PVComBank (Vietnam Public Joint Stock Commercial Bank) has adjusted its deposit interest rates for the first time in over a year (since August 2024).

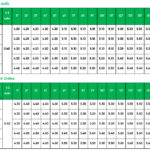

According to the online term deposit interest rate table for individual customers, PVComBank has increased rates by 0.5% per annum across all terms from 1 to 36 months. Specifically: 1-month term to 3.80% per annum; 2-month term to 3.90% per annum; 3-month term to 4.10% per annum; 4-month term to 4.20% per annum; 5-month term to 4.30% per annum; 6-month term and above to 5.00% per annum; 7-11 month terms to 5.20% per annum; 12-month term to 5.60% per annum; and 13-month term to 5.80% per annum.

The highest deposit interest rate at PVComBank reaches 6.3% per annum, applicable to online deposits with terms of 15-36 months.

Source: PVComBank

BaoViet Bank (Vietnam Bank for Investment and Development of Vietnam) has also increased its deposit interest rates after keeping them unchanged for over 7 months.

According to the latest online term deposit interest rate table for new individual customers, BaoViet Bank has increased the 1-month term rate by 0.5% per annum to 4% per annum; the 2-month term rate by 0.6% per annum to 4.2% per annum. The 3, 4, and 5-month terms have all increased by 0.1% per annum, reaching 4.45% per annum, 4.5% per annum, and 4.6% per annum, respectively.

However, the bank has kept the rates for terms from 6 to 36 months unchanged: 6-8 month terms at 5.45% per annum; 9-11 month terms at 5.5% per annum; 12-month term at 5.8% per annum; and the highest rate of 5.9% per annum for 13-36 month terms.

Source: BaoVietBank

BaoVietBank and PVComBank are the latest banks to increase savings interest rates in November. Previously, several banks had also raised savings interest rates in October and early November, including Sacombank, VPBank, SHB, HDBank, GPBank, NCB, BVBank, and Bac A Bank.

According to industry experts, the widespread increase in interest rates indicates that the competition for capital mobilization has intensified again in the fourth quarter of 2025, especially among joint-stock commercial banks, to meet the high capital demand at the end of the year and narrow the gap between deposit and lending growth.

In reality, many major banks have recorded lending growth far exceeding deposit growth in the first nine months of the year, such as VPBank, ACB, SHB, and MB. This situation has forced banks to increase deposit attraction to ensure capital safety ratios.

KB Securities reports that the credit growth of the entire system as of the end of September 2025 was 13.4% – the highest growth rate compared to the same period in recent years. Meanwhile, deposit growth reached 9.7%, creating a significant gap with the strong credit growth. With the monetary policy easing direction throughout this year, the interest rate level has generally remained stable. However, some banks have recorded credit growth of over 20% in the first nine months, which could put pressure on deposit interest rates.

Vietcombank Securities also forecasts that the room for reducing deposit interest rates will be limited in the near future; instead, there is a trend of slight increases due to three factors: First, credit is likely to accelerate at the end of the year as the State Bank of Vietnam raises the credit growth limit, forcing banks – especially joint-stock commercial banks – to strengthen capital mobilization, increasing the risk of local liquidity shortages. Second, the pressure on the USD/VND exchange rate remains. And third, the overheating of the real estate and financial asset markets increases risky credit demand, indirectly driving the adjustment of deposit interest rates to a reasonable level to control capital flows.

Speaking at a recent Business Results Announcement, Mr. Vu Minh Truong, Director of the Capital and Financial Market Division at VPBank, mentioned that the prolonged situation of credit growing faster than deposits puts pressure on liquidity and interest rates in the near future.

According to VPBank’s leadership, the system’s credit growth (year to date) is around 13.5%, while deposit growth is 9.6%. Similarly, compared to the same period in September last year, credit grew by nearly 19%, while deposits grew by about 16%, with a gap of about 3% between these two figures.

“These indicators have been continuously increasing recently, leading to a relatively high loan-to-deposit ratio (LDR) in the system, currently around 98% if only considering the primary market. These are factors indicating that the current pressure to increase interest rates is very clear,” said Mr. Truong.

Interest Rates Show Signs of Rising Despite State Bank’s Net Capital Injection

After a prolonged period of remaining at a low level, deposit interest rates are showing signs of a slight increase in the final months of the year. Despite the system’s ample liquidity, interest rates in both the primary and secondary markets are trending upward, reflecting notable shifts in the balance of capital supply and demand within the system.

Interest Rates on Deposits Edge Up Amid Year-End Capital Demand

Interest rates are expected to fluctuate minimally within a narrow range during the final two months of the year. More significantly, lending rates will remain stable at low levels, providing optimal conditions for businesses to sustain their production and operational recovery.