|

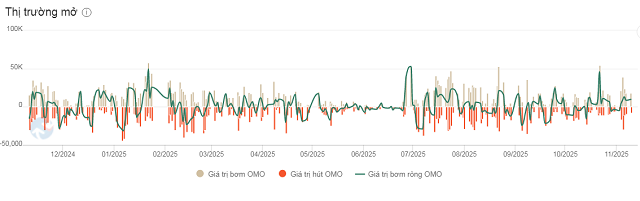

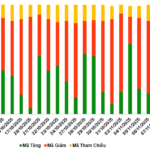

OMO Operations’ Net Pumping Trends Over the Past Year. Unit: Billion VND

Source: VietstockFinance

|

Specifically, 119,443 billion VND was successfully bid on the OMO channel with terms ranging from 7 to 91 days, at a fixed interest rate of 4% per annum. Meanwhile, the maturing capital on the collateralized securities channel reached 80,193 billion VND, bringing the current circulation scale to 299,836 billion VND.

|

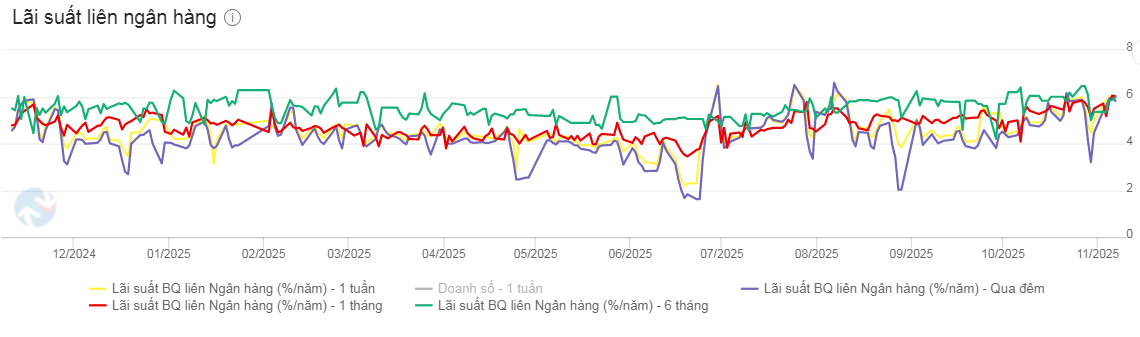

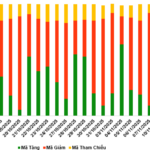

Interbank Interest Rate Trends Over the Past Year

Source: VietstockFinance

|

In the interbank market, interest rates rose across all terms. Notably, the overnight rate surged by 137 basis points compared to late October, reaching 5.82% per annum on November 7th. However, the average transaction value for overnight trades significantly decreased from late October, averaging over 695 trillion VND per day. Rates for 1-week to 1-month terms collectively increased by 53-89 basis points, fluctuating between 5.87% and 6.02% per annum, while the 6-month term rose to 5.99% per annum (a 64 basis point increase from late October).

|

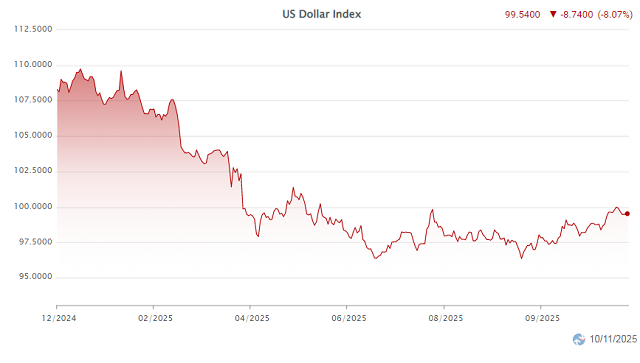

DXY Trends from the Beginning of 2025 to November 10th

Source: VietstockFinance

|

In the international market, the USD Index (DXY), which measures the greenback’s strength against a basket of six major currencies, slightly decreased by 0.2 points from the previous week, settling at 99.47 points on November 7th.

The USD weakened after U.S. President Donald Trump acknowledged for the first time that American consumers are bearing additional costs due to tariff policies, although he maintained that these measures “benefit the nation overall.” This statement, coupled with a partial U.S. government shutdown delaying economic reports, raised concerns about U.S. economic growth prospects and exerted downward pressure on the greenback.

Domestically, Vietcombank’s USD/VND exchange rate closed the week of November 7th at 26,088-26,358 VND/USD (buy-sell), marking an 11 VND increase in both directions compared to the previous week.

– 13:28 11/11/2025

USD Free Market Rate Nears 28,000 VND: Experts Share Latest Forecasts

The USD exchange rate at banks has been on a steady rise, yet experts predict that Vietnam’s currency will soon stabilize, bringing much-needed relief to the market.

Navigating the Warrant Market on 11/11/2025: Unveiling Hidden Risks and Opportunities

At the close of trading on November 10, 2025, the market saw 88 stocks rise, 175 fall, and 38 remain unchanged. Foreign investors continued their net selling streak, totaling 179.06 million VND.