Illustrative image. (Source: TTXVN)

|

Land pricing remains a hot topic of public interest, especially after the Departments of Agriculture and Environment in various provinces and cities proposed draft regulations for establishing new land price lists, effective from January 1, 2026. These new prices are significantly higher than the current rates.

As a professional association and research institution in the real estate sector, the Vietnam Real Estate Market Research and Evaluation Institute (VARS IRE) emphasizes that land price lists are a crucial state tool for land management, budget collection, financial obligation calculations, and legal frameworks for determining compensation and resettlement support.

Therefore, the development of land price lists must be conducted cautiously, scientifically, and with a reasonable timeline to accurately reflect market values while avoiding disruptions and financial burdens on citizens and businesses.

According to VARS IRE, the introduction of new land price lists from January 1, 2026, is an essential step in state management, promoting market transparency and narrowing the gap between state-determined land prices and market prices. However, many argue that the “shocking” increases in several areas pose significant risks for businesses, individuals, and banking credit activities.

VARS IRE’s analysis highlights that individuals and households will be among the most affected. Those undergoing land-related procedures, such as land-use purpose changes, land-use right certificate issuance, or compensation for land clearance, will face the most significant impacts, as their financial obligations are directly calculated based on the new price list.

Additionally, costs for changing land-use purposes, issuing land-use right certificates, and purchasing real estate may surge, affecting middle- and low-income groups. There is also a risk of complaints and disputes in areas undergoing compensation and land clearance if the price adjustments far exceed approved rates.

Illustrative image. (Source: TTXVN)

|

Real estate businesses are also significantly impacted. The rise in land prices increases compensation costs and land-use fees, which constitute the largest portion of project development costs and total investment. For ongoing projects, businesses face difficult decisions about whether to continue or halt development, as increased land-use fees may push total investment beyond their financial capabilities.

For yet-to-be-launched projects, businesses can better plan budgets and compensation strategies. However, whether the market will accept the necessary price increases remains uncertain. Worse still, some projects may incur losses or delay handing over properties to customers, leading to potential disputes.

Furthermore, VARS IRE notes that the 2026 land price list, with its proposed increases, will impact banking and housing credit activities. Asset valuation adjustments may lead banks to tighten lending ratios to manage bad debt risks. Higher housing prices and ownership costs could reduce purchasing power, particularly among first-time homebuyers. If land prices rise faster than real value, the gap between valuation and market prices could compromise credit quality.

Another impact highlighted by VARS IRE is on the market. On the supply side, increased land-use costs, rental fees, and compensation expenses will raise development costs, pushing project values higher. The supply structure will remain imbalanced, favoring high-end and large-value segments as financially robust companies can expedite development and launch products faster. Meanwhile, small and medium-sized enterprises may struggle to initiate new projects, potentially stalling commercial housing supply, especially in suburban areas of major cities.

On the demand side, anticipated price increases due to higher input costs will reduce real purchasing power, particularly among those seeking housing for actual use. This may lead to a cautious wait-and-see approach, temporarily dampening market activity.

Notably, prices are expected to rise. VARS IRE predicts that developers may adjust selling prices upward and focus on high-end products to maintain profit margins amid scarce land resources. Consequently, the overall market price level will continue to rise, pressuring citizens’ access to housing.

In cases where developers can save costs by proactively planning budgets and expediting compensation and land clearance, the overall impact may be less negative if administrative cost savings, time efficiency, and legal risk mitigation offset the increased financial obligations related to land.

For local governments, land price adjustments will boost local budget revenues through taxes, fees, and land-use payments. These additional funds can be reinvested in infrastructure projects, urban renewal, and regional connectivity improvements, enhancing land value and driving local socio-economic development.

However, the volume of land price update applications will surge, potentially causing administrative backlogs, especially given the two-tier local government model’s operational challenges and staffing shortages. Another concern is reduced investment attractiveness due to higher costs, particularly in potential but underdeveloped areas.

VARS IRE emphasizes that all price regulations, including land price lists, are relative. (Illustrative image. Source: TTXVN)

|

Based on these analyses, VARS IRE stresses that all price regulations, including land price lists, are relative. In the long term, real estate prices are determined by supply and demand. It is unrealistic to expect a single land price list to satisfy all stakeholders, given their diverse purposes, interests, and expectations.

Therefore, VARS IRE asserts that land price lists are meaningful only when applied to specific purposes, such as compensation and land clearance. Using them for other purposes like land-use fee calculations, auctions, or taxation would reduce their practicality and require flexible adjustments to balance the interests of the state, citizens, and businesses.

Thus, VARS IRE proposes defining the role of land price lists as state management and taxation tools, not market supply and demand regulators. Land price policy stability should aim for long-term transparency, fairness, and sustainability.

Additionally, responsibilities between central and local governments should be clearly delineated. The state should establish unified technical standards and valuation methods, while local governments should handle implementation and practical adjustments.

Flexibility in land price management should be increased by allowing local governments to set adjustable coefficients based on area, time, land-use type, and socio-economic development goals. Different land-use fees, taxes, and charges should be applied depending on purpose (residential, commercial, industrial, agricultural) and infrastructure development levels.

Crucially, stability and a reasonable adjustment timeline are essential. A suitable adjustment roadmap should be developed to avoid market shocks and sudden impacts on businesses and citizens, especially as many localities are still refining their two-tier urban government models.

Lastly, enhanced communication and implementation guidance are needed. Educating citizens, businesses, and real estate agents about the nature and role of land price lists will prevent price manipulation and misguided market expectations.

Thu Hằng

– 17:28 09/11/2025

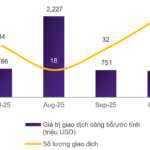

Vietnam M&A Market in October 2025: Real Estate and Industrial Manufacturing Lead in Deal Value

In October 2025, Vietnam’s M&A market witnessed 52 deals with a combined estimated value of nearly $720.5 million. Real estate, energy, industrial manufacturing, and finance emerged as the leading sectors driving market activity.

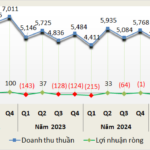

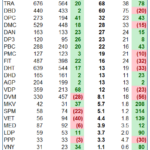

Cement Industry Profits Surge in Q3, Anticipating Strong Year-End Growth

Third-quarter revenue for 17 listed cement companies rose 6%, with industry-wide profits surpassing 70 billion VND, a stark reversal from the 60 billion VND loss incurred in the same period last year. This marks the second consecutive profitable quarter. Fueled by increased public investment disbursement and a gradually recovering real estate market, the sector is poised for accelerated growth in the final months of the year.

Discover the Expansive Land Beyond Hoan Kiem District: Sun Group’s 15 Trillion VND Investment in the Hotspot of Me Linh

The involvement of a major investor, coupled with the decisive intervention of local authorities, promises a swiftly developed, world-class urban area. This new development will seamlessly connect to the heart of the capital via the Ring Road 4 and the Hong Ha Bridge.