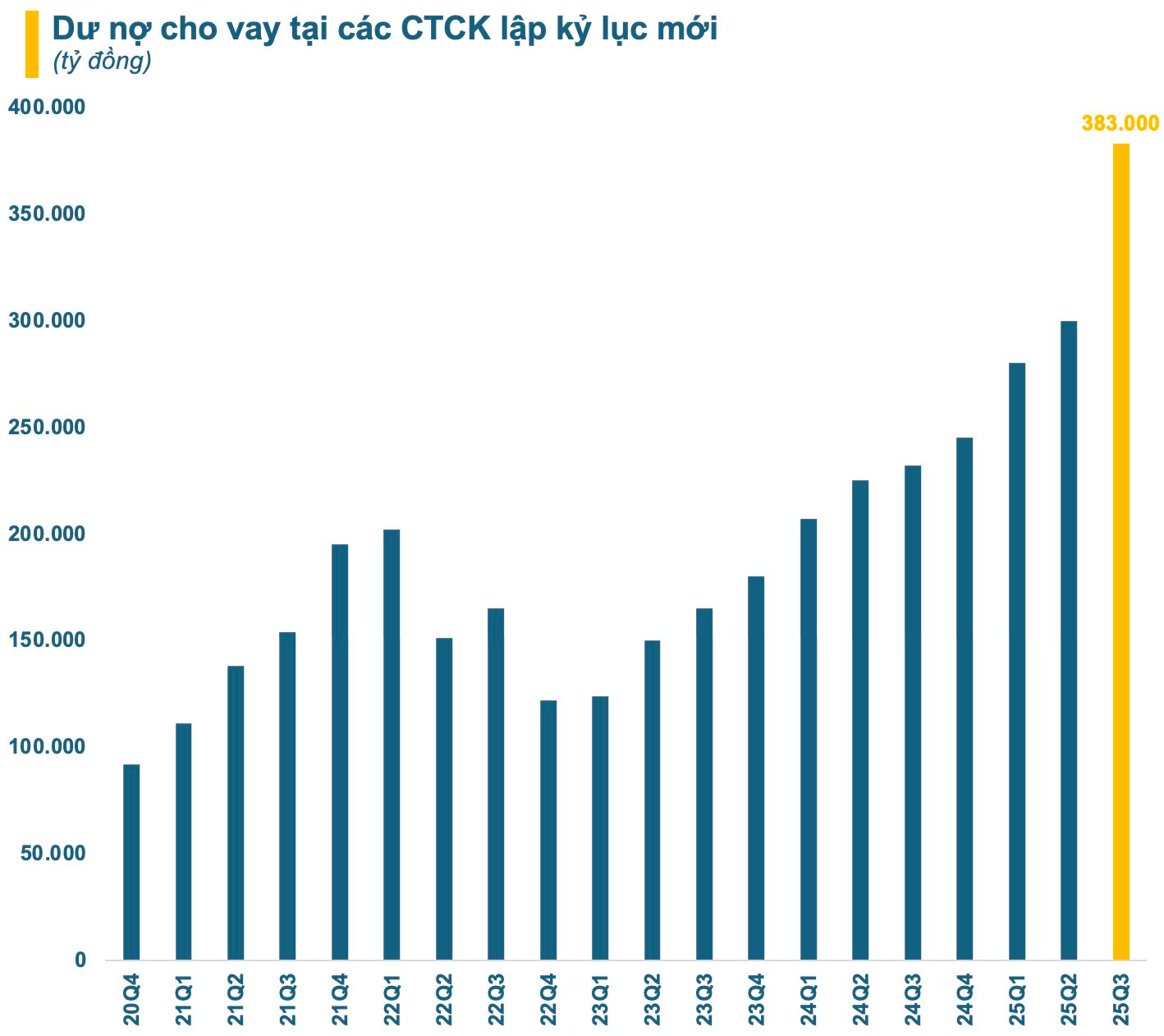

Moreover, margin debt currently stands at approximately VND 370 trillion, a record high, adding pressure during market corrections. In reality, margin leverage is a double-edged sword, potentially boosting profits but also increasing investor risk during sharp downturns.

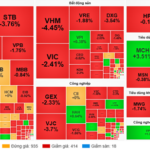

Foreign investors’ net selling also shows no signs of abating, further pressuring domestic investor sentiment. After a brief net buying session, foreign investors quickly resumed net selling, focusing on large-cap stocks, deepening the market’s decline.

The market is also entering an “information vacuum” phase. Supportive factors such as positive Q3 earnings, market upgrade expectations, and potential U.S. Federal Reserve rate cuts have largely been priced in, triggering profit-taking by smart money.

With the VN-Index breaching the 1,600-point mark, Yuanta experts suggest the index may retreat to the 1,525-point range to find equilibrium. While the market is entering a high-risk zone, a silver lining is that valuations are becoming more attractive, particularly for bank stocks expected to stabilize soon.

The expert advises investors to reduce margin ratios to safe levels and avoid high leverage during volatile periods. For self-funded investors, panic selling should be avoided; instead, monitor market stabilization signals before taking action.

Market Pulse 07/11: Foreign Investors Offload Financial & Real Estate Stocks, VN-Index Dips Below 1,600 Points

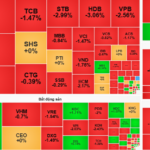

At the close of trading, the VN-Index dropped 43.54 points (-2.65%), settling at 1,599.1 points, while the HNX-Index fell 6.04 points (-2.27%), closing at 260.11 points. Market breadth was overwhelmingly negative, with 540 decliners outpacing 204 advancers. Similarly, the VN30 basket saw red dominate, as 28 stocks declined and only 2 advanced.

Vietcap Outlines Three November Scenarios for VN-Index, Highlighting 1,500 as Critical Support Level

According to Vietcap Securities’ November strategy report, the VN-Index faces three potential scenarios: continued accumulation, a breakout above 1,700 points, or a deep retreat to the 1,500-point range if strong selling pressure and widespread negative sentiment emerge.

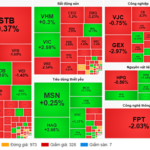

Market Pulse 05/11: Energy Sector Shines as Overall Market Liquidity Declines

At the close of trading, the VN-Index rose 2.91 points (+0.18%) to 1,654.89, while the HNX-Index gained 0.79 points (+0.3%) to 266.7. Market breadth tilted toward decliners, with 361 stocks falling and 323 advancing. Similarly, the VN30 basket saw red dominate, as 18 constituents declined and 12 advanced.