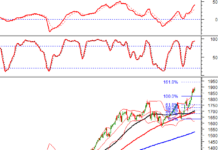

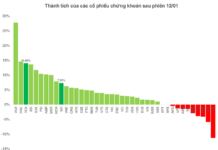

Vietnam’s stock market experienced another volatile trading session on November 10th. The VN-Index briefly turned green before a late-session sell-off pushed it down 18.56 points to close at 1,580.54. Trading value on the Ho Chi Minh City Stock Exchange (HoSE) remained subdued, reaching approximately VND 18.8 trillion.

Foreign investors continued their net selling streak, offloading roughly VND 300 billion, a slight easing from the previous sessions’ massive sell-offs. Here’s a breakdown:

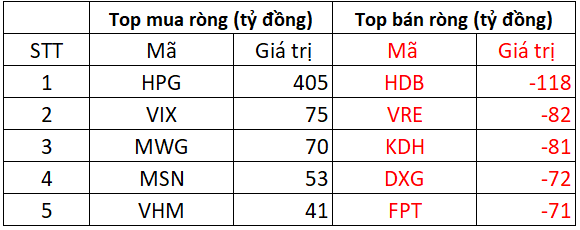

On HoSE, foreign investors net sold approximately VND 177 billion

On the buying side, HPG led the market with foreign investors snapping up VND 405 billion worth of shares. VIX, MWG, MSN, and VHM also saw strong foreign buying interest, with net purchases ranging from VND 41 billion to VND 75 billion per stock.

Conversely, HDB witnessed the heaviest foreign selling pressure, with VND 118 billion worth of shares offloaded. VRE and KDH followed suit, with net selling of VND 81-82 billion each, while DXG and FPT saw net selling of VND 71-72 billion per stock.

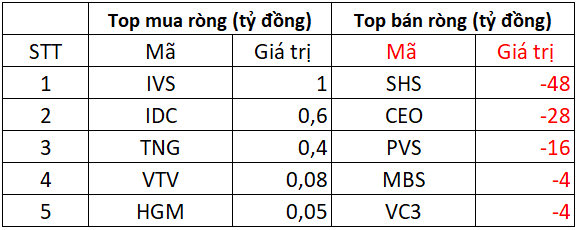

On HNX, foreign investors net sold around VND 113 billion

Foreign investors showed modest buying interest in IVS, IDC, and TNG, with net purchases ranging from a few hundred million to VND 1 billion. VTV and HGM saw negligible net buying.

On the selling side, SHS, CEO, and PVS faced significant foreign selling pressure, with net sales of VND 48 billion, VND 28 billion, and VND 16 billion, respectively. VC3 and MBS also saw notable net selling, with approximately VND 4 billion each.

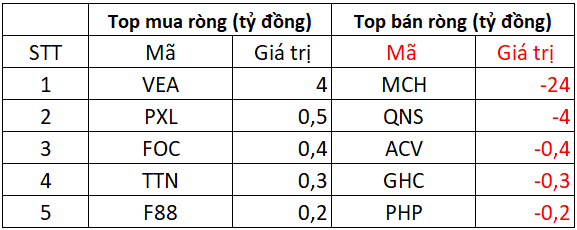

On UPCOM, foreign investors net sold approximately VND 23 billion

Foreign investors bought VND 4 billion worth of VEA shares, while PXL, FOC, TTN, and F88 saw net purchases of a few hundred million each.

MCH faced the brunt of foreign selling, with VND 24 billion worth of shares offloaded. QNS also saw net selling of VND 4 billion. ACV, GHC, and PHP experienced minor net selling.