In just under three weeks, Vietnam’s stock market has lost over 200 points, with the VN-Index dropping from 1,790 to nearly 1,580. Many investors’ portfolios have been significantly eroded, as numerous stocks have plummeted by 20-30%, and even up to 40%. Trading volume has also shrunk dramatically, falling from 40-50 trillion VND per session to around 20 trillion VND.

Identifying Causes, Seizing Opportunities

According to MBS Securities, average liquidity in the first week of November decreased by 22% compared to the previous month, indicating weakening investor sentiment. Foreign investors have net sold for 16 consecutive weeks, with total net sales exceeding 131 trillion VND since the beginning of the year—a record high.

However, Tran Khanh Hien, Director of Analysis at MBS Securities, views this as a normal correction after the market’s rapid rise from April’s lows. “The VN-Index falling below 1,600 wasn’t unexpected, as the initial bottom-fishing attempts were ineffective. The market is reaccumulating and needs time to consolidate,” she explained.

Hien remains optimistic about Vietnam’s macroeconomic fundamentals, highlighting increased public investment and monetary easing as catalysts for recovery. “Over 400 trillion VND in public investment remains undisbursed. Once activated, infrastructure, transportation, and energy projects will boost the stock market by year-end,” she predicted.

Liquidity weakens after the boom in Q2 and Q3 2025. Photo: LAM GIANG

Nguyen Hoai Thu, CEO of VinaCapital’s Investment Division, emphasized that the market remains driven by a few large-cap stocks, while many listed companies with 10-58% profit growth are undervalued. “This suggests ample opportunities for 2026. Corporate profits are expected to rise 23% this year, but the market needs time to absorb this,” she noted.

Thu attributed prolonged foreign net selling to currency pressures, particularly for investors from South Korea, Taiwan, and Thailand, whose currencies have depreciated against the USD. However, she expects foreign capital to return once Vietnam is upgraded to emerging market status, potentially attracting $5-6 billion from passive and active funds.

A VPS Securities executive cited large IPOs by major securities firms as a factor draining liquidity. Additionally, regulatory changes in banking and securities, coupled with rising deposit rates, have shifted idle funds back to savings—a safer option amid volatility. “Some market participants are awaiting clearer policy signals from the National Assembly,” they added.

Testing Investor Sentiment

Beyond liquidity concerns, market sentiment is also being tested. Huynh Anh Tuan, CEO of Vikkibank Securities, noted that recent market behavior has deviated from traditional patterns, catching retail investors off guard. Many expected an uptrend but faced sharp declines during an “information vacuum.” The VN-Index lost 10-15% in three weeks, while individual stocks dropped 30-50%. “Weakened sentiment has forced many to sell or face margin calls,” Tuan said.

Recent mega-IPOs have absorbed significant liquidity, while skepticism about market recovery has kept many investors sidelined. However, Tuan believes the sharp decline has pushed the market into oversold territory, increasing the likelihood of a short-term rebound around 1,600 points.

Dragon Capital analysts offered a different perspective, noting that margin debt has reached historic highs, amplifying corrections during short-term downturns. However, systemic risks remain manageable. They advised patience and caution, avoiding rushed stock purchases until risks clarify.

Normal Consolidation Before Recovery

Technically, the market is nearing a bottoming phase, according to SSI’s Nghiem Dinh Hinh. While recent declines have caused significant losses, many blue-chip stocks are attractively valued for averaging down. “Investors without margin exposure and holding cash can gradually deploy funds and sell on short-term rebounds to reduce losses. Now is not the time for panic selling,” Hinh advised.

A VPS expert likened the current phase to 2021’s consolidation period. Post-correction accumulation is normal before a sustained recovery. “Many stocks have fallen 25% from peaks, limiting further downside while increasing rebound potential. Institutions typically buy during pessimism and sell during retail euphoria. Buying in gloom and selling in boom remains effective,” they stressed. Investors should focus on undervalued securities and real estate stocks for optimal returns.

Dragon Capital expects the market to trade between 1,427 and 1,788 points through year-end, depending on policy and liquidity developments. They recommend diversifying portfolios to reduce concentration risk, favoring fundamentally strong companies trading at low valuations with clear short-term catalysts.

“Current risks are technical and localized, not systemic. Average leverage has cooled, investor cash balances are rising, and many brokerages have increased lending limits after capital hikes. These factors support market stability,” they concluded.

Liquidity in Wait-and-See Mode

The November 10 session closed in the red, with the VN-Index down 18.56 points (1.16%) to 1,580.54. The VN30 lost 20.53 points, closing at 1,804.18. Liquidity exceeded 23.5 trillion VND, remaining high but lower than the previous week, reflecting widespread caution.

Funds exited large-caps and real estate stocks, sectors that led the market in September and October. Analysts believe liquidity isn’t leaving but is “compressing,” awaiting re-entry opportunities as the VN-Index tests the 1,575 support level. Funds are temporarily shifting to steel, consumer, and retail sectors—defensive plays during corrections.

Stock Market Slump Drags Down PYN Elite Fund’s Performance

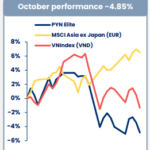

The PYN Elite Fund’s investment performance continued its downward trajectory in October, experiencing a more significant decline compared to the VN-Index.

What’s Happening: Fish Sauce and Instant Noodle Businesses Outpace Hòa Phát, FPT, Vinamilk, and Major Banks

The company’s market capitalization has skyrocketed recently, surpassing the 200 trillion VND mark for the first time since its initial public offering.