The Vietnam Bond Market Association (VBMA) has released its bond market report for the week of October 27 to October 31, 2025.

On October 29, 2025, the State Treasury initially auctioned a total of VND 13,000 billion in government bonds across various tenors: 5-year (VND 5,000 billion), 10-year (VND 6,000 billion), 15-year (VND 1,500 billion), and 30-year (VND 500 billion). Subsequently, the State Treasury added an additional VND 3,000 billion in 10-year bonds to the auction.

As of the end of October 2025, the cumulative value of government bond issuances reached VND 283,429 billion across tenors ranging from 5 to 30 years, fulfilling 56.69% of the annual issuance plan.

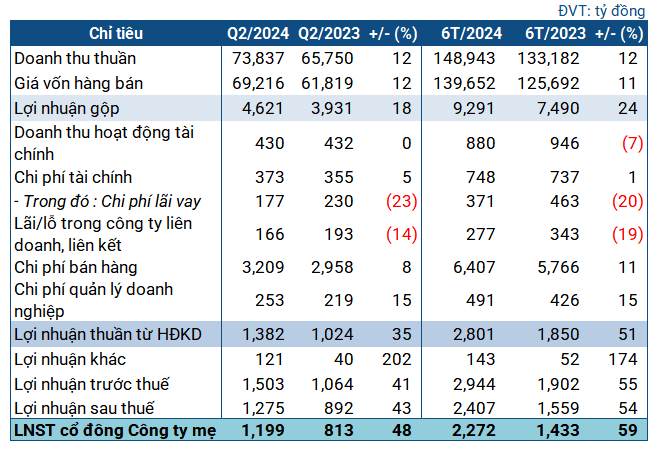

In the corporate bond market, according to VBMA data compiled from HNX and SSC (recorded by issuance and repurchase dates from HNX’s platform, subject to updates based on HNX disclosures), as of October 31, 2025, 42 corporate bond issuances were recorded in October 2025, totaling VND 57,192 billion.

Source: VBMA

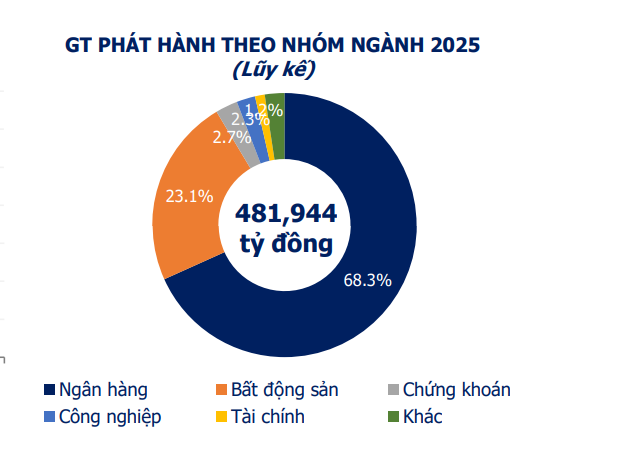

Year-to-date, the total value of corporate bond issuances stands at VND 481,944 billion, comprising 28 public issuances worth VND 50,583 billion (10.5% of the total) and 380 private placements totaling VND 431,361 billion (89.5%).

Looking ahead, several companies are planning to issue bonds worth thousands of billions of dong. Notably, the Board of Directors of BAF Vietnam Agriculture JSC approved a public bond issuance plan for 2025, with a maximum value of VND 1,000 billion. These non-convertible, unsecured bonds have a face value of VND 100 million each, a 3-year tenor, and a fixed interest rate of 10% per annum.

Asia Commercial Bank’s (ACB) Board also approved a third private bond issuance plan for 2025, divided into 20 tranches totaling VND 20,000 billion (face value: VND 100 million per bond). These bonds have a maximum tenor of 5 years and a hybrid interest rate structure (fixed and floating).

Conversely, in October 2025, companies repurchased VND 9,948 billion in bonds. Year-to-date, total early bond repurchases reached VND 247,053 billion, a 49.4% increase compared to 2024. Banks led the repurchases, accounting for 66.7% (VND 164,855 billion) of the total.

In the final two months of the year, VND 32,718 billion in bonds will mature. Real estate leads with VND 12,726 billion (38.9%), followed by banks with VND 8,090 billion (24.7%).