On the morning of November 11, FLC Group held its second extraordinary shareholders’ meeting at The West Building, 36th Floor, 265 Cau Giay Street, Cau Giay District, Hanoi.

One of the most pressing concerns among shareholders was the timeline for the resumption of FLC shares trading. CEO Bui Hai Huyen announced that FLC shares are expected to resume trading on UPCOM in Q1/2026. Alongside expanding and restructuring its ecosystem, FLC is actively fulfilling its financial obligations, aiming to complete all tax liabilities by early Q2/2026.

In preparation for the trading resumption, FLC has collaborated with independent auditing firms and provided financial records for preliminary assessments. The meeting approved the Board of Directors’ mandate to select an auditing firm for reviewing, auditing, and issuing outstanding financial reports.

In 2025, FLC plans to release financial reports from 2021-2024, with the 2025 report scheduled for Q1/2026. Once finalized, the documents will be submitted to the State Securities Commission and the Stock Exchange for trading resumption procedures.

Regarding the group’s restructuring, FLC’s leadership has directed a comprehensive review of its real estate and financial investment portfolio to reassess project statuses and determine recovery or continuation strategies.

Several previously deemed unrecoverable loans, receivables, and investment partnerships now show high recovery potential or viable resolution plans.

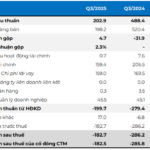

As of December 31, 2022, FLC has recovered VND 256 billion in debt and reinstated accrued interest; offset VND 1,295 billion in debt or secured payment guarantees; and secured partner acknowledgments for VND 2,025 billion in debt with extended repayment terms.

Additionally, investments in affiliated companies, notably Tre Viet Aviation Joint Stock Company (Bamboo Airways), have resulted in the reinstatement of VND 89 billion in provisioned losses, as per the audited 2024 financial report.

Based on these developments, the Board of Directors proposed a comprehensive resolution to address outstanding business, project investment, and financial investment issues. The proposal includes assessing the recoverability of loans, receivables, and joint ventures; formulating recovery plans; and re-evaluating equity investments in subsidiaries and affiliates for optimization or divestment.

The plan also involves adjusting accounting entries, provisioning or reinstating reserves, and managing new investments or debt-to-equity conversions as per the Board’s decisions post-review. The Board is authorized to execute related transactions and contracts, with liability exemptions unless intentional harm to the company is proven. This approach ensures transparent and effective resolution, laying the groundwork for FLC’s long-term recovery and growth.

Between 2020-2023, FLC Group faced significant challenges, including the COVID-19 pandemic, tightened real estate credit policies, high interest rates, and global economic downturn impacts. These factors adversely affected the group’s operations and strained the financial health of its subsidiaries and business partners.

FLC Resurges Post-Turbulence: Rare Project Surges Ahead, Nearly a Year Ahead of Schedule

Hausman Premium Residences is ahead of schedule by nearly a year, with construction progressing at an impressive pace. The project is on track for a June 2026 handover, delivering luxury living well ahead of its original timeline.