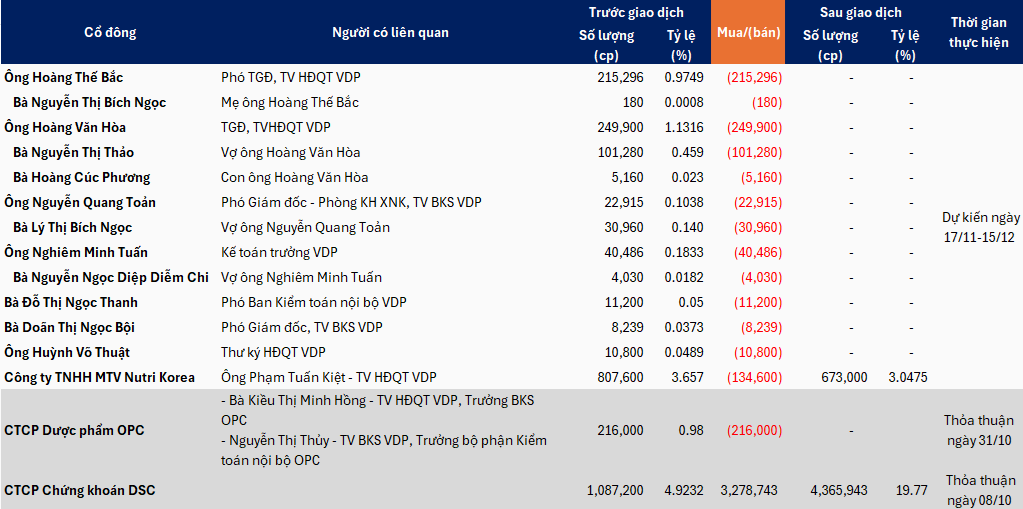

Anticipated transactions are set to be executed via order matching or negotiated deals between November 17 and December 15, aimed at restructuring investment portfolios.

Among these, Mr. Hoàng Thế Bắc, Deputy CEO and Board Member of VDP, plans to sell over 215,000 shares. His mother, Mrs. Nguyễn Thị Bích Ngọc, has also registered to sell 180 shares.

Mr. Hoàng Văn Hòa, CEO and Board Member, intends to sell nearly 250,000 shares. Simultaneously, his wife, Mrs. Nguyễn Thị Thảo, and their daughter, Hoàng Cúc Phương, aim to sell 101,280 shares and 5,160 shares, respectively.

Two other key figures and their spouses are also selling their entire holdings: Mr. Nguyễn Quang Toản, Deputy Director of Import-Export Planning and BKS Member, and his wife, Mrs. Lý Thị Bích Ngọc, plan to sell 22,915 shares and 30,960 shares, respectively. Mr. Nghiêm Minh Tuấn, Chief Accountant, and his wife, Mrs. Nguyễn Ngọc Diệp Diễm Chi, will sell 40,486 shares and 4,030 shares, respectively.

Additional individuals selling VDP shares include Mrs. Đỗ Thị Ngọc Thanh, Deputy Head of Internal Audit (11,200 shares); Mrs. Doãn Thị Ngọc Bội, Deputy Director and BKS Member (8,239 shares); and Mr. Huỳnh Võ Thuật, Board Secretary (10,800 shares).

One organization planning to divest is Nutri Korea LLC, which aims to sell 134,600 shares, reducing its holdings to 673,000 shares, unlike the individual shareholders mentioned above.

In total, 13 shareholders plan to divest during this period, selling a combined 835,046 shares, equivalent to 3.781% of VDP‘s outstanding shares.

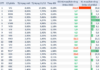

Recently, VDP shares have experienced volatility after reaching a historical peak around 53,000 VND per share. Overall, this pharmaceutical stock has maintained a positive upward trend since the beginning of the year, rising over 37% to 46,600 VND per share (closing price on November 11).

| VDP Shares Fluctuate Near Historical Peak |

Not long ago, VDP recorded two notable share transactions. Most recently, OPC Pharmaceuticals sold all 216,000 shares via a negotiated deal on October 31. Conversely, DSC Securities purchased nearly 3.3 million shares on October 8, becoming a major shareholder with a 19.77% stake in VDP.

|

List of Shareholders and Related Individuals Selling VDP Shares

Source: VietstockFinance

|

In the first nine months of 2025, VDP generated over 794 billion VND in net revenue, a 24% increase year-on-year. However, a decline in gross profit margin from 29.1% to 22.9% resulted in a nearly 3% drop in gross profit to over 182 billion VND.

Additionally, increased selling expenses and losses from other activities further pressured profitability. As a result, the company’s net profit fell by 9% year-on-year to over 44 billion VND.

– 11:18 12/11/2025

FTS Fails to Sell Nearly 1.2 Million MSH Shares

FPT Securities Corporation (HOSE: FTS) registered to sell nearly 1.2 million shares of MSH from August 18 to September 16. However, due to unfavorable market prices, FTS was unable to execute the sale, retaining its full holding of approximately 13.2 million shares, equivalent to 11.728% of MSH’s capital.