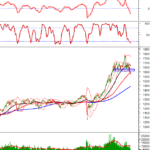

Closing the trading session on November 10, the VN-Index dropped by over 18 points to 1,580 points, while the VN30 index fell sharply by more than 20 points, retreating close to the 1,800 mark. Similarly, the Hanoi Stock Exchange’s HNX-Index also declined by nearly 2 points to 258 points.

Notably, the downturn occurred during the final 15 minutes of the closing order matching period, causing widespread anxiety among investors. Market liquidity plummeted significantly, reaching just over 21.3 trillion VND.

A striking development was the sudden reversal of several stocks, which sharply declined toward the end of the session. Earlier in the afternoon, the market had shown a robust recovery, with the VN-Index climbing nearly 10 points to 1,609 points. Many securities and real estate stocks surged by 3-4% but were swiftly sold off afterward.

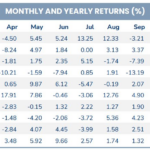

Across various forums and investor groups, many reported holding losing positions in securities, real estate, and banking stocks after purchasing them near the 1,700-point level last month. By now, numerous investment accounts have incurred substantial losses of 20-30%.

Stocks were heavily sold off toward the end of the session

Why are stocks frequently “ambushed” toward the end of the session?

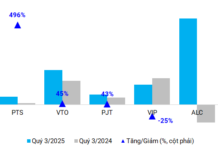

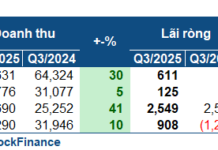

In an interview with the Labor Newspaper, Mr. Bùi Văn Huy, Vice Chairman of the Board of Directors and Director of the Investment Research Division at FIDT Joint Stock Company, analyzed that the stock market in the second and third quarters recorded impressive growth, particularly in large-cap groups led by banking, securities, and real estate sectors.

This growth attracted a significant influx of individual investors. However, the robust growth itself created adjustment pressures.

Information has already been priced in, reflecting expectations of market upgrades, potential Fed rate cuts, and positive third-quarter reports. Once these details are officially announced, they no longer carry enough weight to drive prices higher, instead triggering profit-taking by smart money.

“The sharp and unexpected fluctuations toward the end of the trading session have exploited the weaknesses of individual investors, who exhibit high FOMO (fear of missing out) behavior. When the market shows signs of profit-taking and prices drop rapidly near the close, fear is triggered. This prompts hasty selling in line with herd behavior to avoid losses, creating a selling spiral that intensifies the downward trend compared to intraday trading, especially toward the end of the session,” Mr. Bùi Văn Huy explained.

Financial expert Phan Dũng Khánh also noted that typically after 2 PM, the VN-Index begins to reverse its course, declining amid persistent net selling by foreign investors and low liquidity, which exerts psychological pressure on the market.

Consequently, individual investors often follow the crowd, selling or buying aggressively, causing the market to shift directions rapidly. In reality, while many sessions have been “ambushed,” there have also been numerous sessions where the market surged strongly at the close—contrary to the morning trend.

According to experts, the market’s high margin ratios and thin account buffers, coupled with prolonged periods of “green on the outside, red on the inside,” have led to sharp sell-offs toward the end of sessions.

Nonetheless, in all scenarios, investors should avoid panic and maintain confidence in the market’s medium- to long-term prospects.

VNDirect Forecasts VN-Index Correction Before Surging to 1,720 Points by Early 2026

While not yet inexpensive, current market valuations are underpinned by a robust macroeconomic foundation, the prospect of market upgrades, and sustained optimism regarding the earnings potential of listed companies.