Capital Flow Shifts

With savings in hand, Ms. Phuong Le has been searching for an apartment in both the West and East districts of Hanoi for several months. These areas boast the largest supply of new apartments in the capital, and her goal is to purchase one for rental purposes and long-term asset accumulation. Ms. Le calculates that depositing 2 billion VND in a bank would yield an annual profit of only 90-100 million VND. In contrast, buying a 2 billion VND apartment and renting it out for approximately 10 million VND per month would generate an annual profit of 120 million VND. This strategy offers a dual advantage: the apartment’s value appreciates over time, and the investment safeguards against currency devaluation.

However, despite her efforts, Ms. Le has been unable to find any projects offering one-bedroom apartments priced around 2 billion VND.

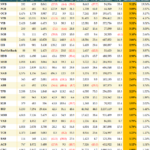

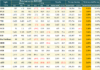

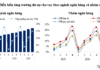

As early as Q1 2025, Savills reported that Hanoi no longer had apartments priced below 2 billion VND. The Vietnam Association of Realtors (VARS) Q3 2025 real estate market report confirmed that approximately 80% of newly launched properties in Hanoi and Ho Chi Minh City were priced above 80 million VND per square meter.

The trend of portfolio restructuring emerged in Q2 2025, with investors redirecting capital to the South or focusing on markets with high tourism potential or significant population growth.

Q1 Tower: A Timely Investment for Visionary Investors

After thorough market research, Ms. Phuong Le decided to invest in an apartment at Q1 Tower in Quy Nhon. This project is highly attractive to buyers seeking a place to live, work, or rent out, offering stable income from tourists, business travelers, and long-term residents relocating to the new administrative center of Gia Lai province following its merger.

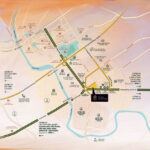

Located at 1 Ngo May, Quy Nhon Nam (Gia Lai), Q1 Tower boasts a prime location near the city center, beach, central square, and park. It also offers the advantages of a high-value real estate product, including location, quality, growth potential, and developer reputation.

Modern, multi-functional Dual-life City Apartment at Q1 Tower

The apartments at Q1 Tower are designed as Dual-life City Apartments, a unique concept in Quy Nhon that combines resort-style living with urban amenities. Owners can live, work, and vacation in a fully equipped space or rent it out for attractive returns exceeding bank interest rates, while also benefiting from a secure, high-value asset.

This potential is reinforced by Lonely Planet’s recent ranking of Quy Nhon as one of the top 25 most attractive destinations globally and the only Vietnamese representative in the “Best in Travel 2026” list. Local authorities plan to further develop tourism as a key economic sector, boosting demand for accommodation and logistics services.

Currently, 4-5 star hotels in Quy Nhon achieve 80% occupancy during peak seasons, yet the city lacks high-end 5-star apartments, with only a handful of 5-star hotels in the city center.

Investing in Q1 Tower offers dual benefits: short-term rental income and long-term capital appreciation, with a realistic 6–8% annual return. The profit margin is highly promising, given the starting investment of just over 2 billion VND, compared to similar properties in Da Nang or Nha Trang priced at 3-5 billion VND. A simple calculation reveals that Quy Nhon apartments have a 30–50% upside potential.

Own a Q1 Tower apartment with an attractive payment plan: only ~300 million VND until handover

Ms. Phuong Le thoroughly researched the project, trusting the developer’s reputation, legal compliance, and timely progress. She opted for a payment plan requiring an initial 300 million VND, with subsequent payments spread over 2%-5% monthly installments.

“This extended payment plan is ideal for investors with limited capital seeking absolute security. The rental income from this apartment will likely surpass that of one-bedroom units in Hanoi, and its value appreciation potential is stronger due to Quy Nhon’s limited central land supply. Properties in prime locations will undoubtedly experience significant price increases in the future,” Ms. Le analyzed.

Many investors, like Ms. Phuong Le, are shifting their capital to Quy Nhon. VARS market surveys indicate that mid- to high-end apartments are driving Quy Nhon’s market, fueled by genuine demand, rental investments, and capital inflows from Northern and Southern investors.

G.Empire Group, the exclusive distributor and marketer of Q1 Tower, confirms a surge in interest from Hanoi buyers, despite the limited supply of only 100 units in Q4 2025.

“Quy Nhon currently lacks an all-in-one, centrally located project like Q1 Tower. This presents an opportunity for early investors to acquire a high-end, multi-functional property, capitalizing on four price growth phases as the market enters a new expansion cycle,” stated a G.Empire Group representative.

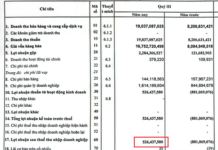

How Indebted is Novaland’s Subsidiary?

August 15th marked the deadline for principal and interest payments on the NTDCH2227001 bond issuance, totaling over 2 trillion VND. However, No Va Thảo Điền has only managed to settle a mere 200 million VND through alternative assets.

East District Infrastructure Soars: Sunshine Legend City Leads the Resident Relocation Wave

East Hanoi’s infrastructure is undergoing its most significant acceleration in a decade, unveiling a transformative new landscape for the entire region. At the heart of this development surge, Sunshine Legend City stands as the market’s most coveted project, boasting a prime location just minutes away from the Hung Yen campus of Hanoi University of Science and Technology and the PVF Stadium.