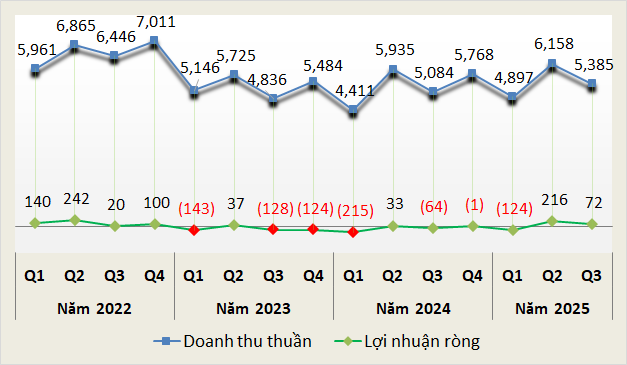

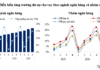

According to data from VietstockFinance, the total revenue of 17 listed cement companies in Q3/2025 reached nearly VND 5.4 trillion, a 6% increase year-on-year. Gross profit margin stood at 9%.

The industry’s net profit continued to recover, hitting over VND 70 billion, compared to a loss of VND 64 billion in the same period last year. Five companies turned losses into profits, three saw profit growth, four experienced declines, and five remained in the red.

|

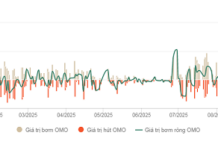

Revenue and Profit of Cement Companies from Q1/2022 to Q3/2025 (Unit: VND billion)

Source: VietstockFinance

|

Industry Leaders Drive Recovery

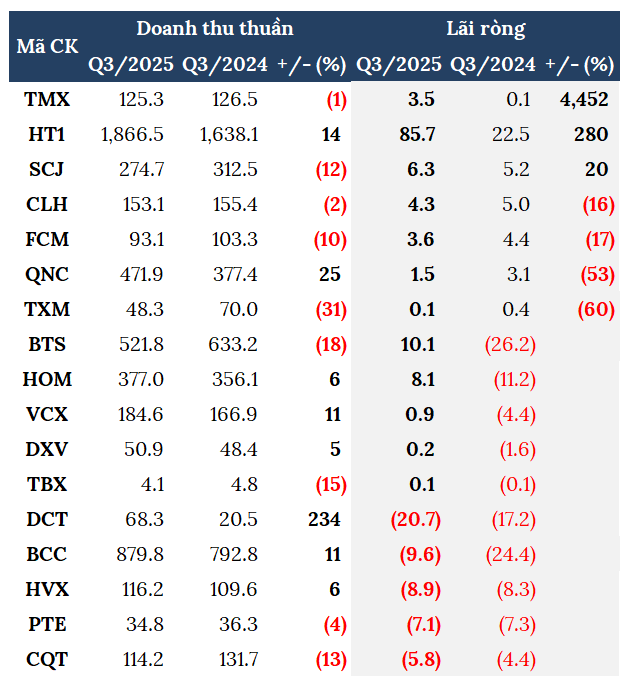

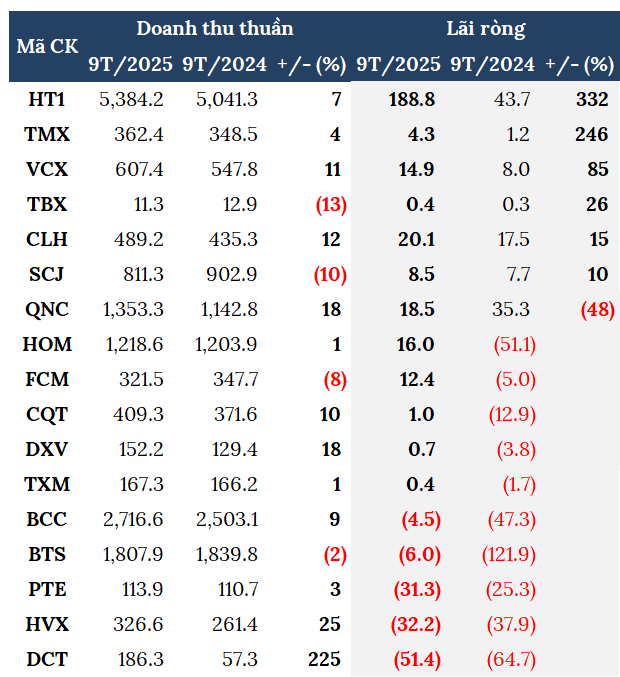

The leading company, Vicem Ha Tien Cement (HOSE: HT1), reported a net profit of nearly VND 86 billion in Q3, 3.8 times higher than the same period last year. This was driven by an 18% increase in sales volume, coupled with controlled production costs and stable input material prices. After nine months, its post-tax profit reached nearly VND 190 billion, 4.3 times higher, exceeding the full-year profit target by 3%.

Besides HT1, Vicem Cement Trading (HNX: TMX) also saw a remarkable turnaround, posting a profit of over VND 3.5 billion, 45.5 times higher year-on-year. TMX attributed this to the recovery of VND 4.7 billion in bad debts from Vuong Anh Co., Ltd., leading to a reversal of provisions for receivables. After nine months, TMX achieved a net profit of over VND 4 billion, 3.5 times higher, significantly surpassing its annual target.

|

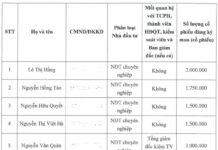

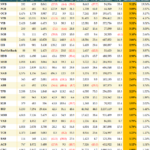

Business Results of Cement Companies in Q3/2025 (Unit: VND billion)

Source: VietstockFinance

|

Profits Return After Quarters of Losses

Thanks to VND 18 billion in other profits from waste treatment, Vicem But Son Cement (HNX: BTS) turned a profit in Q3, earning over VND 10 billion. This marked its second consecutive profitable quarter after a 10-quarter loss streak.

Over nine months, BTS still reported a net loss of over VND 6 billion, a significant improvement from the VND 122 billion loss in the same period last year. As of Q3, BTS had accumulated losses of nearly VND 300 billion.

Vicem Hoang Mai Cement (HNX: HOM) also turned a profit of over VND 8 billion, compared to a loss of VND 11 billion in the same period last year. This was the highest profit in 13 quarters, driven by improved clinker production efficiency, the use of alternative raw materials, and additional profits from waste treatment. The company exceeded its annual profit target by 7% after just nine months.

Struggling in a Cycle of Losses

Despite the industry’s overall improvement, several companies remain trapped in prolonged losses.

The heaviest loss was recorded by Dong Nai Construction Materials Roofing Sheet JSC (UPCoM: DCT), with a loss of nearly VND 21 billion, marking its 14th consecutive quarter in the red. High interest expenses and overdue loan penalties were the primary causes.

After nine months, DCT lost over VND 51 billion, compared to VND 65 billion in the same period last year, bringing its accumulated losses as of September 30 to nearly VND 920 billion, with negative equity of nearly VND 548 billion.

Similarly, Vicem Hai Van Cement (HOSE: HVX) ended Q3 with a loss of nearly VND 9 billion, extending its losing streak to 10 quarters and pushing accumulated losses to over VND 128 billion by the end of September.

HVX attributed this to weak cement demand, delayed civil projects, and intense price competition in the Central region due to high inventory levels and excess production capacity.

Meanwhile, Phu Tho Cement (UPCoM: PTE) reported its 18th consecutive quarterly loss, totaling over VND 7 billion. By the end of Q3, the company had accumulated losses of over VND 478 billion, with negative equity of nearly VND 349 billion. PTE cited plummeting demand, high raw material costs, and production expenses as significant challenges over the past nine months.

|

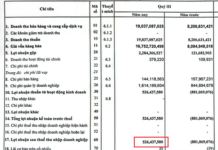

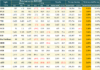

Business Results of Cement Companies in 9M/2025 (Unit: VND billion)

Source: VietstockFinance

|

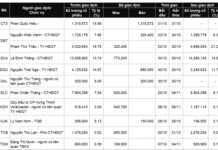

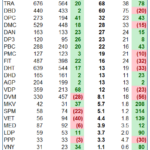

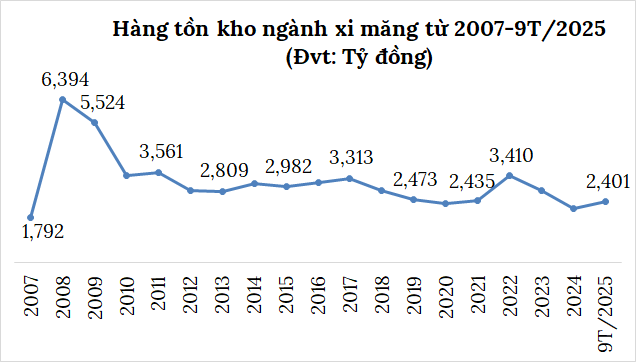

By the end of September, listed cement companies held total inventory valued at over VND 2.4 trillion, up 12% from the beginning of the year. HT1 accounted for 28% of this inventory, with over VND 670 billion, down 4% from the start of the year.

Source: VietstockFinance

|

Bright Prospects for Year-End

Many companies note that the cement market remains under competitive pressure, with numerous brands launching affordable products and high discounts to maintain market share.

Directive 179/CĐ-TTg, issued by the Prime Minister in late September, aims to boost domestic market development in 2025 by accelerating public investment disbursement, particularly for key projects like Long Thanh Airport, highways, and ring roads. This is expected to stimulate demand for construction materials in the final months of the year.

Additionally, the real estate market is gradually recovering, supported by more flexible credit policies and accelerated legal resolutions. These factors are anticipated to drive the cement industry’s recovery and acceleration.

– 10:49 10/11/2025

November Savings at Agribank: What’s the Highest Interest Rate You Can Earn?

Unlock exclusive savings rates with Agribank! Customers can now secure up to 4.9% annual interest by depositing online for terms ranging from 24 to 36 months. Maximize your savings effortlessly with Agribank’s competitive online offers.

MPs Warn: 1-5% Revenue Tax Could Wipe Out Profits for Small Businesses

According to a member of the National Assembly, the tax threshold of 200 million VND in annual revenue for individual and household businesses is unfair. After deducting expenses and personal income, the remaining amount from 200 million VND in revenue “would barely be anything.”