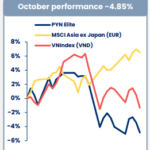

According to a newly released report, in October, the foreign fund Pyn Elite Fund recorded a negative investment performance of 4.85%, while the VN-Index dropped by 1.3%. This marks the second consecutive month of negative returns for the fund, following four consecutive months of positive performance.

Pyn Elite Fund attributes this decline primarily to adjustments in the banking and securities sectors. In October, the VN-Index reached a historic peak of 1,766 points on October 16th, following a third-quarter GDP growth of 8.23% and FTSE’s announcement of upgrading Vietnam to emerging market status (effective from September 2026). However, the index quickly corrected due to profit-taking pressures, closing the month with a 1.33% decline compared to the previous month.

Pyn Elite Fund is one of the largest foreign funds in the market, with a portfolio size of up to 940 million EUR (approximately 28.6 trillion VND ~ 1.1 billion USD) as of the end of October.

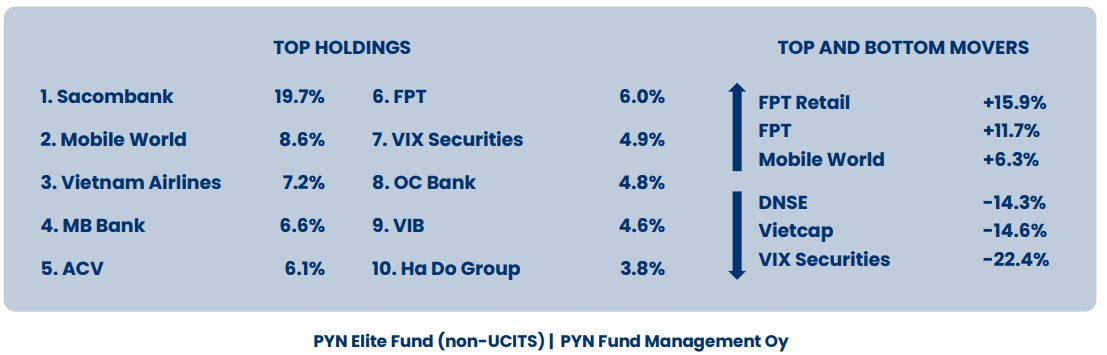

The fund’s top 10 holdings include 4 banking stocks (STB, MBB, VIB, OCB), 1 securities company (VIX), 2 aviation companies (HVN, ACV), 1 retail company (MWG), 1 technology company (FPT), and 1 real estate company (HDG).

Notably, FPT shares unexpectedly returned to the fund’s top 6 holdings with a 6% weighting, after being absent from the top 10 in the September report.

In October, the FPT-related stocks, FRT and FPT, surged by nearly 16% and 12% respectively, significantly contributing to the fund’s performance. Conversely, financial stocks like VIX, VCI, and DSE plummeted by 14% to 22%, dragging down the performance of this foreign “shark.”

Despite the pressure from financial stocks on the portfolio’s performance, PYN Elite still considers TCX a promising investment due to its strong business foundation and industry-leading position. TCBS (TCX) is the securities company with the largest market capitalization and equity in Vietnam, and has been the most profitable company in the industry for six consecutive years.

TCX completed its highly anticipated IPO in September 2025 with an oversubscription rate of 2.5 times, and listed on HOSE on October 21st. Pyn Elite Fund revealed that it subscribed for a significant amount during this offering.

On the macroeconomic front, Vietnam’s economy maintained robust growth in October. Exports and imports increased by 17.5% and 16.8% year-on-year, respectively, while industrial production accelerated to 10.8%, marking the second consecutive month of double-digit growth. The manufacturing PMI reached 54.5 points, the highest since July 2024.

In the first 10 months, registered FDI increased by 15.6%, and disbursed FDI rose by 8.8% year-on-year. October’s retail sales grew by 7.2%, slightly slowing down due to widespread storms and flooding. Inflation remained under control at 3.25%.

Public investment disbursement in the first 10 months increased by 27.8% year-on-year, while state budget revenue rose by 30.8%, reaching 111% of the annual plan.

On October 26th, Vietnam and the US announced a Bilateral Trade Agreement Framework, paving the way for deeper cooperation and potential tariff reductions in the future.

Additionally, the 10th Session of the 15th National Assembly, which opened on October 20th and will last for 50 days, will consider approving a 300 billion USD public investment plan for 2026–2030, along with 49 draft laws and 4 resolutions to address legal bottlenecks in key sectors such as real estate and public investment.

VNDirect Forecasts VN-Index Correction Before Surging to 1,720 Points by Early 2026

While not yet inexpensive, current market valuations are underpinned by a robust macroeconomic foundation, the prospect of market upgrades, and sustained optimism regarding the earnings potential of listed companies.

Stock Market Slump Drags Down PYN Elite Fund’s Performance

The PYN Elite Fund’s investment performance continued its downward trajectory in October, experiencing a more significant decline compared to the VN-Index.