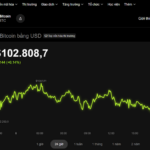

On the evening of November 7th, the cryptocurrency market experienced a widespread decline. Data from the OKX exchange revealed that Bitcoin’s price dropped by over 2% in the past 24 hours, falling to $100,180.

Other major cryptocurrencies also saw significant losses, with Ethereum (ETH) losing nearly 5% to $3,230, XRP dropping more than 5% to $2.10, BNB decreasing by over 1% to $934, and Solana (SOL) falling more than 5% to $151.

Is Bitcoin Poised for Recovery?

According to Cointelegraph, after six consecutive days of outflows, Bitcoin ETFs in the United States witnessed a resurgence of capital inflows totaling $240 million on November 6th. This development has sparked optimism among investors, who anticipate a potential market recovery if Bitcoin can maintain its critical price levels.

Prior to this, a prolonged period of outflows from October 29th to November 5th coincided with Bitcoin’s price plummeting to $98,900, its lowest point since June. Subsequently, the cryptocurrency rebounded by approximately 3%.

Bitcoin is currently trading at $100,180. Source: OKX

Analysts suggest that $100,000 is a crucial psychological threshold. If Bitcoin can hold above this level, it may gradually recover. However, a weekly close below this mark could intensify selling pressure.

Some experts speculate that $98,000 might serve as a short-term bottom, as selling pressure has diminished and fresh capital is re-entering the market.

Shelving Plans for a New Exchange

During an extraordinary shareholders’ meeting on the afternoon of November 7th, Mr. Tô Hải, CEO of Vietcap Securities Corporation, revealed that upon the announcement of the proposed digital asset exchange pilot earlier this year, the company promptly formed a research team to closely monitor developments.

Vietcap also received numerous partnership offers from the world’s largest cryptocurrency exchanges. “However, by August, the company decided to withdraw from the project due to the exorbitant capital requirement of 10,000 billion VND. We cannot allocate such a substantial amount to an emerging field,” Mr. Hải explained.

Vietcap’s extraordinary shareholders’ meeting on November 7th

Currently, Vietcap boasts a charter capital of 7,226 billion VND, with plans to increase it to 8,500 billion VND following a private placement by the end of this year or early next year. According to regulations, one of the prerequisites for establishing a digital asset exchange is a minimum charter capital of 10,000 billion VND.

Following the issuance of Resolution 05/2025 by the Vietnamese government regarding the pilot implementation of the digital asset market, numerous domestic companies have swiftly entered the fray.

For instance, Lộc Phát Việt Nam Cryptocurrency Exchange (LPEX) was established on September 30th with an initial charter capital of 6.8 billion VND. HD Securities has also outlined plans to raise over 7,300 billion VND, including nearly 1,500 billion VND in capital contributions to HD Cryptocurrency Exchange.

Other companies, such as KIS Vietnam Securities, SSI Securities, and VPBANK Securities, have also established legal entities and invested in domestic digital asset exchange operators.

Notably, in June 2025, Vimexchange Cryptocurrency and Digital Asset Trading Company was founded with a charter capital of 10,000 billion VND, becoming the first digital asset company in Vietnam to reach this capital threshold.

Miracle at Tether: World’s Largest Stablecoin Issuer Sees Each Employee Generate $185 Million in Annual Profit, Outpacing 400 Apple Employees

With high productivity and significant economic value, the digital economy presents a golden opportunity for Vietnamese students and technology engineers, according to industry experts.