Ministry of Finance Announces Pilot Period for Short Selling and Day Trading

|

Perfecting Legal and Technical Frameworks for Market Upgrade

The Ministry of Finance has officially issued Decision No. 3761/QĐ-BTC dated November 6, 2025, regarding the implementation plan for Decision No. 2014/QĐ-TTg, which approves the project to upgrade Vietnam’s stock market. This marks the next step in concretizing the government’s directives, aiming to elevate Vietnam to an emerging market status by international standards during the 2025-2030 period.

The plan’s focus is on accelerating the completion of legal mechanisms and market infrastructure, with the State Securities Commission (SSC) serving as the focal point for monitoring, urging, and synthesizing implementation progress.

The SSC is tasked with closely coordinating with units under the Ministry, stock exchanges, and the Vietnam Securities Depository and Clearing Corporation (VSDC) to promptly address challenges and investor recommendations, particularly those from foreign investors.

The plan also outlines a series of short-term tasks to meet international upgrade criteria, including gradually eliminating the requirement for advance payment for securities purchases during the pre-Central Counterparty (CCP) mechanism phase. This involves refining non-collateralized trading mechanisms for foreign investors and enhancing transparency regarding foreign ownership ratios to ensure equal access.

Additionally, the plan mandates upgrading the information system between custodian banks and securities companies to support investor trading activities (STP), implementing the Omnibus Trading Account (OTA) mechanism in line with international practices, and strengthening IT infrastructure to handle increasing trading volumes.

The SSC will collaborate with the State Bank of Vietnam to review and propose amendments to regulations related to banking services for foreign investors, addressing discrepancies in custody, settlement, and transaction utilities. These factors directly impact the upgrade assessments by organizations like FTSE Russell and MSCI.

Comprehensive Upgrade for Sustainable Capital Market Development

To ensure the upgrade goals extend beyond technical criteria, the plan sets forth long-term tasks with a broader scope, encompassing market structure, legal frameworks, and supervisory capabilities.

Initially, the Ministry of Finance has tasked the Foreign Investment Agency with reviewing the list of restricted industries for foreign access, studying the expansion or removal of unnecessary foreign ownership limits, in line with improving the investment environment. This is a critical barrier in the upgrade assessment.

Regarding infrastructure, VSDC will establish a subsidiary to implement the CCP mechanism—a key condition for applying T+0 or T+2 non-collateralized settlement, bringing the market closer to emerging market standards.

The plan also emphasizes the controlled implementation of securities lending and borrowing mechanisms and short selling, alongside modernizing trading systems through new technologies.

|

Short selling is the practice of selling securities that the seller does not own at the time of the transaction. In short selling, investors borrow securities from a broker’s account and sell them, anticipating a price drop. Later, they repurchase the securities at a lower price to profit. Essentially, short selling involves borrowing shares to sell at a high price, then buying them back at a lower price to make a profit. |

From 2026 to 2030 and beyond, the Vietnam Stock Exchange (VNX) will continue to modernize trading and settlement systems, enhance system capacity to handle large trading volumes, and gradually integrate new technologies into market operations.

Additionally, there is a mandate to review and amend legal provisions related to financial supervision and security to ensure system safety, enhance transparency through audit quality control, adopt IFRS for listed companies, and elevate corporate governance standards in line with OECD practices. The Accounting and Auditing Supervisory Department will lead this task, with coordination from the SSC, VNX, subsidiaries, and the Vietnam Association of Certified Public Accountants.

The plan also emphasizes expanding the product base by developing new derivatives, green bonds, depository certificates, and benchmark indices, while diversifying investors by encouraging individual participation through investment funds and implementing the Investor Restructuring Project.

Beyond intra-sector efforts, the Ministry of Finance stresses inter-sector collaboration with the State Bank of Vietnam and the Ministry of Public Security to monitor capital flows, ensure financial security, and maintain macroeconomic stability. This is a cornerstone for sustaining market robustness during the upgrade phase.

The decision also outlines funding sources for implementation, including the state budget, socialized resources, and other lawful sources.

– 21:15 11/11/2025

Revitalizing the Stock Market: The Urge for Fresh Listings and New Capital

Following FTSE Russell’s upgrade of Vietnam from frontier to secondary emerging market status, the immediate priority is to enhance both the quantity and quality of securities listed on the Vietnamese stock market. This strategic move will alleviate capital dependency on banks and significantly contribute to achieving the ambitious double-digit growth targets set for the 2026-2030 economic period.

Top Global Funds with Trillions in Assets Eye Vietnamese Stock Market Post-Upgrade

Following the announcement of Vietnam’s market upgrade, there has been a significant surge in interest from both passive and active fund investors who previously had not focused on the country. Many are now actively seeking to explore opportunities within the Vietnamese market.

SSI Research Maintains 1,800-Point Target for VN-Index in 2026

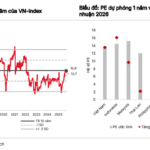

Despite the significant price surge in 2025, the VN-Index is currently trading at a forward P/E of 13.9x for 2025 and 12.0x for 2026, below its 10-year average of 14.0x and the 15-16x thresholds seen during previous market exuberance phases. SSI Research maintains its 2026 target for the VN-Index at 1,800 points.

International Media: Foreign Capital Set to Surge into Vietnam

According to Reuters, upgrading Vietnam’s stock market status will eliminate numerous technical barriers, which have previously prevented passive funds from investing in domestically listed stocks.