HSV has recently approved a plan to issue 15 million shares privately at a price of 10,000 VND per share, scheduled for execution from 2025 to Q1/2026. The shares will be subject to a one-year transfer restriction. If successful, HSV‘s chartered capital will increase to 307.5 billion VND, and the company expects to raise 150 billion VND.

On the UPCoM market, HSV‘s share price remains stagnant at 4,200 VND per share, 58% lower than the planned offering price of 10,000 VND. Over the past month, the stock has declined by 9% but still shows a nearly 11% increase year-to-date. Average trading volume is approximately 116,000 shares per session. For many years, HSV has traded in the range of 3,000-5,000 VND, far below its peak of nearly 30,000 VND per share reached in 2021 when it was listed.

| HSV’s Share Price Movement Over the Past Year |

The raised capital will primarily fund investments in watercraft.

The issued capital will be allocated as follows: 67 billion VND for building two new inland watercraft fleets, 45 billion VND for purchasing two used tugboats and eight barges, and 38 billion VND for repaying bank loans. The total capital requirement for these three projects is nearly 175 billion VND, with the remaining 25 billion VND to be covered by existing capital.

The entire portion of self-funded capital will be dedicated to developing the inland waterway transportation sector, a new business line added by the company in 2025. The 38 billion VND allocated for debt repayment will be used to restructure loans at Vietinbank, where the outstanding principal as of June 30, 2025, exceeds 263.5 billion VND.

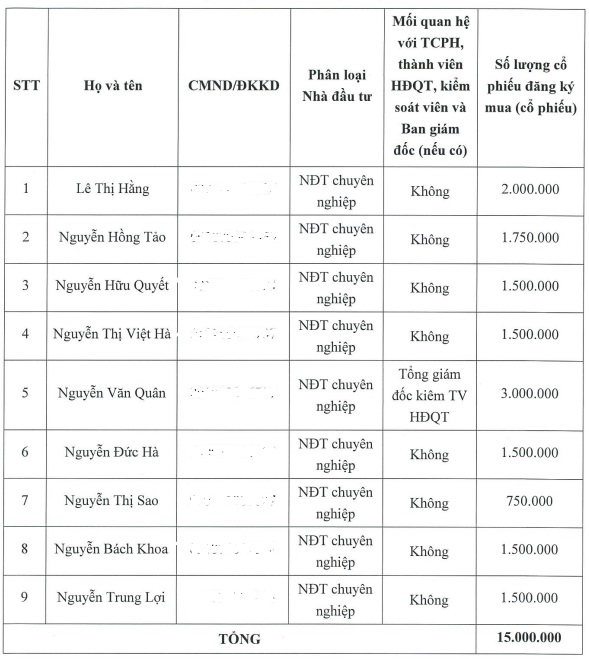

Nine investors have registered to participate in the issuance. Notably, CEO and Board Member Nguyễn Văn Quân plans to purchase the largest amount, with 3 million shares; followed by two individual investors, Ms. Lê Thị Hằng (2 million shares) and Mr. Nguyễn Hồng Tảo (1.75 million shares).

List of investors participating in the issuance, updated as of the Board Resolution dated November 4, 2025

|

Alongside the capital raise, on October 24, the company approved the purchase of an investment property at Tower T18, Vinhomes Times City Urban Area (Mai Động Ward, Hanoi), with a total value of 18 billion VND.

Q3 Profit Rises 70%, Significant Increase in Deposits

HSV was established in 2013 as Hanoi Steel Corporation, specializing in wholesale scrap and industrial chemicals. After multiple capital increases from the initial 10 billion VND, the company now has a chartered capital of over 157 billion VND and has been trading on UPCoM since 2021.

A significant milestone at the 2025 Annual General Meeting was the addition of two new business lines: inland waterway freight transportation and wholesale of fabrics, apparel, and footwear. In late Q3, the company recorded an investment in H2 Vietnam Transportation LLC worth 40 billion VND, equivalent to 40% of its chartered capital, a company also operating in inland waterway transportation.

In Q3/2025, HSV reported a net profit of nearly 891 million VND, a slight 2% decrease year-on-year. For the first nine months of the year, the company achieved a net profit of nearly 4 billion VND, up 70%. This result stems from revenue of 1,136 billion VND, a 68% increase, and financial income of over 5 billion VND, double that of the same period last year.

| HSV’s Quarterly Business Results from 2020-2025 |

By the end of September, bank deposits surged to over 144 billion VND, a 62% increase since the beginning of the year. Inventory reached nearly 98 billion VND, up 58%. Total outstanding loans increased to over 362 billion VND, a 58% rise, with 75% borrowed from Vietinbank Thang Long Branch.

– 13:12 10/11/2025

Vingroup Merges Two Subsidiaries

Vingroup’s Board of Directors has approved the merger of VinApp into VinSmart Future, strategically optimizing the operations of its technology companies within the conglomerate.

Is the Largest Stock Offering in History on the Horizon?

Vingroup, one of Vietnam’s leading conglomerates, is seeking shareholder approval for a groundbreaking issuance of 3.85 billion shares—the largest in the country’s stock market history. If successful, this move will double the company’s chartered capital to over 77 trillion VND, marking a significant milestone in its growth trajectory.

SSI Securities Reduces Number of Shares Offered to Shareholders

SSI Securities Corporation has revised its planned offering of shares to existing shareholders, reducing the number from 415.58 million units to 415.18 million units.