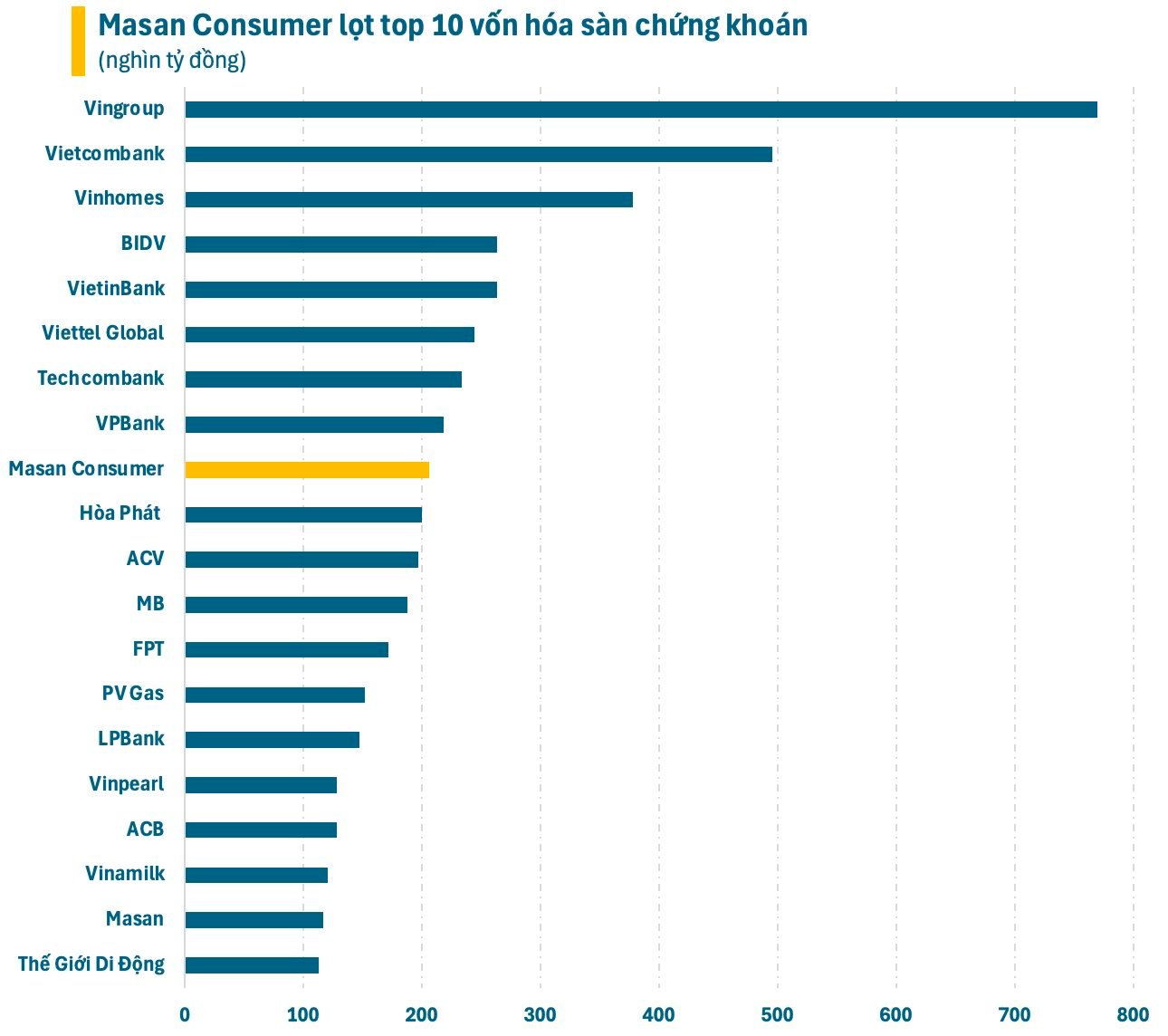

Masan Consumer Holdings (stock code: MCH) is making waves in the market with its impressive performance, defying the broader market trend. Over the past month, the stock has surged by 50%, reaching a new peak of VND 194,800 per share. Consequently, the company’s market capitalization has surpassed VND 200 trillion for the first time since its listing.

This remarkable rally has propelled Masan Consumer into the top 10 largest companies by market cap in Vietnam, overtaking industry giants such as Hoa Phat Group (steel), Airports Corporation of Vietnam (ACV), FPT Corporation (technology), Vinamilk (dairy), and even its parent company, Masan Group. Its market cap now exceeds that of several major banks, including MB, LPBank, and ACB.

Masan Consumer is renowned as one of Vietnam’s leading consumer goods companies, specializing in convenient food products. Its portfolio includes well-known brands such as Omachi, Kokomi, and Sagami instant noodles; Nam Ngu and Chinsu fish sauce; Chinsu soy sauce; Vinh Hao mineral water; and Vinacafe coffee.

Listed on the UPCoM market since 2017, MCH quickly became one of the largest stocks by market cap on the platform. After nearly nine years, the company is preparing to move to the Ho Chi Minh Stock Exchange (HoSE), having recently submitted its initial listing application. With a charter capital of VND 10,676 billion (approximately 1.067 billion shares), MCH is poised to join major indices upon listing.

During a recent investor meeting in late October, Mr. Micheal Hung Nguyen, Deputy CEO of Masan Group, expressed optimism about Masan Consumer’s upcoming financial performance. He also emphasized the importance of positive market conditions to ensure a smooth IPO process.

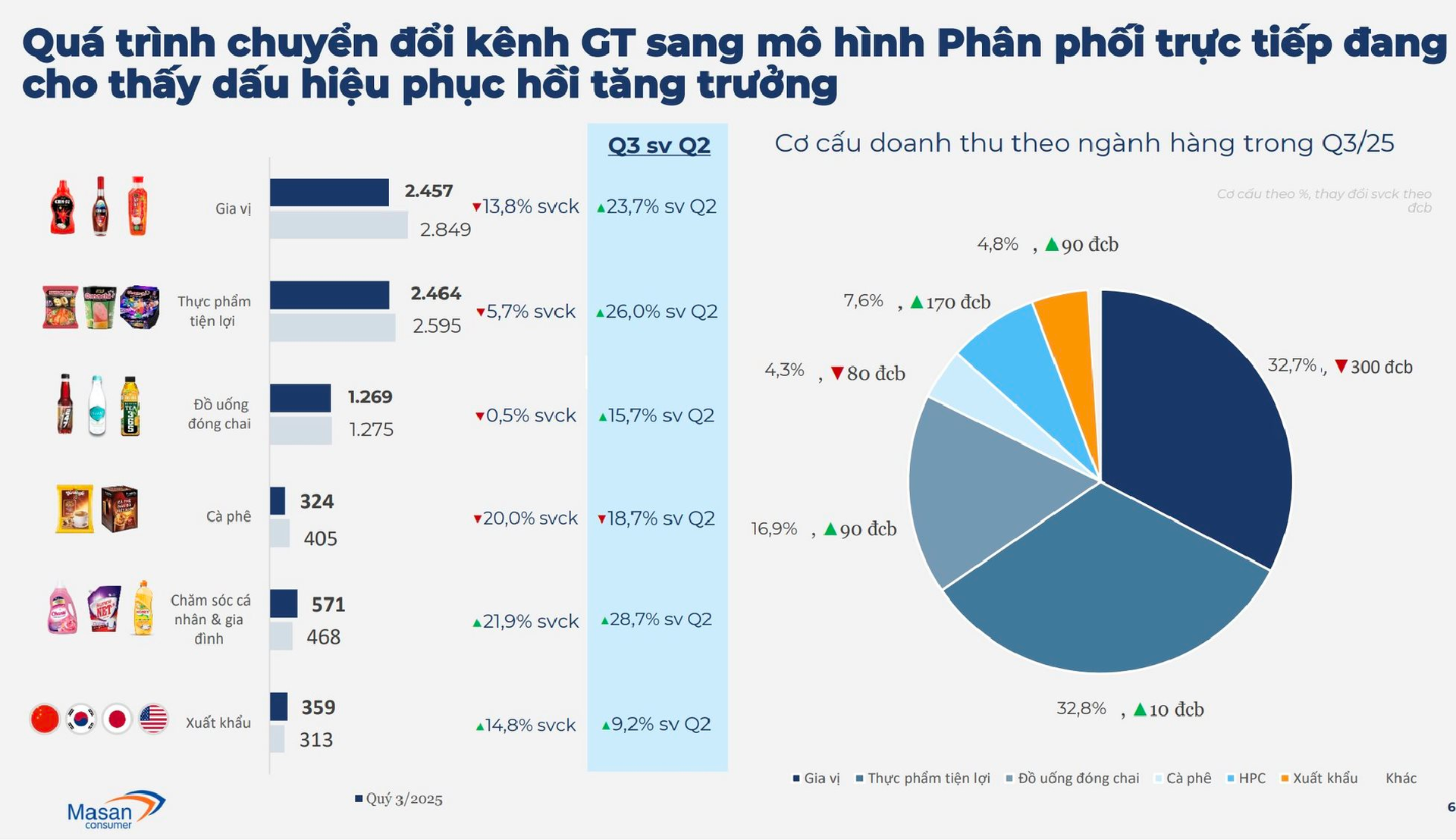

In Q3 2025, Masan Consumer reported revenue of over VND 7.5 trillion, a 6% year-on-year decline but a 20% increase from the previous quarter. This growth was driven by improved sales following anti-counterfeiting efforts and tax policy changes in Q2. Nine-month revenue reached VND 21 trillion, achieving 63.5% of the annual target.

Net profit in Q3 fell by 19% year-on-year to VND 1.9 trillion, due to lower gross margins and a 66% drop in net financial income. Interest income from deposits and bond investments decreased by 58% to VND 159 billion. Nine-month net profit stood at VND 4.7 trillion, meeting 63.8% of the annual goal.

Notably, the 6% revenue decline in Q3 marks a significant improvement from the 15% drop in Q2, indicating a recovery trend. Modern retail and export channels grew by 12.5% and 14.8%, respectively. Masan Consumer’s management clarified that the slowdown was a deliberate, short-term strategy.

“The primary reason was the implementation of the ‘Retail Supreme’ project, which focused on direct distribution in traditional retail channels to reduce intermediary inventory. This initiative aimed to enhance supply chain control, data management, and store-level efficiency,” explained a Masan executive.

By the end of Q3 2025, the average number of active retail outlets reached 345,000, a 40% year-on-year increase. Sales team productivity rose by 50%, and distributor inventory days decreased to 15 (down by 8 days). With the project fully implemented across 34 provinces, Masan Consumer’s leadership is confident about returning to positive growth in Q4 2025.