|

Source: VietstockFinance

|

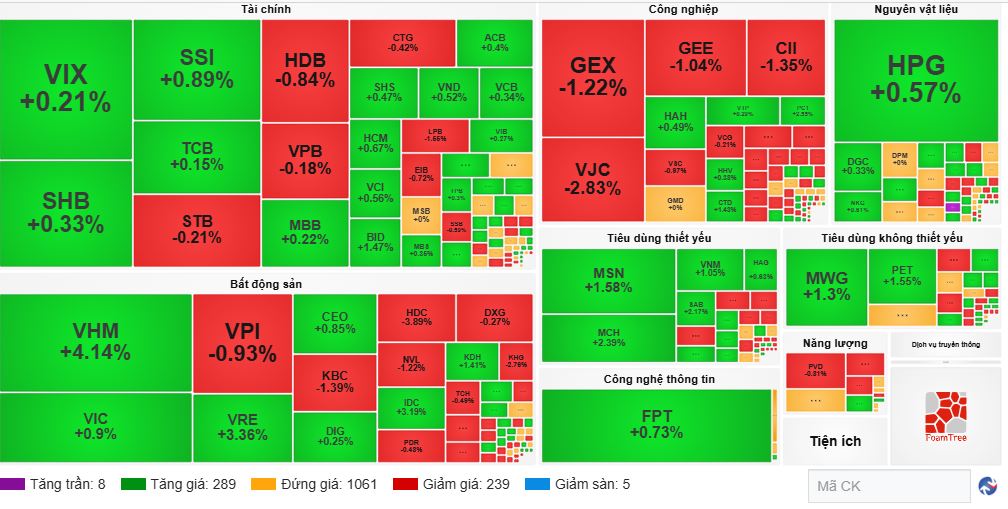

Large-cap stocks like the Vingroup family (VHM, VIC, VRE, VPL), MSN, VNM, and financial stocks such as BID, CTG, SSI, SHB were the most positive contributors to the VN-Index. Conversely, HVN and LPB exerted significant downward pressure.

The financial sector stood out today, with notable gains in VIX (up over 4%), SSI (nearly 4%), SHB (over 3%), and STB, CTG, SHS, VCI, among others. However, LPB, TCX, VIB, SSB, and a few others saw slight declines.

A similar trend was observed in the real estate sector, where VIC, VHM, CEO, VRE, DXG, DIG rose by 2-3%. In contrast, VPI, KBC, HDC, NVL, KHG, NLG experienced losses.

Despite the market closing in the green, sector-wise performance was mixed, with half of the sectors gaining and the other half declining. The equipment and healthcare sectors (including TNH, TTD, JVC, DP1, BBT) and telecommunications services (VGI, FOX, SGT, ICT) were the hardest hit today.

Insurance stocks had a strong session, with BVH, PVI, PRE, BMI, ABI all posting gains. Since early November, these stocks have outperformed, contrasting with the VN-Index‘s decline.

However, the market’s green exterior masked underlying weakness. Liquidity was modest at nearly VND 22 trillion, lower than recent periods. Foreign investors net sold a modest VND 80 billion. The top net buys included VIC, HPG, and VNM.

| Foreign Net Buying/Selling Trends |

Morning Session: Polarization Resumes

The morning session ended with major indices in the green, as the VN-Index rose nearly 6 points to 1,586.47. The HNX-Index added 0.3 points to 258.5. However, red was gaining ground, with over 300 decliners versus 280 advancers.

Real estate and financial stocks were polarized. Still, key stocks supported the indices. In real estate, VHM, VIC, VRE were pillars. In finance, VIX, SSI, TCB, VPB, ACB maintained gains.

Essential consumer stocks remained positive, with MSN, VNM, MCH, SAB up 1-3%.

Fertilizer stocks also performed well, with DPM, DCM, BFC, LAS rising. Plastic stocks like NTP, VNP, AAA gained, with VNP hitting its ceiling.

Utility stocks (electricity, water, gas) such as GAS, REE, DNH, PGV, BWE showed strength.

Morning liquidity exceeded VND 9 trillion. Investors remained cautious. Foreigners net sold a modest VND 200 billion, reducing recent selling pressure.

| Foreign Net Selling Eases Recently |

10:40 AM: Key Stocks Sustain Support

By 10:20 AM, buyers dominated, though red spread across sectors, notably real estate and industrials. The VN-Index maintained a nearly 7-point gain.

Key stocks like VHM, VIC, VRE, HPG, FPT, MSN, MCH held green since the open. The VN30 group remained positive.

Industrial stocks fell, with GEX, GEE, VJC, CII, VSC down 0.4-2.5%. Energy stocks like PVD, PVS also declined.

VHM, up over 4%, was the main driver, contributing over 3 points to the VN-Index by 10:40 AM.

Source: VietstockFinance

|

Opening: Positive Start, Green Dominates

The November 11 session opened broadly positive, with 250 advancers versus fewer than 100 decliners. Green prevailed across sectors, lifting the VN-Index over 5 points.

Large-cap stocks were upbeat early. The VN30-Index rose over 10 points, with 24 gainers, 5 decliners, and 1 flat. VHM, VIC, HPG, BID, MWG led market gains.

Brokerage stocks led early gains, with TCX, SSI, VIX, VND, VCI, MBS, SHS rising. However, PHS bucked the trend, falling sharply at the open.

Telecom services lagged, with VGI, FOX, SGT dragging the sector down. CTR, ICT, ABR, ABC rose but couldn’t offset losses.

Despite positive indices, trading volume was 20% below yesterday’s level, reflecting cautious sentiment.

– 15:50 11/11/2025

Vietstock Daily 12/11/2025: Market Pulls Back from Decline

The VN-Index has rebounded, yet trading volume remains below its 20-day average, indicating lingering investor caution following the recent sharp decline. The Stochastic Oscillator continues to weaken in oversold territory. Should buy signals reemerge in upcoming sessions, the recovery outlook may strengthen.

Market Pressures Mount: What Lies Ahead for Stocks Next Week?

Last week, the VN-Index fell below the 1,600-point mark amid mounting pressure from a strengthening USD/VND exchange rate and heavy net selling by foreign investors. Despite positive macroeconomic data and third-quarter corporate earnings, analysts predict that the stock market may shift toward a consolidation phase next week, testing the support range of 1,550–1,580 points in the short term.

Capital Inflows Surge into Insurance and Oil & Gas Sectors

Liquidity diverged across two listed exchanges during the week of November 3rd – 7th. Cash flow exhibited polarization across various sectors. Nonetheless, certain sectors demonstrated robust capital inflows.

Vietstock Weekly 10-14/11/2025: Seeking New Foundations?

The VN-Index extended its losing streak into the fourth consecutive week, underscoring a pronounced weakening trend in the market. Trading volumes remained below the 20-week average, indicating persistent caution among investors. The index is now retreating to test the Middle Band of the Bollinger Bands, as both the Stochastic Oscillator and MACD continue to weaken following earlier sell signals.