The demand for profitability and professional personal asset management in Vietnam is rapidly increasing. 88% of individual investors expect returns above 7% per year (TVAM 2025), while current investment channels primarily revolve around traditional options like savings accounts, gold, and real estate, lacking diversification and professional management. McKinsey highlights that only 20% of total personal financial assets in Vietnam are professionally managed, indicating a market potential five times larger. A significant pool of assets awaits exploration, optimization, and structured management.

VIB Privilege Banking is designed to address this gap by creating a standardized and personalized Wealth Management ecosystem tailored to each financial life stage.

Asset Optimization Across Life Stages: VIB’s 360-Degree Strategy

At the recent “360° Investment – Optimizing Assets, Seizing Opportunities” seminar, VIB experts shared a comprehensive asset management roadmap based on three pillars: optimal capital allocation, proactive risk management, and flexible cash flow maintenance. At each stage, selecting the right products and strategies ensures asset growth, protection, and alignment with specific financial goals.

Ages 25-45: Building a Strong Financial Foundation

This stage sees rapid income growth but also expanded spending at milestones like marriage, childbirth, and home purchases, often disrupting savings. VIB experts recommend three pillars for disciplined financial habits:

– Smart liquidity with the Super Interest Account, offering up to 4.3% annual interest while keeping funds accessible for wealth-building opportunities.

– Efficient investing by combining term deposits (guaranteed attractive rates) with a flexible, rigorously vetted investment portfolio. The dedicated PRM team acts as a partner throughout the wealth-building journey.

– Protective barriers: Investment-linked life insurance offers a smart solution, safeguarding against unforeseen events while effectively growing assets.

Ages 45-60: Prime Time for Wealth Accumulation

Income peaks during this phase, but larger financial demands arise simultaneously (significant investments, overseas education, healthcare, retirement planning). The focus should be on safe, sustainable wealth growth through three pillars:

– Portfolio restructuring: Reduce high-risk, illiquid investments and increase stable return products like flexible-term periodic investments.

– Currency risk hedging for international education, relocation, or investments: VIB’s hedging solutions save $700-$1,200 annually on $200,000 transfers with 5% exchange rate fluctuations.

– Enhancing lifestyle and experiences: The VIB Debit Signature and VIB Travel Élite cards offer global perks, especially for travel, golf, healthcare, and unlimited airport lounge access. Exclusive benefits are available at over 300 Marriott hotels and resorts worldwide.

Ages 60+: Preserving Wealth

At 60, priorities shift from high returns to security and convenience. Asset management services at this stage are designed around three core principles: Safety – Flexibility – Legacy.

For safety, stable return products like the Super Interest Account, bank bonds, and retirement funds are prioritized. Funds remain secure, earn steady interest, and are easily managed via the app.

Flexibility is ensured through short-term deposits and adaptable interest payouts, allowing retirees to maintain cash flow control for their lifestyle needs.

For meaningful legacy planning, life insurance remains a key tool for transparent, effective wealth transfer to the next generation, providing peace of mind.

Unlimited Privileges

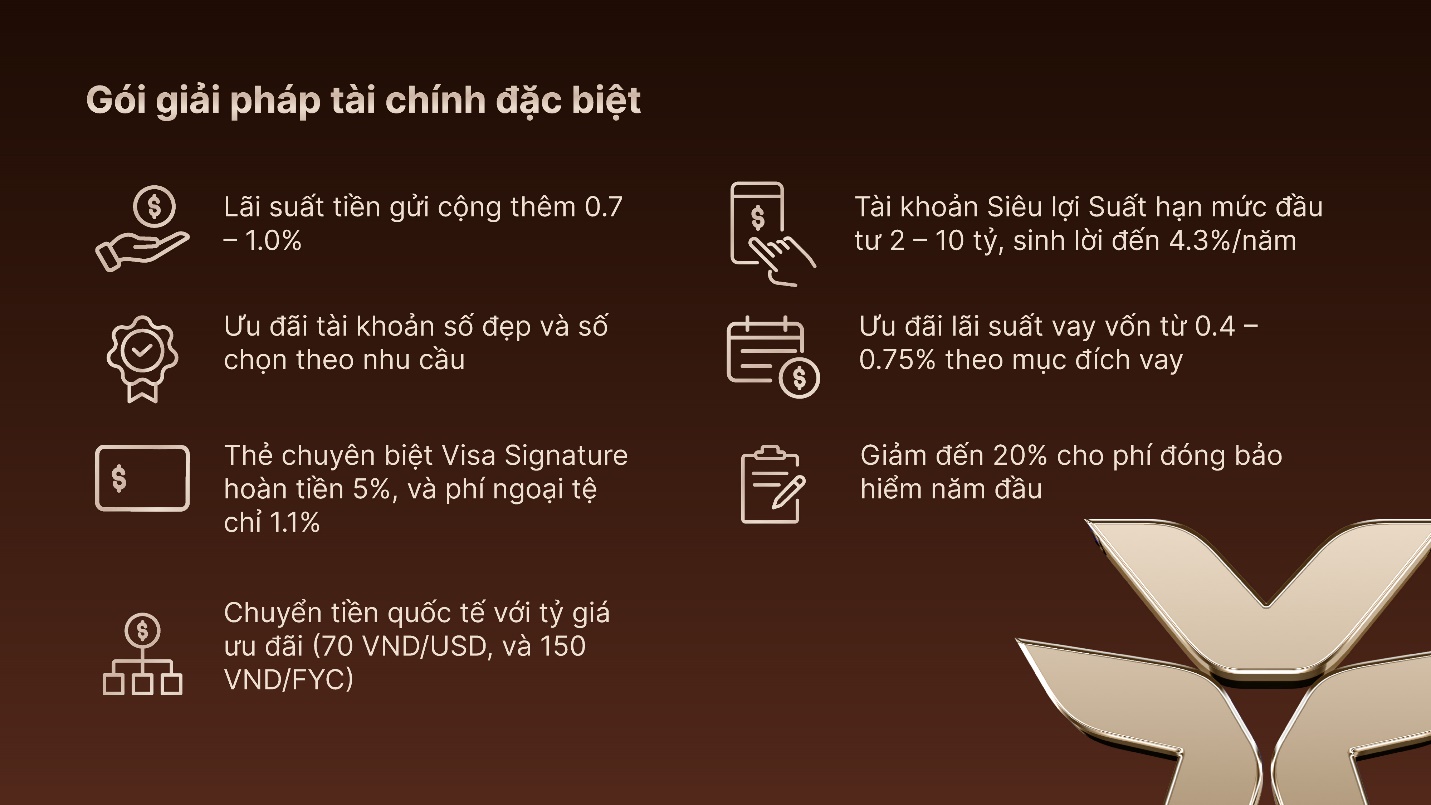

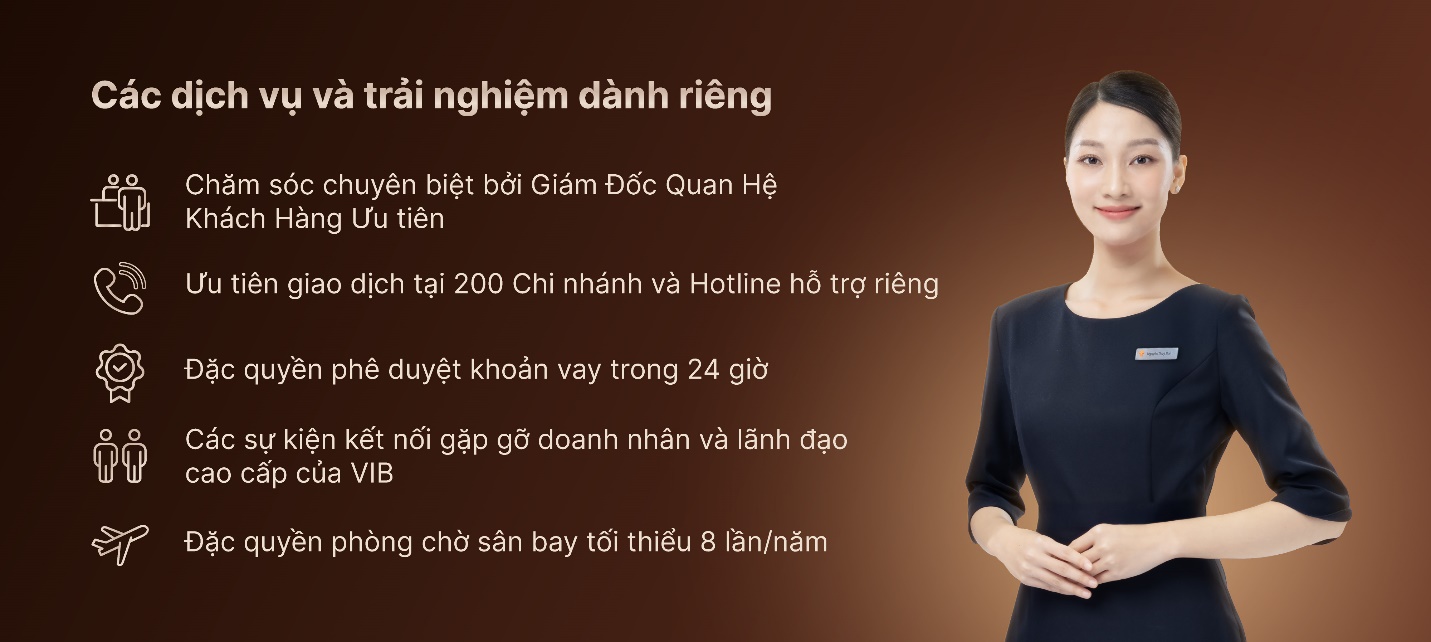

Understanding the need for wealth growth, opportunity connectivity, and value creation, VIB Privilege Banking continuously enhances its exclusive offerings and experiences. This flexible ecosystem helps clients connect and amplify their values at every life stage.

There’s no one-size-fits-all approach to asset optimization. Each individual has unique needs and management styles at different stages—prioritizing safety, aggressive growth, or stable cash flow.

The VIB Privilege Banking ecosystem caters to diverse needs, from investment accumulation and flexible savings to insurance, foreign currency, and professional asset management. Clients simply identify their financial stage to select suitable products. Learn more about VIB Privilege Banking here or call 1900 2200 for detailed consultations.

Ngô Thành Huấn: The Steward of 1,500 Vietnamese Families and the Philosophy of Lifelong Learning

In the context of Vietnam’s rapidly growing economy, where incomes are rising and the younger generation is taking a more proactive approach to financial management, the story of Mr. Ngo Thanh Huan, MSc – CEO of FIDT Company – stands as a compelling testament to the power of choice and continuous learning.

VIB Launches Privilege Banking: Comprehensive Exclusive Benefits for Priority Customers

Amidst the evolving landscape where customer demands are shifting from singular products to holistic financial experiences, Vietnam International Commercial Joint Stock Bank (HOSE: VIB) has officially launched Privilege Banking—an exclusive customer service program. This marks a significant milestone in VIB’s journey to empower clients in growing their wealth, building legacies, and crafting enduring financial heritages.

VIB Launches Privilege Banking: Comprehensive Exclusive Benefits for Priority Customers

In a rapidly evolving financial landscape where customers increasingly seek holistic financial experiences over isolated products and services, International Bank (VIB) proudly introduces Privilege Banking—an exclusive client priority service program. This launch signifies a transformative milestone in VIB’s commitment to empowering clients on their journey toward asset growth, wealth preservation, and legacy creation.