PVT Logistics (PVT Logistics JSC, Stock Code: PDV) has recently announced a resolution to increase its charter capital through the issuance of dividend shares for the year 2024.

The company plans to issue over 13.2 million shares as dividends to shareholders at a ratio of 100:20, meaning for every 100 shares held, shareholders will receive an additional 20 new shares. These shares will be unrestricted for transfer.

Illustrative image

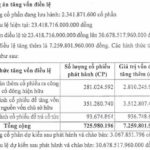

The total issuance value, based on the par value, is approximately VND 132.2 billion. The capital for this issuance will be sourced from the undistributed after-tax profits as reported in the audited financial statements for 2024. The issuance is expected to take place in Q4/2025.

Upon successful completion, the total number of shares will increase from nearly 66.1 million to over 79.3 million, raising the charter capital from approximately VND 661 billion to nearly VND 793.2 billion.

In related news, the Hanoi Stock Exchange (HNX) has decided to delist PVT Logistics’ shares (PDV) from the UPCoM market, effective November 6, 2025, with the last trading day being November 5, 2025.

The delisting is due to PVT Logistics’ approval for listing on the Ho Chi Minh City Stock Exchange (HoSE), as per the provisions of point d, clause 1, Article 137 of Decree No. 155/2020/NĐ-CP dated December 31, 2020, issued by the Government, detailing the implementation of certain articles of the Securities Law.

Previously, HoSE approved the listing of nearly 66.1 million PDV shares of PVT Logistics, with a total par value of approximately VND 661 billion.

Established in April 2007 as PVOil Eastern Petroleum Transportation JSC, PVT Logistics JSC (PVT Logistics) has since expanded its operations to include maritime transport, road freight, inland waterway transport, maritime brokerage, ship supply services, and maritime agency services.

As of September 30, 2025, PVTrans (Petrovietnam Transportation Corporation, Stock Code: PVT, listed on HoSE), a subsidiary of the Vietnam National Oil and Gas Group (Petrovietnam), holds 51.87% of PVT Logistics’ charter capital.

What Will PV Power Use the Capital Raised from Its Share Offering For?

PV Power plans to allocate VND 2.810 trillion to settle contracts with partners for the development of the Nhon Trach 3 and Nhon Trach 4 power plant projects.

Vingroup Doubles Charter Capital to 77 Trillion VND, Stock Price ‘Splits’ to 100,000 VND Level: What’s Next?

The remarkable fivefold surge in VIC shares since the beginning of 2025, reaching an all-time high, makes the provisional price of 100,000 VND more accessible to individual investors. Additionally, the increased number of outstanding shares will enhance the stock’s liquidity, benefiting traders and investors alike.