Throughout today’s trading session (November 7), the VN-Index remained in negative territory. The decline widened in the afternoon session, with selling pressure intensifying as several large-cap stocks hit their lower limits. VHM closed at its floor price, dropping 7% to 92,000 VND per share.

The negative trading activity of the Vingroup stocks was a primary driver of the market’s sharp correction. VIC also fell by 3.9%, while VRE and VPL adjusted by 2-3%. Notably, VIC and VHM alone dragged the benchmark index down by over 13 points.

Selling pressure extended to other blue-chip stocks, including STB (-6.8%), MWG (-4.7%), LPB (-4.3%), and CTG (-4.1%). Stocks like SSI, VPB, SHB, and GVR declined by more than 3%. The banking sector saw 25 out of 27 stocks on HoSE decline, with only MSB maintaining its reference price.

All securities stocks closed in the red.

Real estate stocks plummeted, with many declining over 4%, including DXS, SCR, DXG, KDH, HPX, and KBC. Securities stocks also saw a deep sell-off, with VIX nearing its floor price, and SSI, SHS, VND, HCM, VCI, and MBS all closing in negative territory.

Despite the broad market correction, liquidity remained low. While cash inflows improved in the afternoon session, the total trading value was still about 10% lower than the recent weekly average. HoSE liquidity reached over 24.289 trillion VND.

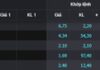

At the close, the VN-Index fell by 43.54 points (2.65%) to 1,599.1 points. The HNX-Index dropped by 6.04 points (2.27%) to 260.11 points, while the UPCoM-Index gained 0.53 points (0.46%) to 116.75 points. Foreign investors net sold over 1.368 trillion VND, primarily in STB, HDB, MBB, MCH, and SSI.

Over 2 Million New Securities Accounts Opened in 10 Months

According to the Vietnam Securities Depository (VSDC), nearly 310,500 new domestic individual accounts were opened in October, the highest monthly increase in over a year. This brings the total number of individual accounts nationwide to 11.29 million, equivalent to about 10% of Vietnam’s population. Domestic institutional investors opened 155 new accounts, 1.5 times more than the previous month. In the first 10 months of the year, domestic individual investors opened approximately 2.05 million new accounts.