On the afternoon of November 8th, during the regular government press conference, the media inquired about strategies to strengthen capital mobilization through initial public offerings (IPOs) and corporate bonds, aiming to establish these channels as pillars of the national capital market.

Deputy Minister of Finance Nguyen Duc Chi stated that the development strategy until 2030, approved by the Prime Minister, clearly outlines the goal of implementing solutions to make the capital and stock markets the primary and crucial channels for medium and long-term capital mobilization in the economy.

To achieve this, the Ministry of Finance has implemented a range of synchronized measures to foster market development. Throughout this period, particularly in 2025, the Ministry has conducted numerous practical activities in the stock and capital markets.

Deputy Minister of Finance Nguyen Duc Chi discusses capital mobilization solutions. Source: VGP

The Ministry of Finance has also collaborated with relevant agencies to evaluate the 2025 corporate bond market, identifying bottlenecks and issues while proposing solutions.

Furthermore, the Ministry reported to the Government, leading to the issuance of Decree No. 245/2025/NĐ-CP, which amends and supplements Decree No. 155/2020/NĐ-CP. This new decree significantly facilitates enterprises conducting IPOs linked to stock market listings.

Specifically, administrative procedures have been streamlined. Previously, post-IPO financial report reviews took 3-6 months. However, under Decree No. 245/2025/NĐ-CP, this process has been reduced to approximately 30 days, greatly encouraging enterprises to list their shares on the stock market.

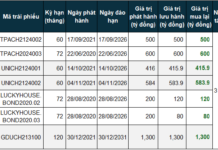

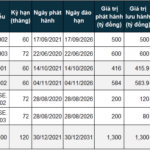

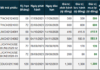

In 2025, the government plans to issue approximately VND 500 trillion in government bonds. The corporate bond market, both public and private, has rebounded, with a total issuance of around VND 500 trillion. Thus, Vietnam’s 2025 bond market is expected to reach VND 1,000 trillion, encompassing both corporate and government bonds.

However, Deputy Minister Chi noted that this market size does not yet match the potential or capital mobilization needs of the government and enterprises for 2026 and beyond. Therefore, the Ministry of Finance has proposed fundamental solutions to develop the market, enabling both the government and enterprises to effectively raise capital through bond issuances.

The amended Securities Law 2024 includes provisions for corporate bond issuances and investor participation. The Ministry is drafting a government decree to guide these regulations, set to take effect on January 1, 2026.

The Ministry of Finance will focus on improving procedures, clarifying issuer-related regulations, and ensuring bond quality. This includes defining investor eligibility criteria for different bond types and establishing monitoring mechanisms to ensure a safe and transparent market.