The stock market marked its fourth consecutive week of decline, breaching the psychological 1,600-point threshold and hitting a four-month low. Currently, the VN-Index stands at 1,599 points, a 2.47% drop from the previous week. Notably, the final session alone saw intense selling pressure, causing the index to plummet by 43 points and close below the critical 1,600-point support level.

Market liquidity remained subdued last week, with trading values on HOSE falling below VND 18 trillion in some sessions, reflecting investor caution.

Numerous sectors witnessed a sea of red, with stocks not only declining for multiple days but also breaking through long-standing support levels.

Across forums, investors expressed anxiety as their portfolios turned red, with accounts heavily in the negative, and losses reaching 30-40% for those using margin (borrowed capital).

“Has everyone closed their apps yet? I’m officially closing mine,” said Manh Hao, a Ho Chi Minh City-based investor with five years of market experience, unable to hide his disappointment as the VN-Index breached the 1,700 and then 1,600-point levels.

His portfolio has incurred a 20% loss, with some securities stocks plunging by as much as 25%.

According to reporters from *Bao Nguoi Lao Dong*, as the market retreated to the 1,650-point level, many brokers from various securities firms continued to recommend investors buy into securities and real estate stocks.

Next week’s stock market is forecast to turn positive.

Dinh Viet Bach, an analyst at Pinetree Securities, predicts that in the short term, pressure may persist from blue-chip stocks such as banking, Vingroup, and other VN30 constituents.

However, mid-cap stocks are showing more positive signs, potentially forming a short-term bottom.

“It’s likely that next week, the market will experience another strong shakeout to offload weak holdings, thereby activating sidelined capital. The key condition is a resurgence in buying interest, which could trigger a technical rebound,” Bach anticipates.

Conversely, if investors remain cautious, selling pressure could spread to even robust stocks, pushing the index further down to the 1,500–1,520 range.

According to SHS Securities, a bright spot this month is the addition of approximately 311,000 new investor accounts in October 2025. Year-to-date, nearly 2.1 million new accounts have entered the market. Despite the price correction, the medium-term demand from new investors continues to accumulate, providing a cushion for recovery once liquidity improves and investor sentiment becomes less cautious. If the VN-Index stabilizes around 1,600 points with increased trading volume, investors may consider gradually increasing exposure to fundamentally strong stocks poised to benefit in Q4/2025 and early 2026.

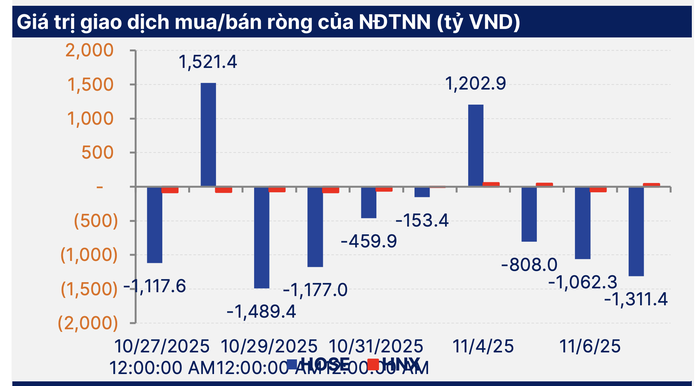

Long-term prospects, particularly for foreign capital, look promising. Tuan Nhan, Deputy CEO of Vietcap Securities, notes that foreign funds and investors could bring in approximately USD 1.5 billion to Vietnam next year, following FTSE Russell’s upgrade of Vietnam to secondary emerging market status.

This influx of capital is expected to offset the net selling by foreign investors this year, with growing interest from new investors in Singapore and Hong Kong (China).

Source: SHS