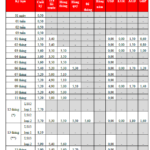

As of the end of November 11th, Bao Tin Minh Chau listed the price of gold rings at 149.3 – 152.3 million VND per tael. Meanwhile, PNJ and DOJI both quoted gold rings at 148.5 – 151.5 million VND per tael, and SJC maintained their gold ring price at 147.3 – 149.8 million VND per tael.

For gold bars, PNJ, DOJI, and SJC uniformly kept prices at 150 – 152 million VND per tael (buy – sell), while Bao Tin Minh Chau listed them at 150.5 – 152 million VND per tael.

During today’s trading session, domestic gold prices rose by an average of 2 million VND per tael, following the strong upward trend of global gold prices.

—

By midday survey, Bao Tin Minh Chau had adjusted the price of gold rings to 149.3 – 152.3 million VND per tael, an increase of 1.8 million VND per tael compared to yesterday’s closing session. Similarly, their gold bar prices were adjusted to 150.5 – 152 million VND per tael.

At PNJ and DOJI, gold ring prices were uniformly listed at 148.5 – 151.5 million VND per tael, up 2 million VND per tael from the previous session.

Meanwhile, SJC also adjusted their gold ring prices to 147.3 – 149.8 million VND per tael, a 2 million VND per tael increase.

Gold bar prices at PNJ, DOJI, and SJC were also adjusted to 150 – 152 million VND per tael, reflecting an increase of approximately 1.8 million VND per tael.

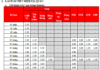

In the global market, spot gold prices continued their upward trend, reaching $4,147 per ounce, up $30 per ounce from the start of the trading session.

—

As of the morning survey on November 11th (Vietnam time), spot gold prices on the international market stood at $4,127 per ounce. In yesterday’s trading session, global spot gold prices surged by $112 per ounce (+2.79%).

This impressive rally marked the strongest session in over a month. Economists suggest that the precious metal may have completed a two-week accumulation phase and is reigniting its historic uptrend that began mid-year.

Global gold price trends. (Source: Kitco News)

Previously, the December gold contract hit a record high of $4,374 per ounce on October 20th, before entering a deep correction, dropping to $3,901.9 per ounce on October 28th—a decline of $472 from its peak. However, yesterday’s strong session propelled gold prices back to their highest levels since late October, bolstering market sentiment.

According to experts, gold’s recovery is fueled by expectations that the U.S. Federal Reserve (Fed) will cut interest rates by 0.25 percentage points in its December meeting—a move seen as a powerful catalyst for gold prices, as lower rates reduce the opportunity cost of holding non-yielding assets.

Another factor supporting gold prices is positive signals from the U.S. Congress. On November 10th, the Senate passed a critical procedural step to advance legislation ending the prolonged government shutdown. The weeks-long government closure had stalled key economic reports, including the Consumer Price Index (CPI) and Nonfarm Payrolls (NFP)—two critical data points guiding Fed policy.

Markets currently assign a 70–80% probability to the Fed cutting rates next month. If this scenario materializes, the U.S. dollar could weaken, paving the way for gold to continue its upward trajectory in the final weeks of the year.

Analysts note that if the U.S. government officially reopens within the next 24–48 hours, gold prices might see a slight correction as risk sentiment improves. However, any delays in this process will likely trigger another wave of safe-haven gold buying.

Domestically, at the opening of the trading session, Mi Hong Gold (Ho Chi Minh City) raised both gold ring and gold bar prices to 149.2 – 150.2 million VND per tael (buy – sell), increasing the buying price by 400,000 VND per tael while keeping the selling price unchanged from yesterday.

Other gold traders have not yet adjusted their prices, maintaining them at yesterday’s closing levels. Specifically, at Bao Tin Minh Chau, gold ring prices hover around 147.5 – 150.5 million VND per tael, while PNJ and DOJI list them at 146.5 – 149.5 million VND per tael. SJC currently trades in the 145 – 147.5 million VND per tael range.

For gold bars, major brands like SJC, PNJ, and DOJI uniformly quote prices at 148.2 – 150.2 million VND per tael, while Bao Tin Minh Chau trades gold bars at 148.7 – 150.2 million VND per tael.

Today’s Gold Price (Nov 9): Surprising Developments in Gold Bullion

Compared to its historical peak of $4,380 per ounce, the precious metal has declined by approximately $380, equivalent to roughly 12 million Vietnamese dong.