Analyzing the factors influencing gold prices in the coming period, Mr. Shaokai Fan, Regional Director for Asia-Pacific (excluding China) and Global Central Bank Director at the World Gold Council (WGC), emphasized that the trade tensions between the U.S. and China remain a critical factor impacting gold prices.

Mr. Shaokai Fan, Regional Director for Asia-Pacific (excluding China) and Global Central Bank Director at the World Gold Council (WGC)

With the preliminary trade agreement between the U.S. and China in place, what factors should investors monitor to gauge gold price movements? Mr. Shaokai Fan noted that the trade deal emerged from the recent APEC summit meeting between Chinese President Xi Jinping and U.S. President Donald Trump. “However, it’s important to recognize that this is only a temporary one-year agreement. Historically, U.S. trade policies have been subject to sudden changes, especially given the current White House administration’s approach. We believe trade and tariff issues persist and require close observation,” he stated.

Additionally, Mr. Shaokai Fan highlighted several key factors influencing gold prices that investors should consider:

First, macroeconomic policies, particularly the U.S. monetary policy, with upcoming Federal Reserve (Fed) decisions on interest rate cuts expected to positively impact gold.

Second, the independence of the Fed, which directly affects confidence in the U.S. dollar and U.S. institutions, thereby influencing gold prices in the future.

Moreover, gold is becoming increasingly attractive to investors due to two significant factors:

First, the rising public debt in many countries. Government debt burdens are becoming a major risk amid global fiscal unsustainability.

Second, the erosion of international system norms, leading to diminished trust in international systems and approaches, reducing predictability. In this context, gold naturally emerges as an appealing asset for investors.

“A crucial factor driving gold prices is the global risk-aversion sentiment, including fears of a bubble in AI technology. If AI proves to be a bubble and bursts, gold and other assets will become strategic safe-havens,” he analyzed.

World Gold Council Lacks Data on Vietnamese Gold Holdings

Regarding reports that Vietnamese citizens hold approximately 400-500 tons of gold, valued at $35-40 billion, or nearly 8% of GDP, Mr. Shaokai Fan stated that the World Gold Council does not have estimates of Vietnamese gold holdings. “We cannot track the amount of gold currently held by Vietnamese citizens,” he confirmed.

On mobilizing gold held by the public, Mr. Shaokai Fan suggested that Vietnam could learn from other markets. In Turkey, where gold is integral to the financial system, gold has been incorporated into bank accounts, allowing citizens to use it for transfers and payments between individuals.

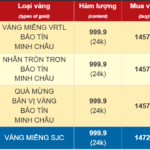

Afternoon of November 5th: SJC Gold Bars and Ring Gold Prices Reverse, Trending Upward

As of the latest update on the afternoon of November 5th, SJC gold prices and gold ring prices have rebounded slightly after a sharp decline of 1.2 million VND per tael.

Why Gold Sales Should Remain Tax-Free: A Timely Perspective

The Vietnam Association of Financial Investors (VAFI) has recently proposed a measure to stabilize the gold market by imposing a 10% value-added tax (VAT) on invoices for gold bullion and jewelry sales. However, experts caution that the taxation of gold should be carefully considered to avoid the issue of “tax on top of tax.”

November 4th: SJC Gold, Gold Rings Prices Drop, Buy-Sell Spread Widens to 3 Million VND per Tael

Following a modest recovery yesterday, gold prices took a downturn this morning, November 4th. The current buy-sell price differential stands at approximately 2-3 million VND per tael.